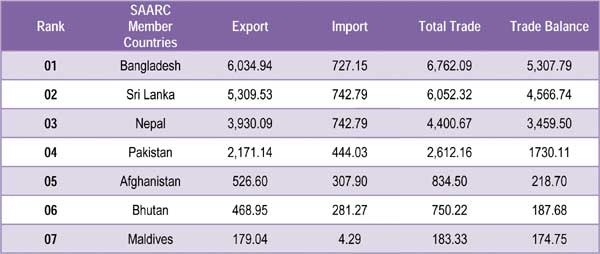

As for international politics, international trade has nothing personal about it. While India may have earned the entitlement of a rising power in some quarters of projected strategic imagination, facts express a dim picture. India’s total trade (2016-17) with its immediate neighbours minus China remains miniscule when compared with China which is India’s largest trading partner followed by United States. Members of SAARC do not figure in top 25 trading partners of India making South Asia the world’s least economically integrated regions of the world.

Year: 2016-2017 (Apr–Feb), Values in US$ Million Department of Commerce: Export Import Data Bank (India’s Total Trade-Top Five Countries)1

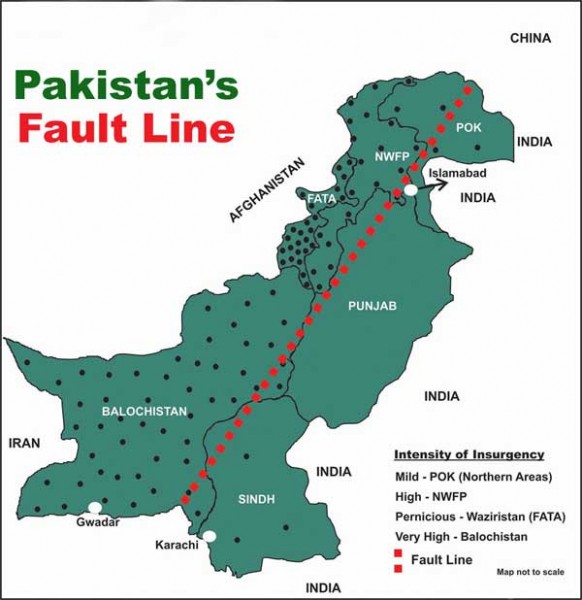

Over the past decade, China has become a significant economic partner to SAARC member countries, forging particularly strong ties with smaller states through trade, diplomacy, aid, and investment, which has the potential to challenge India’s traditional role in the South Asian regional order[1].However, India still retains strategic advantage in SAARC member nations minus Pakistan which has extra-ordinary strategic relationship with China. However, such an advantage for India is fast eroding in the wake of China’s growing potential economic influence in the region. Sri Lanka which shares a significant relationship with India has now slowly drifted towards China which has improved its relationship with the island nation since the out-break of civil war in 2009 which peaked in 2011.

Year 2016, Values in US$ Million, Department of Commerce: Export Import Data Bank (India’s Total Trade-SAARC Member Countries)2

Between 2012 and 2015, China disbursed almost $2.5 billion, of which more than 75 percent came from the Export-Import Bank of China and the Sino-Sri Lankan relationship was upgraded to “Strategic Cooperative Partnership” in 2013. During the same period, India extended $660 million in lines of credit[2].However, despite similar developments in Bangladesh and Nepal, India’s cultural ties born out of civilizational linkages and geographical proximity within the region remain intact and likely to remain so in near-long term. For example, remittances from Indian migrant workers stood at $ 9 billion in the region compared to China’s $ 1 billion of which $ 958 million came from Chinese workers in Bangladesh alone[3].

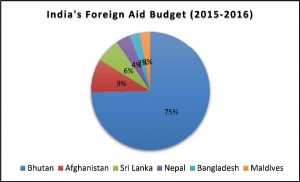

India too has in the past decade stepped up its efforts at investing, providing foreign aid and improving its trade relations with its neighbors in South Asia. During 2009-10, India provided US$ 383.01 million in aid and loans to South Asian countries (except Pakistan), which has expanded to US$ 1,149 million in 2015-16[4].

Despite India’s expanding investments abroad, in comparison it remains less significant in value. According to the United Nations Conference on Trade and Development’s World Investment Report (2016) India does not figure in the top 20 economies with FDI outflows[5]. China along with US and Japan remain among the top five investing economies. In Asia, the top investing economies in 2014 remain China (FDI stock $ 513 billion) followed by US ($ 430 billion) and Japan ($ 414 billion). Four of the top ten investor economies in Asia are extra-regional (US, UK, Germany and France), the remaining are from Asia itself[6]. The largest recipient of FDI in Asia are Hong Kong, China ($174.9 billion), China ($135.6 billion), Singapore ($ 65.3 billion), India ($44.2 billion), and Turkey ($ 16.5 billion)[7].

Despite India’s expanding investments abroad, in comparison it remains less significant in value. According to the United Nations Conference on Trade and Development’s World Investment Report (2016) India does not figure in the top 20 economies with FDI outflows[5]. China along with US and Japan remain among the top five investing economies. In Asia, the top investing economies in 2014 remain China (FDI stock $ 513 billion) followed by US ($ 430 billion) and Japan ($ 414 billion). Four of the top ten investor economies in Asia are extra-regional (US, UK, Germany and France), the remaining are from Asia itself[6]. The largest recipient of FDI in Asia are Hong Kong, China ($174.9 billion), China ($135.6 billion), Singapore ($ 65.3 billion), India ($44.2 billion), and Turkey ($ 16.5 billion)[7].

India occupies the eighth position among the top investing economies in Africa in 2014 with $15 billion of FDI stock. The largest investors in Africa were UK ($ 66 billion), US ($64 billion), France ($ 52 billion) and China ($ 32 billion). The largest recipients of investments in Africa are Angola ($8.7 billion), Egypt ($6.9 billion), Mozambique ($3.7 billion), and Morocco and Ghana ($ 3.2 billion). Expect for South Africa, all major investors are extra-regional powers[8]. Nigeria and Libya have emerged as investment destinations in 2015.Both India and China do not figure in top investing economies in developed nations (2014), however Japan does at seventh position. US ($ 2031 billion), UK ($ 1360 billion), France ($856 billion), Germany ($820 billion), Netherlands ($ 780 billion) and Switzerland ($720 billion) are the major investors. The major recipients are United States ($ 379.9 billion), Ireland ($100.5 billion), Netherlands ($72.6 billion), Switzerland ($ 68.8 billion), and Canada ($48.6 billion). In least developed economies China is the top foreign investor ($ 27 billion) in 2014 followed by US ($ 9 billion), and Norway and Republic of Korea ($ 6 billion)[9].

India’s contribution to least developed economies remains insignificant. Since it launched reforms and opening up, China has attracted over $1.7 trillion of foreign investment and made over $1.2 trillion of direct outbound development[10]. For the future according to President Xi Jinping in next five years China is expected to import $8 trillion of goods, attract $600 billion of foreign investment and make $ 750 billion of outbound investment.

In analysis, developed nations invest in developed economies, Asia and Africa, however the proportion of investment in advanced economies in much higher compared to investments in Asia and Africa. Unlike Africa which relies on investment from extra-regional powers, Asia’s investments largely come from Asia, however extra-regional powers do invest in Asian economies. The current investment values are less significant compared to the required investments in Asian economies which according to some estimates is approximately $14 trillion required by energy, social, educational and infrastructural sectors. Sanitation alone is likely to be a source for major investments in Asian economies given its population size.

Statistical analysis of any phenomenon is a murky affair, like a lady’s short skirt which reveals what’s important but hides what is vital. A comparison of international trade in goods reveals a comparative advantage in favour of China given its positive balance of trade vis-a-vis India, United States, and United Kingdom who have a negative balance of trade. However, when taken into account the quality of the goods being traded China may not have such an advantage. For example, while China’s top exported good remains electrical machinery and equipment and parts thereof along with machinery, mechanical appliances, nuclear reactors and boilers thereof, for United States it is aircraft, spacecraft and parts thereof along with machinery, mechanical appliances, nuclear reactors and boilers thereof.

China further imports mineral fuels, mineral oils, and products of their distillation to the extent that United States does not. For U.S. mineral fuels are fifth most exported commodity in 2016. In between US, China, UK, and India – US is the largest importer of goods along with largest negative trade balance where as China is the largest exporter along with largest positive trade balance. However, China’s exports are dependent on high-technology imports that are used to process further exports such as electronics which shares 50.4% (2012) of all of China’s processing exports. Its ordinary exports remain textile which constitutes 24.8 % (2012) of the total ordinary exports[11].

For India, whose largest exported commodity is natural or cultured pearls, precious or semi-precious stones, precious metals share its largest negative trade balance with China (-46,793.24 US$ million) and largest positive trade balance with US (18,091.65 US$ million). India’s economic potential remains bleak not just in Sino-Indian context but also within the context of BRICS where India happens to be the weakest link.India shares the highest percentage of primary industry among BRICS grouping members at 25.7 per cent of the GDP in 2000 and 20.5 per cent in 2013 compared with Russia at 4.0 per cent, Brazil at 5.7 per cent and China at 10 per cent in 2013[12].

The United States is the largest economy in the world with a GDP of $18trillion. China is the world’s second largest economy with a GDP of $11 trillion. Meanwhile, the United States is the largest developed country, with its per-capita GDP reaching $50,000, and China is the largest developing country, with its per-capita GDP reaching $8,000. The average per-capita GDP is $11,000 worldwide. The volume of Sino-US bilateral trade was over $500 billion in 2016, the highest bilateral investment figure in the world[13]. The GDP per capita in India was 1751.70 US dollars in 2015, the highest for an average GDP per capita of 654.70 between 1960-2015[14]. The GDP per Capita in India is equivalent to only 14 percent of the world’s average.

It is quite evident from the above comparison that China’s has a unique position when compared with India to contemplate and execute a major initiative such that of OBOR which is not limited to the material capability alone but a grand strategy that interprets its intent and therefore providing an acceptable rationale for its execution at such a grand scale. The strategic consequence associated with OBOR which spills over to the security domain requires subtle clarification. In theory, with investments made into a particular economy, political influence is expected to follow that may alter the existing strategic balance. However, such a reality has not unfolded in Africa, South East Asia, and elsewhere in Central Asia. The logic of international politics continues despite economic interferences.

For example, China’s investments in Gwadar or Colombo and Hambantota transforming into a strategic asset is not dependent on the economic investments alone, the political relationship will remain significant despite investments. Sri Lanka in the recent past has factored in India’s sensitiveness with respect China’s submarines docking at its port facility[15] and Pakistan is likely to factor in US concerns prior to allowing its territory to be used by a third power such as China. There are limitations to which economic transaction may convert itself to political influence. It’s a complex equation and not a simple straight jacket, however it does not allow space for complacency. Iraq and Afghanistan where the western powers invested heavily to institute and develop democratic political system has not ended up to their advantage or allow for significant political influence.

In Afghanistan Taliban will remain central to its political evolution and Iraq will exercise its national interest despite decade long western investments only to reengage its erstwhile military supplier Russia. Hence “Politics is Politics” and economic interference has a limited value in shaping the political realities in which strategic decision is likely to be made. For India, China is her largest trading partner with huge trade deficit in favour of China, does that mean India is likely to follow Chinese dictum at the cost of her national interest? The simple answer is no. India has trained Afghan civilian and security leadership in India and incurred high value investments, does that mean Afghanistan is likely to accept all of Indian requests without factoring in its national and domestic interests? The simple answer in no.