The report card of Modi 2.0 government’s 50 days that has been issued echo the optimism of the General Budget of 7th July. It plans to transform India into a 5 trillion dollar economy by 2024 by creating enabling environment for massive investment of $1.5 trillion by the private sector during (2019-2024).

It also plans to recapitalise the public sector banks by Rs.70000 crore. This will ensure that the five remaining public sector banks will come out of the purview Preventive Corrective Action (PCA). There is also a move to bring down labour laws for 622 to 134 and have 4 codes, so that manufacturing activities gain greater traction. Credit also needs to be given to the government for amending the POCSO Act, which provides for death penalty for serious sexual offences against the children. The other legislation to ban unregulated deposits (Ponzi scheme) is also welcome.

While the gun vs. butter controversy is inherent in any discussion, India has to be cognizant of its security concerns and state of art platforms, weapon systems required for meeting looming challenges of the adversary have to be in place

The removal of tainted officers under Rule 56J of CSS (CCA) conduct Rules is also timely. The bureaucracy can be extremely venal, dilatory and non accountable for its malfeasance. This is due to long winded procedure and constitutional protection available to the civil services under Article 311. Rule 56J, after the age of 56, is an effective way to move out corrupt and malingering officers.

Justice V.R. Krishna Iyer in a famous judgement had approved exercise of 56J as a potent weapon to ‘get rid of the dead wood in the system’. The proposal to set up a National Research Fund is also praise worthy. There is a move to create separate funding for defence and created a non lapsable fund. Each of these major initiatives needs to be objectively assessed.

Non Lapsable Fund for Defence

The Union Cabinet has amended the terms of reference of the 15th Financial Commission, so that the need of defence and internal security are set aside from regular expenditure. They would be treated as ‘non lapsable fund’, so that unspent amounts, particularly in capital expenditure, do not lapse at the end of the financial year.

This is a well conceived move, as modernisation of the defence services has been receiving short shrift over the years. Earlier defence budget was considered a Non-Plan budget, where the Planning Commission had no say. Even the finance commissions have rarely tried to tinker with budget allocation for defence; except to make an assessment of its expenditure implication in terms of GDP share.

There are concerns that if such security specific funds are created, this may affect revenue that goes to the states and deprive the country from alternative spending in education, health and economic infrastructure. There is an apprehension that it may upset the fine balance of federalism, where the expenditure under ‘Union List’ does not get precedence over the ‘State List’.

While the gun vs. butter controversy is inherent in any discussion, India has to be cognizant of its security concerns and state of art platforms, weapon systems required for meeting looming challenges of the adversary have to be in place. In this backdrop the real ‘Make-in-India’ challenge in defence manufacturing promotion of new age skills like AI, robotics and IOT for manufacturing of defence tanks, submarines, aircrafts and armoured vehicles are paramount.

For achieving $5 Trillion, the manufacturing activities need to be substantially bolstered.

With a Self Reliance Quotient of 30% in defence manufacturing as assessed by the Kalam Committee, the defence budget needs to be ring-fenced against premature surrender of funds at the end of the financial year.

Making India a $5 Trillion Economy

This dream is predicated on massive investment of $300 billion per year. Presently $50 billion has been provided is the capital budget. Given this yawning gap, the expectation that the shortfall would be sourced with a mix of deepening of capital bond market and floating of sovereign dollar debt need to be properly followed up. Unfortunately the surcharge in IT and FPI proposed in the budget has dampened the investment sentiment.

As per the OECD report (2018) India’s average tax rate at the top is around 48%, as against 25% for Emerging Market Economies (EMEs). The corporate sector was hopeful that the government would act on the recommendation at Arvind Modi committee which had proposed a reduction of corporate tax to 15 – 20%. The animal spirits, instead of soaring, has actually been dampened and the sensex is down by 2500 points. The government has also not followed up acted on the Kelkar Committee recommendation to break the logjam in PPP implementation in the infra sector.

For achieving $5 Trillion, the manufacturing activities need to be substantially bolstered. Sadly the budget does not provide adequate incentives, except by way of increasing the limit of 25% taxation to Rs.400 crore to the corporate sector.

Recapitalisation of Banks

Recapitalisation of banks has been a welcome move, as 5 public sector banks like UBI, UCO, Central Bank of India, IOC and Dena bank are still under PCA. It is to the credit of Modi 1.0 that the Insolvency & Bankruptcy Code has been able to clean up about 1 lakh crore from the gross NPA, which had swelled to 12 lakh crores during 2017-18. However, the solution to financial intermediation of public sectors banks is not in capital infusion but administering them in an efficient and professional manner with least government interference.

The Rajasthan government made a pioneering move by amending the three major acts in this regard viz. IDA (1947), Contract Labour Act (1970) and Factories Act (1948).

The P.J. Nayak Committee had suggested that the best course is to privatise the PSBs. At the least they should run on professional lines with independent directors. The Narasimham Committee in 1998 also had strongly advised the government to bring down its equity to 33% and refrain from infusing capital into the banking system. As India experiences 50 years of bank nationalisation, there is a strong case to revisit the recommendations of these two committees and take a final view regarding structural reforms required by PSBs.

Quite clearly the present patchwork through recapitalisation will not improve financial intermediation, which is very critical for reviving credit growth which has remained stagnant around 10%, as against 16-18% a decade back.

Labour Reforms

The labour reforms proposed are a welcome move. It may be recalled that P.C. Mahalanobis, speaking in 1969 had observed that India is “most protective of labour interests and the present form of protection could be an obstacle to growth”. Fifty years later he could not have been more prescient. With 44% workers in agriculture and another 42% working tiny enterprises, with less than 20 workers, India’s informal sector is characterised by inefficiency, low productivity and high cost.

The Rajasthan government made a pioneering move by amending the three major acts in this regard viz. IDA (1947), Contract Labour Act (1970) and Factories Act (1948). The limit for closure, retrenchment and lay off was increased to 300 workers as against 100 earlier, the threshold limit of contract labour from 20 to 50 and the definition of an organised factory increased from 10 to 20 workers, with power. In a remarkable study made on Impact of Labour Reforms by the PH.D. Chamber in Rajasthan (2015), the report has come to the conclusion that the amendments are symbolic in nature and has not attracted big investment or created job opportunities.

The reasons why manufacturing has not picked up in Rajasthan significantly, are mainly due to non-availability of skilled manpower and skill upgradation. The crux of the problem is not labour reform but poor infrastructure, non availability of skilled labour.

India spends less than 1% of its budget on Research, Development and Innovation.

The Economic Survey (2018-19), on the other hand has brought out how organised industries with more than 100 workers have become far more productive than industries with less than 100 works. This is based on ASI data (2016) for Rajasthan. There is a strong case for increasing the size of the industries; for which reforms in the labour laws would be very helpful.

The other area that needs attention is devoting greater attention is imparting high quality skills at all level. China is trying to become the global power in artificial intelligence, surpassing USA. For adapting industry 4.0, IOT, Cloud Computing, Data Mining and Artificial Intelligence have to be embraced. Bolstering manufacturing will be the key to generating substantial employment and for achieving Industry 4.0, rapid integration of physical and cyber systems are critical. India has to invest substantially in inculcating high skills amongst the workers. The Skill India report clearly brings out how only 7% are employable in reasonable jobs after, undergoing various skill training.

National Research Fund

The budget proposes for getting up a National Research fund so that all research activities are well coordinated and funded. While on the face of it, it looks to be a sound idea, on closer examination it will reveal that it may promote centralisation in decision making, with attendant delays and bickering among the stakeholders.

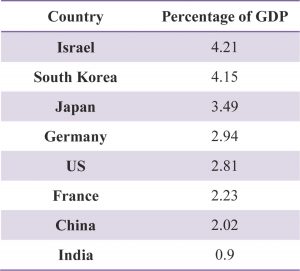

India spends less than 1% of its budget on Research, Development and Innovation. The following table would bring out the global comparison.

Mr. Arun Jaitley had proposed a Defence Technology Fund with a modest allocation of Rs.100 crore. This is yet to be operationalised. The DPP-2018 provides for 80% funding for making successful prototypes of Make projects by the private sector. This is yet to see light of the day and the budget earmarked every year gets surrendered.

The two areas in which India is critically dependent on imports are (a) sensors, and (b) propulsion. Defence R&D must come out of its monopoly of DRDO and include the academic and private sector players to forge meaningful joint design and development ventures with reputed global design houses. That’s the way forward, instead of making defence PSUs and DRDO the monopoly receivers of critical technology transfers from OEMs and design houses.

Conclusion

The harsh reality of the Indian state is that unemployment is at an all time high of 6.1 as estimated by CMIE and the GDP growth has been scaled down to 6.8% for 2019-20 by the NSSO. India also needs to scale up its efforts on imparting new age skilling technologies on a massive scale.

We need to come out of the low skill trap, which will deny us the benefit of reaping the fruits of globalisation. India must promote global manufacturing hubs, in which defence manufacturing can be a powerful component.

The initiative of the government to set up NRF, earmark funds for defence and encouraging MRO industry in the aviation sectors are welcome moves. Similarly the vision to integrate infra investments in areas like industrial corridors, freight corridors, Bharatmala and Sagarmala are very welcome. However, inorder to make India the preferred destination for investments, the tax rate must be lowered significantly from the present level of more than 40% to around 20-25% which is in vogue in Emerging Market Economies like China, South Korea and East Asian tigers.

The FM has missed a trick on this, which has seriously dented the spirits of both private entrepreneurs in India and abroad. She should have also increased FDI in defence to more than 50%, with suitable safeguards for national security to bring in critical technology. But the biggest challenge would be quality education, where the government invests too little (3% of GDP as against 6-10% in most developed and EMEs), and imparting state of art skills to our workers. We need to come out of the low skill trap, which will deny us the benefit of reaping the fruits of globalisation. India must promote global manufacturing hubs, in which defence manufacturing can be a powerful component.

The National Manufacturing Zone Policy (2011) had strongly advocated for such integration. Increasing manufacturing, inculcating workers with right skills and ensuring a low tax regime would pave the path for Make-in-India and provide employment opportunity to 10-12 million who enter into the market place every year. Thomas Friedman in his book ‘The World Is Flat’ wrote “when the Berlin wall fell, the windows came up”: ushering in the advent of internet which has completely changed the lives across the world. Communication has become faster, smart machines and systems have mushroomed everywhere, making the globe hyper connected. The leadership challenge in such an environment is how to collaborate, socially connect and to innovate.

Dr. APJ Abdul Kalam had rightly said that “an ignited mind is more powerful than anything on the earth, over the earth and under the earth”. The aspirational youth of India is looking forward to leadership of Mr. Narendra Modi to help India to be digitally more connected, getting educated with quality at affordable cost and receiving good health care at reasonable distance.

The demographic dividend in the absence of such credible policy and follow up and leadership which transcends caste, class, religion and ethnicity consideration would not happen. Mere invocation to patriotism and national security would not empower the youth with requisite skills and reasonable job opportunities. The digital divide needs to be bridged through holistic intervention.