Legacy pension disbursement system named ASHRAYA & SUVIGYA vs SPARSH (System for Pension Administration – RAKSHA)

- Aashraya and Suvigya are/were established pension disbursement systems implemented by Controller General of Defence Accounts (CGDA) and are now sought to be replaced at considerable additional and avoidable expenditure. The blurb below is from the official website of CGDA and is available in the public domain (https://cgda.nic.in/index.php?page=aashryaN):

“Defence Accounts Department is responsible for sanction and disbursement of Defence Pension to retired Service Officers, JCOs and ORs, Defence Civilians and their families. Efficient Disbursement of Pension to the Defence Pensioners is of primmest concern to the Defence Accounts Department. The Defence Pension budget constitutes approximately 62% of total pension budget of Central Govt. Pension is sanctioned to approximately one lac retirees each year by three Pension Sanctioning Authorities of the Department and is disbursed monthly to approximately 23.5 Lacs pensioners out of which nearly 5 Lacs receive their pension through 61 Defence Pension Disbursement Offices (DPDOs) spread across the country. With increased life expectancy and a dependency ratio of over 100% for defence pension it is imperative to ensure that correct pension is paid to the pensioners as the quantum of pension and its regularity impacts over 2 million defence personnel.

Given the huge amount of expenditure incurred by the Govt. towards its pension liability and a large no. of people being its beneficiaries, it is absolutely necessary to have a pensioner friendly, efficient and a transparent Pension Disbursement System and Pension Enquiry System. Accordingly the project “Aashraya: Pension Disbursement System” and “Suvigya: Pension Enquiry System” were launched in Jun-2010. These were developed and inaugurated by Hon’ble Raksha Mantri on DAD Day i.e. Oct 1, 2010.

Aashraya

The Defence Pension Disbursement offices were running on COBOL Based Pension Disbursement System called RNPDS. This was an outdated system with very limited utility and required programming skills for its operations for every transaction. Hence, it was not user friendly and required COBOL programming skills for operation. It had a limited facility to generate Pension Schedule of Pensioners. There was no role based operation. The MIS generation and audit was not possible. The Staff and officer of the DPDO were dependent on the programmers of the COBOL to operate it for settling any grievance. With change in pension entitlements like Dearness Relief, Allowances etc the payment of correct entitlements and arrears were a tedious job.

In view of above situation, the Defence Accounts Department conceived the idea of making an efficient Pension Disbursement System (i.e. Project “Aashraya”) for making the correct payment of pension and addressing grievances of the pensioners while automating the most of the manual work of DPDOs. Accordingly the Project “Aashraya” was initiated. This software was developed by using open source platform i.e. PHP/ MySQL and runs on Linux/Windows etc. It has been designed, developed and implemented by in-house team of officers without third party assistance and expenditure on this account. It has following salient features:

- Transparency and stakeholder participation: “Aashraya” software is very user friendly with role based authentications. Pensioner’s profile module in the system enables DPDO staff to view the complete profile of a pensioner by entering the ID of pensioner and payment history for the purpose of redressal of grievances. In earlier system the information could only fetched by writing COBOL program on every case and was dependent on availability of one technical person in DPDO office. Now, “Aashraya” has made available the pensioner’s information with every staff and officer of DPDO for faster redressal of grievances if any or otherwise with least manual effort.

Innovativeness of the initiative and its replicability: ‘Aashraya’ has automated the disbursement of pension to 5 lac pensioners from 61 Defence Pension Disbursement (DPDO) offices across the country. It can be customised for the use of any pension disbursement agency (Post office, civil treasury, bank etc.)

The Software is:

-

- Intuitive, normal office staff without much computer knowledge can work on it.

- Web-enabled, can be run at dispersed locations across the country.

- Inexpensive, based on freeware platforms and developed in-house and needs minimal outstation resources.

- Comprehensive, covers all main activities of a pension disbursement office and

- Green saves lot of printing effort and paper.

A modified PDCA (plan-do-check-act) iterative cycle was used at all stages for the development. The difference was that the users (Non-EDP taskholders/supervisors) themselves were the problem-solvers, equal participants in the cycle. They concurrently did the data input and suggested further screen improvements that the programmers readily implemented. By the time the system was fully evolved, the users developed an ownership stake and their enthusiastic participation led to an implementation momentum that crashed all timelines. The result is there for all to see.

Increased efficiency of outputs/processes and effectiveness of outcomes: This software has increased many folds the working efficiency of DPDOs staff as working on new system is very user friendly and faster.The process which took many hours now takes few minutes to finish.

I. Web Enabled User Friendly Operations: “Aashraya” is web enabled software with user friendly interface screens and navigation. Any non-technical person in DPDO can easily operate it. The operations of DPDO like generation of Pension Payment Schedule of Pensioners, MIS, Common reports and returns etc could be generated on click of button without programming knowledge

II. In-Built Help: There is in-built help for operation of every screen. There is no need for officers and staff to wait and depend on the COBOL programmer to process any transaction.

III. Pensioners’ Profile: the module “Pensioners’ Profile” gives information regarding pensioners, pension related matters and entitlements being paid. These can be fetched easily by staff and officers of DPDO for attending the grievances and its quick settlement. This has resolved the problem of earlier system where it was not feasible for staff and officers to do so.

IV. Role Based Operations: In “Aashraya” the functioning of DPDO has been made role based for various tasks and ranks as per procedures. This has induced accountability for various tasks at various ranks. Respective operators of “Aashraya” can print the record of the transactions done by them. The administrator can track the person carrying out the transaction. This has resolved the problem of single point data entry and operations by the COBOL programmer on behalf of other staff in earlier COBOL based system. The staff had responsibility without record and direct access to what had been done on their behalf.

V. In-Built Audit Checks: Common Audit Checks have been built into “Aashraya” to ensure accurate data entry and output results. These checks were not there in old system generally leading to output with lesser accuracy. Further, the manual checking of payment schedule as audit requirement in earlier system was time consuming. The “Aashraya” automatically compares the schedules of desired months. ]

VI. History of payments: “Aashraya” has facility to maintain the history of pension disbursement for longer periods to facilitate quick payment of arrears in the event of change of entitlements by Government and for settlement of a grievance etc. The earlier system could maintain the history of payments of pension only up to 15 months and calculation of arrears in case of change of entitlements etc was tedious manual task.

VII. Monthly Pension Slip to Pensioners through E-MAIL and SMS: “Aashraya” contains the facility for sending monthly pension slip of the pensioners to their e-mail and also on their mobile through SMS. The DPDO has to just press the button once for it.

In nut-shell, the “Aashraya” has automated the operations in DPDOs in a user friendly manner, ensured accuracy by audit checks, minimised grievances and quicken the settlement of existing grievances thereby enhancing the overall efficiency of DPDOs.

VIII. Date of implementation of the initiative:

This project was formally inaugurated by Hon’ble Raksha Mantri Sh. A K Antony on DAD Day on Oct 1, 2010 and the completely implemented by March 2011 in 61 DPDOs. Now it is running in all 63 DPDOs.

Suvigya

Armed Forces Personnel generally retire at an early age. The pension structure compensates them for early retirement and also for acts of bravery, strain of active service and so, is very different from civil pension system. Pay Commissions and other Authorities constantly keep improving their entitlements. Hence, Defence Service Pensions are far more complex. At present, pension is being disbursed to pensioners by Defence Pension Disbursement Offices, banks, State Government Treasuries and Post Offices. They also carry out table based pension revision. While the DPDO understands the technicalities of pension, being part of DAD, other agencies, especially bank branches have limitations.

Our experience at the Pension Adalats has been that most of the issues in pension arise at the bank level. In this back drop project SUVIGYA is a total in-house designed and developed Pension enquiry System, was taken up in July, 2010 with a view to empower the pensioners to know what their correct entitlement of pension is from time to time. It is a web-technique based system. The system requires very few basic inputs from the pensioner. Once data is entered software calculates the pension and changes to it from time to time. Pensioner can get a print out of inputs provided by him and of the outputs generated by the system. If a pensioner finds his/her pension actually paid or being paid is less then the results given by the system, he/she can take up the matter with the Pension Sanctioning Authority or Pension Disbursing Agencies for rectification.

To the best of our knowledge, no other Government department has so far established such a comprehensive and interactive Pension Enquiry System. We have provided e-kiosks at various DAD and Service secured locations accessible to the pensioners. For computer-shy pensioners, we have trained the concerned officials of DAD, Zila Sainik Boards and other offices where e-kiosks have been provided” (emphasis supplied).

SPARSH

Now, Ministry of Defence (MoD) has introduced SPARSH (System for Pension Administration – RAKSHA) (https://sparsh.defencepension.gov.in/) for Army, Navy, Air Force and Defence Pensioners at considerable expenditure to replace pension payments through an elaborate and exceptionally well functioning system through Central Pension Payment Centres (CPPCs) of Public Sector Banks, ostensibly to effect savings but to the disadvantage of 26 lakh Defence pensioners (Civilian and Armed Forces), a majority of who live in rural areas, whose surviving wives are poorly educated and do not possess internet and/or smartphones to download the SPARSH app.

SPARSH was made operational about 3 years ago is based entirely on the electronic connectivity of India which is poor in rural India (A Survey on Rural Internet Connectivity in India – https://ieeexplore.ieee.org/document/9668358; S. K. A. Kumar, G. V. Ihita, S. Chaudhari and P. Arumugam, “A Survey on Rural Internet Connectivity in India,” 2022 14th International Conference on COMmunication Systems & NETworkS

(COMSNETS), Bangalore, India, 2022, pp. 911-916, doi: 10.1109/COMSNETS53615.2022.9668358.)

An abstract is re-produced below: –

“Rural connectivity has been a widely researched topic for several years. In India, around 50% of the population have poor or no connectivity to access digital services. Numerous technological solutions are being tested around the world, as well as in India. The key driving factor for reducing the digital divide is to lower the cost of network deployments and improve service adoption rate by exploring different technological and economical solutions. This survey aims to study rural connectivity and create awareness about the use-cases, state of the art projects and initiatives, challenges, and technologies to improve digital connectivity in rural parts of India. The strengths and weaknesses of different technologies tested for rural connectivity are analysed. The study includes a brief discussion of rural connectivity trials performed in India and around the world. We also explore the rural use-case of the 6G communication system, which would suit the rural Indian scenario.”

SPARSH was introduced first by stating that migration from the legacy system through CPPCs would be voluntary but transited to being mandatory without seeking views of the pensioners. Glitches galore have compelled the MoD/Principal Controller of Defence Accounts (Pension) to hire the services of Tata Consultancy Services at more expenditure, to little effect. Attached are just a few live examples as proof of the errors in PPOs.

In conclusion

Listed are errors of SPARSH subsequent to “without your permission/willingness” migration

Shri S K Mohanty is a Defence civilian pensioner who joined Indian Ordnance Factories Service (IOFS) through UPSC as Asst Works Manager in the year 1963 and retired on superannuation in the year 2002 as Director General (DGOF) & Chairman/ Ordnance Factory Board.

All these years his pension account was with SBI and he was getting his monthly pension regularly and meticulously in time without any problem. Then all on a sudden his pension account was migrated to SPARSH in November 2022 without his knowledge or approval.

To his good fortune, this problem of LC was solved with the help of his banker SBI branch by furnishing DLC in December 2022.

He got the SPARSH PPO. He was also able to log into their Site. His portal shows his pension slip which contains his name, PAN, Aadhar number, Pension amount, and TDS correctly.

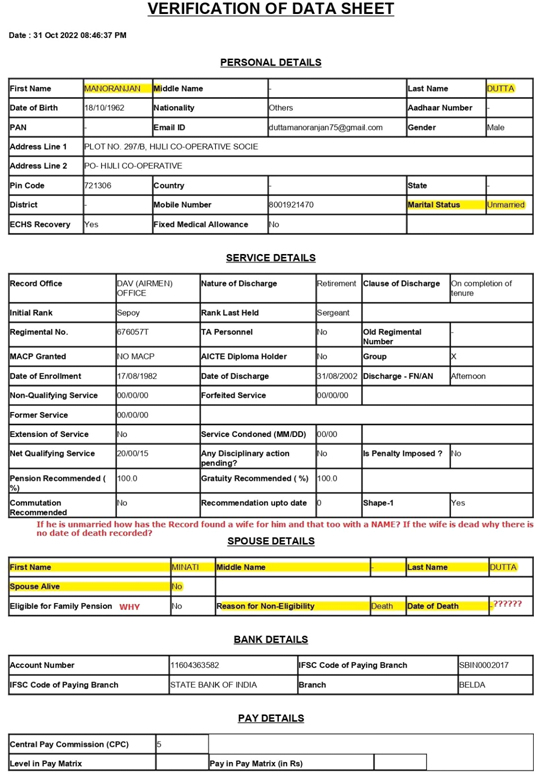

However, in his profile there is nothing else. But by clicking here and there, he could get following STARTLING details:

– He joined the service as a Sepoy. – He retired as Dy General Manager. – His wife is dead. (She is very much alive in real world). – He is UNMARRIED !

He is now 81+ years old. If something happens to him, then his family may not get family pension.

A few more such errors are listed below:

Wonder who in MoD is responsible and wonder how many more there would be who have been mistreated just because Ashraya & Suvigya have to be replaced by an acronym at more considerable expense, including fees paid to TCS.

Thank you sir, for detailed analysis. Very well articulated.