Interception by Arrow

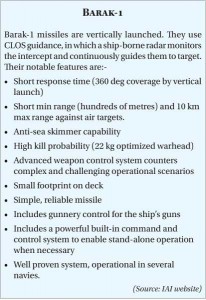

In missile technology, IAI is again at the cutting edge. The IAI Barak-1 is one of the most potent ship-launched surface-to-air missiles designed for superior performance against the full range of naval threats. Several frontline warships of the Indian Navy are armed with the Barak-1 acquired in 2000.

Israel is perhaps the only country in the world actively working towards a national missile shield expected to be operational by 2015. The shield comprises three layers. The bottom layer consists of Iron Dome, which uses small radar-guided missiles to destroy short-range rockets—like the Katyusha and Grad used by Hezbollah in Lebanon and Hamas in the Gaza Strip.

To counter medium-range missiles, there’s David’s Sling or Magic Wand which is the middle layer. And the top tier is Arrow, jointly produced by IAI and Boeing. Arrow-2 interceptor missiles are already operationally deployed in Israel. In July 2010, Israel and the US signed an agreement to produce the Arrow-3, capable of shooting down long-range missiles outside the atmosphere.Arrow-3, to be deployed in conjunction with Arrow-2 and employing kinetic kill instead of Arrow-2’s proximity-warhead detonation, it will be the most advanced ballistic missile interceptor in the world. It will have super manoeuvrability enabling it to change its trajectory to engage another target—even one that was detected after its own launch. Its maiden launch is expected mid-2011.

To counter medium-range missiles, there’s David’s Sling or Magic Wand which is the middle layer. And the top tier is Arrow, jointly produced by IAI and Boeing. Arrow-2 interceptor missiles are already operationally deployed in Israel. In July 2010, Israel and the US signed an agreement to produce the Arrow-3, capable of shooting down long-range missiles outside the atmosphere.Arrow-3, to be deployed in conjunction with Arrow-2 and employing kinetic kill instead of Arrow-2’s proximity-warhead detonation, it will be the most advanced ballistic missile interceptor in the world. It will have super manoeuvrability enabling it to change its trajectory to engage another target—even one that was detected after its own launch. Its maiden launch is expected mid-2011.

A Win-Win Relationship

And what of the Indian market? India is reportedly looking at a possible $50 billion worth of defence purchases over the next five years and some $100 billion by 2022. Over the past decade, Israel has rapidly emerged as India’s second largest defence supplier, next only to Russia. The relationship has blossomed despite the dichotomies in India’s foreign policy in the region. Israel responds to India’s arms requests promptly and has secured several lucrative modernisation contracts. Russian equipment—tanks, ships, helicopters and fighter aircraft—all have been upgraded with Israeli electronics and missiles. And IAI has been in the forefront of the action.

Several joint R&D projects between IAI and DRDO are reportedly underway including long-range SAMs for naval warships, medium-range SAMs for the Indian Air Force, UAVs, network-centric warfare equipment, satellite systems and advanced precision-guided munitions (PGMs).

Technological cooperation has focused on surveillance radars, drones and missile systems. Major contracts between India and Israel that feature IAI include three Phalcon AWACS radar systems, 18 low-level quick-reaction Spyder missile systems, four EL/M-2083 Aerostat radars and the Barak ship-based air defence system. Several joint R&D projects between IAI and DRDO are reportedly underway including long-range SAMs for naval warships, medium-range SAMs for the Indian Air Force, UAVs, network-centric warfare equipment, satellite systems and advanced precision-guided munitions (PGMs).

Both sides benefit from the collaboration. In January 2008, ISRO successfully launched TECSAR, an advanced synthetic aperture radar (SAR) satellite developed by IAI. TECSAR ranks among the world’s most sophisticated space surveillance systems. It carries an SAR payload, designed to provide images during day and night, and under all-weather conditions, including through cloud cover. Then there’s Nova Integrated Systems Ltd, a joint venture between IAI and Tata Advanced Systems, near Hyderabad. The facility will be used to manufacture a wide range of defence and aerospace products, including missiles, UAVs, EW and homeland-security systems. Work is likely to begin in 2011. In fact, such has been the range and depth of India’s relationship with IAI that it has not been seriously affected even by allegations of kickbacks in the Barak-1 missile deal.

Privatise for Progress

Israel currently ranks third, after the US and Russia, as a global arms exporter. This is because it refrains from mixing politics with business, focusing on technological sophistication and competitive pricing. And IAI plays a large part in Israel’s stellar export performance. Around 80 per cent of IAI’s sales revenue comes from exports. Though it lacks a strong domestic customer base and faces intense competition from foreign companies, some are 10 times larger, IAI consistently punches above its weight. Its total sales in 2009 amounted to $2.9 billion, a creditable performance by any yardstick. Besides, it currently has a healthy $9 billion backlog, which will help ensure the company’s growth over the coming years. “Our products are appreciated by our customers, and we strive to develop new products that will open new international markets for us,” says IAI CEO Yitzhak Nissan. Understandably, therefore, the IAI stall at expos, including Aero India, attracts many visitors. There is no doubt that Aero India 2011 would witness participation by IAI in full strength!

Though America is Israels closest ally, it rarely hesitates to intervene to scuttle arms shipments to third countries.

Being a government-owned company, IAI has to contend with bureaucratic supervision and intrusion that competitors could not imagine. Company officials complain that IAI has lost out on major deals or lucrative joint ventures for lack of the required government authorisation and tardy decision making. Privatisation is the obvious answer, witness how Embraer of Brazil soared after it was freed of government control. In Israel, the arms industry is intimately involved in the whole gamut of national security, so private ownership could well create some grey areas. Nevertheless, a gradual process of semi-privatisation began around 2006 when a restructuring exercise shed many group and division level managers. Early 2010 IAI formally applied to move towards privatisation. However, privatisation is likely to be incremental rather than overnight.

IAI is also subject to foreign political pressure. Though America is Israel’s closest ally, it rarely hesitates to intervene to scuttle arms shipments to third countries. IAI old-timers rue the day when the Lavi project was cancelled under US demands and domestic indecision. Had the Lavi succeeded, IAI may well have emerged as a leading developer of combat aircraft. Is it still capable of designing a first-rate fighter aircraft? Some of the expertise that existed at the time of the Lavi has undoubtedly disappeared over the years. But, as Israel has proved time and again, it is not lacking in advanced technological capability, management skills and steely determination. If IAI’s track record in developing sophisticated UAVs and missiles is any indicator, it does indeed have the potential to successfully produce any major weapons system, even combat aircraft.

Others in the Race in Aerospace

No doubt the state-owned Israel Aerospace Industries (IAI) towers above its rivals being a prime source of aerospace products, this should not mask the notable contribution of the country’s other major aerospace entities: Elbit Systems, Rafael Advanced Defense Systems and Israel Military Industries (IMI). These too have to contend with a very limited domestic market and depend on aggressive exports to survive, even though their products are boycotted by several countries, especially major West Asian buyers with deep pockets. Each firm has made a name for itself , achieving noteworthy success in competition with the best technology offered by the West , Russia and now China.

Elbit’s Systematic Success

Take Haifa based Elbit Systems Ltd—Israel’s only major privately owned aerospace company—which employs over 11,000 people worldwide. Elbit is a famous name in defence circles thanks to its family of Hermes and Skylark UAVs, value upgrades for aircraft, helmet-mounted displays, and satellite imagery. It began in 1966 as a small computer and electronics firm; today it is a multi-billion dollar enterprise that ranks among the world’s 40 largest defence firms. It regularly features in Fortune’s list of the world’s 100 fastest-growing companies, currently standing at 56. With growth by 700 per cent over the past decade, its revenue was $2.83 billion in 2009, up 7.4 per cent from 2008. Its backlog of orders exceeded $5 billion.

It is anything but difficult to fall prey to bumbling programmers, yet in the wake of understanding this, I trust you never must be a survivor of programmers who can’t finish the activity given to them. I was at one time a casualty yet not any longer and this is on the grounds that I have discovered the best programmer ever and I wish to tell you that (cryptocyberhacker @ gmail com), Whatsapp:+15188160274 is as well as can be expected ever consider and he generally convey and he his solid.