The emergence of shale gas on the global scene has ushered a new era of energy revolution transforming the need versus resource debate with far reaching strategic ramifications. Heightened vulnerabilities of yesteryears on account of energy shortages are being replaced by considerable optimism in the developed world in particular because of advanced methods of extraction. Analysts are speculating that energy self sufficiency may lead the US to let more regions submerge in chaos in subtle manipulation through controlled engagement in line with is emerging doctrine and similarly, increased self sufficiency on this count in China may lend her to become even more aggressive.

If indeed India is floating on natural gas, raising the wellhead price of dry natural gas to levels unheard of anywhere else in the world is the worst policy option to release this national wealth.

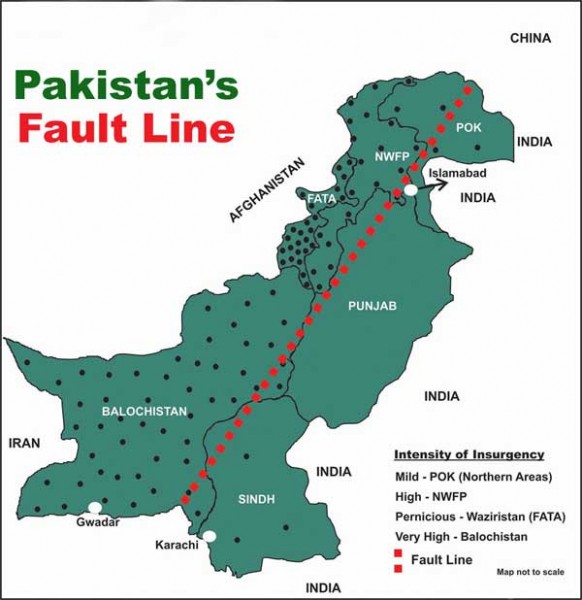

In a report released on 17 June 2013, jointly prepared by U.S. Energy Information Administration (EIA) and Advanced Resources International (ARI), the top three countries with technically recoverable shale gas resources are USA (1,161 trillion cubic feet – tcf), China (1,115 tcf) and Argentina (802 tcf). However, In terms of recoverable shale oil barrels, the top three are Russia (75 billion), USA (48 billion) and China (32 billion). In the case of India, the report makes a joint India-Pakistan regional assessment of “risked” technically recoverable Shale Gas Resources as 114 tcf assessed in 2011, which has been hiked to 201 tcf as per 2013 assessment but with the comment that this is an expanded assessment in case of Pakistan. The reason why India and Pakistan have been grouped together is not explained but other countries are mentioned individually. In China, 100 exploration wells are being looked at already for shale gas and it is axiomatic that Pakistan will be beneficiary of such exploratory technology as well as surplus Chinese shale gas. There are reports of the US offering shale gas to India ostensibly to reduce energy dependence on Iran.

As per earlier assessments, India has shale gas reserves of 63 tcf, which may increase as drilling progresses. In January 2011, ONGC had discovered shale gas in its first pilot shale gas drilling venture in Damodar basin. Bidding for shale gas reserves in India is likely within 2013. While ONGC and OIL are undertaking pilot projects to assess the shale gas potential, Reliance and GAIL have entered US shale industry to gain technical expertise. In April 2012, the Directorate General of Hydrocarbons (DGH) submitted its draft policy on exploitation of shale gas to the Ministry of Petroleum and Natural Gas (MoPNG). But in issuing the final policy, it is imperative that the government and the industry work together to come up with shale gas exploration policy that not only encourages foreign investment but also encourages domestic economic growth since unlocking of domestic shale gas can help India meet its growing energy demand, besides reducing its dependence on expensive energy imports and the energy import bill. This needs to be done speedily as it would take at least four to five years from any policy announcement to actual production of fuel from domestic shale gas reserves. Incidentally, natural gas prices in the US are at record lows as the surge in shale gas production coupled with lower demand has brought the average price of gas from US$8.8 per mmbtu in 2008 to around US$2.9 per mmbtu in July 2012.

Recent announcement by Government of India to double the price of gas from April 2014 on account of low domestic production has come in for heavy criticism on grounds that it can curtail growth of important industries and even have a substantial negative effect on the overall economy. This is not only because the hike will substantially push up prices and curtail output of important industries like power and fertilizer, which account for bulk of natural gas consumption, but also because it will further contribute to the inflationary spiral. R Jaganathan writing in First Post calls it a ticking time bomb for this government. Surya P Sethi, former Principal Adviser, Power & Energy, Government of India and now Adjunct Professor, Lee Kuan Yew School of Public Policy, National University of Singapore terms this a totally indefensible hike and a gigantic scam on impoverished people of India. His scathing attack is based on:

…why are we importing coal in these quantities in the first place with our own coal reserves standing a 27,34,971.15 million tons…

- Formula used to double the price is of Reliance Industries Limited (RIL); price of $4.20/mmbtu was derived based on a RIL formula that had never been used and is still not used anywhere in the world to price natural gas at the wellhead or any other form of gas anywhere. The $8.40 number reportedly flows from the Rangarajan formula, which again is not used anywhere else in the world to establish the wellhead price of natural gas or any other form of gas anywhere.

- There is not even a single gas field in the world that gets a well head price of $8.40/mmbtu for conventional dry natural gas?

- Despite raising domestic wellhead price of natural gas by almost 300 per cent investments in the sector and the country’s gas output have actually dropped.

- Bulk of the drop is because of RIL whose demands triggered the recent price increase while CAG has explicitly stated RIL has been reneging on production commitments.

- Import parity price for a globally traded commodity such as crude oil (unlike natural gas) that has justifiably been in place since the 1990s has not succeeded in raising domestic crude production significantly or attracted significant FDI in the Indian sedimentary basin.

- The same KG basin gas that was once offered to NTPC at $2.34/mmbtu for 17 years and which is documented to cost under a dollar per mmbtu to produce received $4.20/mmbtu in the first five years and is now guaranteed to receive twice that or more in the next five years.

- If indeed India is floating on natural gas, raising the wellhead price of dry natural gas to levels unheard of anywhere else in the world is the worst policy option to release this national wealth.

- Absence of any evidence-based research backing key economic decisions is the true “economic reality” of India, which is today the only country in the world that sees no difference between the wellhead price of natural gas and the price of liquefied natural gas (LNG).

One ton of Thorium can produce same energy as 200 tons of Uranium, or 3,500,000 tons of coal.

Next is the news that power prices are to go up as imported coal costs will be passed on to consumers because of the falling rupee. The decision to allow power companies to pass on the costs of foreign coal to customers is reportedly to boost imports boost imports and investment in power generation and bring more energy prices to consumers. The new power prices need to be approved by individual states, which can decide to subsidize them and ease the costs for millions of poor Indians. Electricity tariff across the country will increase by a minimum 15 to 17 paise per unit. India is the world’s third-largest producer of coal and more than half the country’s power comes from burning the fuel, but domestic output falls short of demand, triggering frequent and lengthy power cuts. It is estimated that the move could help bring as much as 78,000 MW of generation capacity on stream. Under the proposed mechanism, the entire additional cost of imports would be passed on to the consumers as against the averaging of prices of imported and domestic coal under the earlier planned price-pooling mechanism. But this issue needs much deeper analysis. As per records, India’s coal imports rose to a record 135 million tons in the last fiscal year – a rise of nearly 33 percent albeit drop in global coal prices softened the impact. But the million dollar question is that why are we importing coal in these quantities in the first place with our own coal reserves standing a 27,34,971.15 million tons; 33,688.73 million tons coking coal, 2,58,315.78 million tons non-coking coal and 1,492.64 million tons tertiary coal. Little wonder the government said there was no Coalgate Scam because all the coal remained underground. But the fact is that a country holding third largesse reserves of coal in the world should not be importing any coal. Why should we not be exporting coal? Clearly we have no plan or inclination to manage our resources.

Then is the issue of nuclear energy which is clearly linked with nuclear safety. Latter perhaps was the main reasons for the Kudankulam protests in the wake of the Fukushima disaster. Our Kakrapar nuclear reactor being the world’s first using Thorium and since we hold more than 25% of global Thorium reserves (IAEA puts it at 67% – almost two third of global reserves), India should consider switching completely to Thorium based nuclear reactors as they are far safer than the Uranium based ones. Most significantly, a Thorium nuclear reactor has “no possibility of a meltdown”. Thorium cannot sustain a nuclear chain reaction without priming, as a result of which fission stops by default. Though Thorium does require start-up by neutrons from a Uranium reactor, from thereon this activated Thorium reactor can activate other Thorium reactors discounting any further requirement of Uranium. Compared to Uranium, Thorium does not require enrichment, has superior physical and nuclear properties and much reduced nuclear waste production. One ton of Thorium can produce same energy as 200 tons of Uranium, or 3,500,000 tons of coal. Of course it is harder (not impossible) to extract weapon grade fissile material from a Thorium reactor but then how many nukes do we need? Thorium being the future of nuclear energy, we need to conserve our reserves and not pass these on under clauses of the Indo-US nuclear deal like “India and the US agree to transfer nuclear material, non-nuclear material, equipment and components”. Concurrently, we should redouble our efforts to exploit renewable energy, alternative fuels, fossil fuels and the like. Learning from Fukushima, can you imagine the consequences of a sustained cyber attack on the power grid of our nuclear reactors, reducing the critical function of cooling to back up generators that themselves get overheated and have to be periodically switched off?

Courtesy: This article was first published by the United Services Institution of India