The General Budget for 2019-20 can be pigeonholed as a ‘wish list’ for infrastructure to propel India to a $5 trillion economy by 2024. The new Finance Minister has sought to change the syntax from ‘consumption driven’ high growth to ‘investment driven’ growth; where government will provide the enabling conditions to aid and abet the ‘animal spirits’ of the private investors. While the budget is high on hypes, the supporting structures to realise such vision seems to be missing.

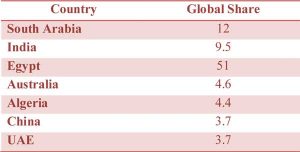

What is most disappointing is that Ms. Nirmala Sitharaman who has crossed over from the MoD to MoF, has made no change in the allocation made by her predecessor in the interim budget. Of particular concern is the fact that capital expenditure for defence modernisation has been given a short shrift. The only foot note in the budget is that spurring defence imports not manufactured in India, will be exempt from the purview of basic E.D. This will bolster import of defence equipment into India, which is the second highest global importer of conventional arms, as per SIPRI Year Book (2019).

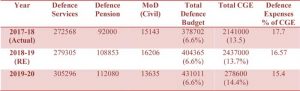

Defence expenditure in India has three components viz. the expenditure incurred by the three defence services and the 40 ordnance factories, (70%), defence pension to nearly 3.1 million pensioners (24%), and defence civilians (0.4 million) (6%). This year’s total estimated defence expenditure will be around Rs.3.79 lakh crore, which is around 15.4% of central government expenditure. This shows a drop of 2.3% from the actual expenditure of 2017-18. The trends are tabulated below.

It would be seen from the above that the increase in defence budget has been around 6.6% over the last three years, whereas the general budget has been hiked by around 14%. In terms of share in total CGE, there is a consistent drop from 17.7% (2017-18) to 15.4% during 2019-20. In terms of share in GDP, it’s around 2%, which is much lower than 3% threshold that the defence services, has been constantly clamouring for.

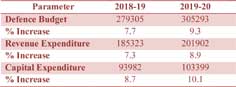

It would be equally important to look at the allocation made to both revenue and capital component of defence expenditure, which is as under:

It would thus be seen, that after accounting for inflation of around 4% per year, the real increase in capital expenditure is only 6%. In case of revenue component it’s around 5%. Ideally the modernization component of defence expenditure for acquiring aircrafts, submarines and tanks, platforms and systems should be around 40% of total defence expenditure; while in India it’s around 30%. The other disturbing element is that roughly 60% of defence budget is spent on salary and pension. The teeth to tail ratio is proportionately high (60:40), as in developed economies it’s around (80:20). A higher tail clearly shows that the support services and the overheads are unusually high. Carrying on with services like military farms, huge fleet of military transportation, unusually high level of inventory are symptomatic of the long tail, that need to be trimmed considerably.

There are a few concern areas that the Finance Minister should have ideally addressed in this budget.

FDI into Defence

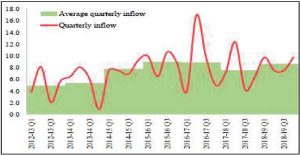

She has justifiably highlighted that FDI inflow into India has remained robust despite global headwinds, where it slid by 13% in 2018 (UNCTAD World Investment Report 2019). In contrast, India’s FDI inflow in 2018-19 has remained strong at US$ 64.3 billion, marking a 6% growth over the previous year. The FDI inflow trend is as under.

It’s heartening to find the Finance Minister has permitted 100% FDI in to insurance intermediaries and looking forward to opening up of the FDI in aviation, media and insurance. It may be recalled FDI into Defence manufacturing, was hiked from 26% to 49%.

It has been suggested by many discerning analysts that this limit should be increased to more than 51%, with suitable safeguard; so that reputed OEMs bring in state of technology and engage in long term JV the with Indian companies. China is an excellent example in this regard as it allows 76% FDI in the aerospace segment. The 49% limit has so far bought in only ($0.18 million) i.e. Rs.1.16 crore, as per reply given by MOS in Defence Ministry; 2018. While the Minister stated that approval has been accorded for another Rs.237.44 crore, the inflow has actually not started. The Finance Minister has lost a wonderful opportunity by not increasing the FDI limit in defence manufacturing. While she has identified self reliance in MRO and bolstering domestic aviation market as thrust areas, she has lost a wonderful opportunity of improving the production footprint of dual sectors like aviation and shipbuilding, where higher FDI would have helped. This would have contributed to Make-in-India in defence manufacturing instead of perpetuating with a stagnant Self Reliance Index (SRI) of 30% since 1995.

PPP in Defence Manufacturing

The budget makes a pitch for increasing India’s infrastructure to $1500 billion till 2024; mostly through the PPP mode. Sadly there has been no such mention for defence manufacture; in this while in case of railways she has made a strong pitch for PPP to ‘unleash faster development and completion of tracks, rolling stock manufacturing and delivery of passenger freight services’. Most of the 40 ordnance factories of India have became a cesspools of inefficiency, high cost with very poor accountability.

A case in point are the ordnance clothing and equipment group of factories at Kalupur which still produces ill fitting uniforms and poor shoes for our soldiers. The factories at West Bengal (MSF, GSF, OFD) are also extremely old and inefficient. There is a strong case for disinvestment and privatising these factories. The PM Nair Committee (1988) had strongly suggested for privatisation. However these sensible recommendations have been put to the back burners. Equally inefficient are many of the factories of HAL which are producing ALHs at Bangalore and accessories at Kanpur and Lucknow. They are ideal candidates for PPP as many robust private sector companies like Tatas.

On the ship building front, L&T has evinced strong interest to produce frigates and surveillance vessels etc. The government must look for such opportunities, instead of getting nettled by recommendations of Dhirendra Singh Committee for strategic partnership between selected public and private sector players. The concept of Raksha Utpadan Ratnas (RUR) is not getting traction.

One of the serious concerns in infra sector in India has been the slowing dam of the PPP experiment due to contracting hiccups. Vijay Kelkar has made many sensible suggestions to get over such logjam. The Finance Minister must operationalize these suggestions; as PPP has excellent potential in major manufacturing activities like railways, defence, national highway, ports and airports.

Structural Changes

The defence set up of MoD requires significant structural changes; particularly in terms of its acquisition process and R&D. The Sisodia Committee had suggested that India must adapt the DGA structure of France, where right from R&D, production to maintenance, the entire gamut of defence acquisition cycle is handled under one umbrella. The other major structural change needed is to bring in greater vitality and accountability to our DRDO laboratories by opting for the DARPA structure of USA. In case of DARPA, no funding support is provided by the government and it’s expected to fund frontline research itself, in collaboration with private sector players, universities and research agencies. This has to be the long term vision of government of India. DRDO has singularly failed to deliver critical subsystems like aero-engines, air to air missiles and state of art radars. Once market mechanism is put in place, research and innovation would get real fillip in collaboration with private sector players.

Concluding Thoughts

With the massive mandate of Modi 2.0, it was expected that incrementalism in economic liberalisation will give way to fundamental structural changes. Prominent investment analysts like Ruchir Sharma constantly lament about the fact that political freedom in India has not been accompanied by economic freedom for private business enterprises. This is particularly true of the defence manufacturing segment, where the process of liberalisation has been halting and half hearted.

The PSUs and OFs are the captive beneficiary of this non-liberalisation process. While ‘Make-in-India’ has been touted as overall policy mosaic to prop up our gross value addition, defence manufacturing in the aerospace sector has been dominated by assembly of parts and not manufacturing parts and components by a major defence PSU like the HAL. The other defence PSUs and OFs suffer from enormous inefficiency, time delay and cost overruns. Being under the protective umbrella of MOD (Production), their accountability in terms of such overruns, poor quality and high cost are hardly taken to their logical conclusion. Passing the buck happens, between the stakeholders; viz. the services, production agencies and policy makers in the South Block.

One expected Ms. Nirmala Sitharaman to have learnt these undercurrents of inefficiency during her stint as the defence minister to make amend, in terms of policy as pronouncement in the budget. By not increasing FDI limit in defence manufacturing and not promoting PPP in defence production. She has missed a big opportunity to usher in concrete, big bang reforms in our military industry capability. The long term strategic independence of the country requires that we promote greater involvement of the OEMs, global decision houses and private sector players as long term investors in this country. FDI and PPP can be the pied pipers in this vision, and will promote employment, technology and higher self reliance in the defence sector!