The Indian Ministry of Defence introduced offset provisions in its Defence Procurement Procedure 2005 (DPP-2005)1 for capital acquisition schemes exceeding an estimated cost of Rs. 300 crores i.e. around $ 66 million with the fond hope to build indigenous capability in design, development and production of critical military hardware, systems, & components by promoting Joint Venture (JV) arrangements, Foreign Direct Investment (FDI) inflow, skill up gradation, setting up Manufacture Repair & Overhaul (MRO) facility, boosting export etc.

As part of the liberalisation process and to foster long term business/production tie up with global companies the offset policy in DPP 2006,2 2008,3 20094 included provision for credit banking5, delineation of defence products6 and dispensed with the licensing requirement in Ministry of Defence (MOD).

There is an urgent need to look at our offset policy options; particularly in regard to inclusion of technology transfer in priority areas, FDI policy in Defence and a more effective offset implementation arrangement.

DPP-20117 made a substantial leap from the earlier stipulation of direct offsets by including dual use Civil Aerospace products and Homeland Security items8 thereby ushering indirect offsets in a limited way. It also makes a definitive policy statement for progressive indigenization in critical areas and ensuring level playing field for the private sector including private shipbuilding companies.9

DPP-2011 was soon followed up with a Defence Production Policy10 document which outlines the road map for indigenization.

This paper examines impact of offset policy during (2005-2010) on indigenous capability build up in MIC (Military Industrial Complex) and bolstering self reliance. It brings out how offset realisation of around $2B during (2005-2010) was mainly for sub contractorisation of low end products and services, MRO facilities, Training & soft skills and has not brought in the expected inflow of FDI and JV arrangements, exports & long term business partnership in design, development and production of high end products.

There is thus an urgent need to look at our offset policy options; particularly in regard to inclusion of technology transfer in priority areas, FDI policy in Defence and a more effective offset implementation arrangement.

2. India’s Military Industrial Complex

India’s military industrial complex consists of 9 DPSUs, 40 OFs, 50 DRDO labs, 140 private defence companies, 5000 SMEs (Small and Medium Enterprises) involved in production of around 450 items.12

Product range: DPSUs & OFs

The nine DPSUs (Defence Public Sector Enterprises) are engaged in manufacture of wide range of products like helicopter, fighters, warships, submarines, patrol vessels, heavy vehicles and earthmovers, missiles and a variety of electronic devices, alloys and special purpose steel.13

A very high degree of self reliance has been achieved in these areas except in the area of artillery guns of 155 mm calibre where army is still groping to fill up the void in towed and wheeled category-thanks to Bofors imbroglio.

The forty ordnance factories are engaged in production of small arms and ammunition of all the weapon systems, clothing, armoured and transport Vehicles.14 A very high degree of self reliance has been achieved in these areas except in the area of artillery guns of 155 mm calibre where army is still groping to fill up the void in towed and wheeled category-thanks to Bofors imbroglio.

Value Addition

The DPSUs and OFs, largely through licence agreements since 1960s have built substantial production capability for tanks, ICVs, Vehicles, missiles, frigates, submarines, aircrafts and electronic devices.

The overall value addition of DPSUs hover around 37%. Midhani is a healthy exception (57%) where substantial self reliance in several critical material like titanium alloys, managing steel, special steel alloys, nickel base and cobalt base, super alloys and Niobium-Hafnium required by strategic sectors and programmes has been achieved.15

In case of OFs the value addition is substantial (85%), possibly because of the lesser technology depth of land systems compared to fighters and frigates.

Even amongst the naval platforms, value addition in submarines is substantially less (23%) compared to patrolling vessels (37%), because of technology depth.

The value addition of each deliverable would, depend on the depth of technology provided and stage of technology absorption.

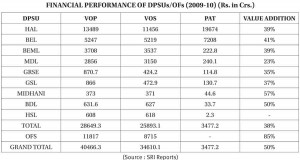

An overview of performance of the DPSUs and OFs is placed below:

The value of sales of DPSUs & OFs (Ordnance Factories) was of the order of $7.7Billion during (2009-10) with Profit after Tax to Sales a healthy 13% for the DPSUs.

DRDO: Major Programmes

The 50 Defence R&D lab(s) are engaged in progressive enhancement of self reliance of defence systems.16

Some of the major milestones towards making the country self- reliant in the areas of military technology are:

- Prithvi (Surface to Surface missile) in the ranges of 150 km & 250 km

- Agni-I (Surface to surface missile) with a range of 700km

- Akash (Surface to Air) missile with 25km range

- Brahmos (Supersonic cruise missile) – a JV product of India & Russia

- Light Combat Aircraft (LCA) Tejas

- Battle field surveillance radar- Short Range, Phased Array Radars

- Electronic warfare programme for Army (Samyukta) & Navy (Sangraha)

- Multi barrel rocket system(Pinaka) in 37.5 km range

- Hull mounted sonars HUMSA (NG)

- Torpedo Advanced Light (TAL) MK-1

The value of systems/products/technologies developed by DRDO and inducted into the services is in the range of $11B.17

Private Sector Participation:

Consequent on opening up of the defence industry sector in May 2001, allowing Indian private sector participation with FDI cap of 26%, a number of JVs have mushroomed between Indian and foreign companies.

| Editor’s Pick |

Major private sector industries and SMEs are actively engaged in software development, engineering services, manufacturing & sub assemblies, accounting for 17% of outsourcing18 to DPSUs, OFs.

They are also associated with national & strategic programmes like LCA, MBT (Main Battle Tank), Pinaka, Arihant, Dhanush & Brahmos.

Many of them have excellent facilities like Tatas, L&T, Pipava but significant limitation in terms of design capability and system’s integration.

The Buy & Make (Indian) option in 2009 would provide private sector a window to TOT19 which was the exclusive preserve of DPSUs/OFs earlier.

They are now into cost effective production of fast patrol vessels and IPVs & outcompeting defence shipyards – thanks to the level playing field provided in Ship Building Procedure.20 Even DPSUs like HAL are giving way to the Tatas in manufacture of Aerostructures & Cabins where foreign OEMs like Lockheed Martin & Sikorsky have shown distinct predelection for partnership with Tatas

They are now into cost effective production of fast patrol vessels and IPVs & outcompeting defence shipyards – thanks to the level playing field provided in Ship Building Procedure.20 Even DPSUs like HAL are giving way to the Tatas in manufacture of Aerostructures & Cabins where foreign OEMs like Lockheed Martin & Sikorsky have shown distinct predelection for partnership with Tatas

3. Self Reliance

Self-Reliance Index was defined as the ratio of Indigenous Systems Procurement Cost to Total System Procurement Cost of the year.22

Despite the impressive indigenous capability, Self Reliance Quotient has not moved beyond 30% since 1993.

In the aerospace sector, predominant reliance on licensed manufacturing without taking adequate steps to bolster nascent design and development capability is a major cause,23 of our lack of indigenous capability in the fighters segment.

The most serious problem in aircraft design, development and production is the vertical disjunction between design, development and production agencies.24

The Soviet Union brought the production agencies directly under the design bureau with remarkable results. Tony Saich also observes that the major orgnisational problem with S&T System has been lack of linkage across vertical structure; particularly between research & production sectiors.25

The Defence Expenditure Review Committee (2009) accordingly makes a strong case for drawing a self reliance road map for attaining the goal of 70% indigenisation in a 15 – 20 year time frame.26

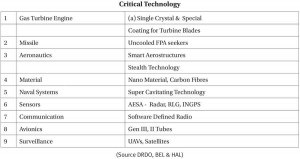

4. Gaps in Critical Areas of Technology

Self-Reliance is linked to indigenous capability to design, develop & produce critical subsystems like Propulsion, weapon, sensors of major platforms. The areas identified by Dr. Kalam 18 yrs’ back remain largely unchanged Even aerograde material used for fuselage by fighters27 and high quality steel required by frigates, submarines and aircraft carrier,28 our dependence on imports is around 90%. It is sometimes alluded to lack of economies of scale29 which is indefensible as India must have indigenous capability to produce such critical material to meet recurring requirement for aircraft and naval platforms.

5. Budget Trends: Capital Acquisition

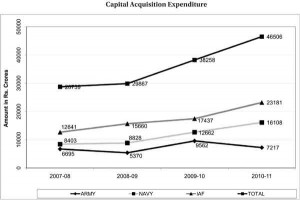

There has been a significant spurt in acquisition by IAF and Navy in recent years, major acquisition contracts signed being viz. MIG 29 (upgrade) (Rs.3856 Cr.), Medium Lift Helicopters (Rs.5600 Cr), C-130 J aircraft (Rs. 366 Crores) and LRMRASW (Long Range Maritime Reconnaissance and Surveillance) Aircraft) for the Navy (Rs.10684 Crores).

The trend of capital acquisition expenditure is placed below:

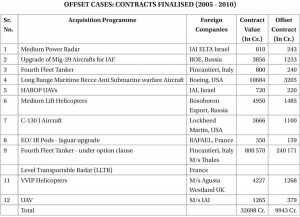

5. Offset Contracts (2005-2010)

The broad details of the 12 acquisition programmes & offset contracts concluded with foreign companies is placed below:-

Continued…: Impact of Offset Policy on India’s Military Industrial Capability – II