The Highlights of Offset Contracts:

- Steady increase from $ 48.6M in 2007 to $519.5M in 2008, $974M in 2009 to around $ 700 M during 2010.

- The Aerospace sector accounts for 65% and balance by the other services.

- Level playing field concerns has been turned on its head as the Indian private industry accounts for 70% in value of these contracts.

- The DPSUs viz. HAL and BEL and Tatas and L&T from the private sector are major players.

- The SMEs and IT companies have also a fairly handsome share.

- There is no positive impact on exports.

- In terms of FDI inflow for infrastructure, production and R&D, the impact is minimal.

- Only l case of credit banking has been approved so far.

Major Beneficiaries

The major beneficiaries of the offset arrangements in the public and private sector are given below:

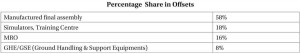

Major Areas of Offset Realisation

The major areas of Offset realisation are (a) Sub contractorisation (58%) involving supply of fuselage, cabins, radome, tail cone, data link, & other products (b) Engineering projects, project management, (c) Overhaul and repair facilities (16%) (d) Various types of training facilities, simulators & (e) Ground Handling/Support Equipments.

7 Impact of Offsets

Aerospace Sector

The Aerospace sector is historically the prime beneficiary of Offsets as most countries source their fighter aircrafts like F5, F15, F16 and F18 with varying degrees of offset obligations.

USA accounts for nearly 60% of global Arms production which was around $ 471 B during 2008.30 Of the 100major global Arms producing companies, aerospace products account for nearly 80%.31

HAL enjoys monopsonic position in aerospace sector and has been beneficiary of Technology transfer for MIG 21(1960s- 70s),MIG 27, MIG 29 and SU30(1996). It has enabled HAL to achieve high level of technology capability in manufacturing combat aircraft and engines.32

The TOT arrangements, however, has not created defence industrial capability for supplying advanced weapons system that would be competitive with western equipments. Nor has the technology gap closed.33

The types of work realised through offset arrangement in HAL are as under:

MRO Capability

In the Defence sector capability to undertake MRO, (Manufactures Repair Overhaul) upgrade and assemble is the most basic level capability. Establishment of depot Maintenance capability (MRO) was one of the key areas recommended by Dr. Kelkar through offset arrangements.34

The offset contracts for Mig 29 upgrade and VVIP helicopters, are in this genre. In case of the ‘Globe master’ contract, HAL is likely to benefit in terms of ROH (Repair Overhaul) facilities through offset.35

Credit Banking

A provision of banking credit with sunset and sunrise clause was introduced in DPP 2009. Of the 8 proposals received only one has been approved so far in respect of M/s. Eurocopter.

There has been unusual prevarication in MOD to finalise such banking arrangements though the amounts involved are insignificant & that too from reputed OEMs. This has understandably embittered foreign OEMs36 as they look for expeditious approval process.

Impact on Indian Partners

A questionnaire was sent to Indian partners involved in ongoing offset contracts to elicit their response to such arrangement with OEMs. From the feedback received, it was seen that offset arrangement has helped them in skill up gradation, boosting export & helping market penetration.

These contracts seem to have a favourable impact on export, skill up gradation with a potential for future business. Sustainment is another challenge.

Defence, being a very niche sector with specific skills requirement, it is important to develop training grounds for manpower.

Impact on Exports

It would thus be seen that except for BEL there has been no impact of Offset for promoting exports. A rank correlation between arms exports and size of defence industrial base during 1980-2006 for EDA (European Defence Agency) countries reveal a significant rank correlation (+0.76) showing that size of DIB (Defence Industrial Base) was positively associated with arms exports.37

Cost Effectiveness

Critics of offset arrangements often contend that offsets come at an additional cost implication ranging between 4 – 15%.38 Wally Strys argues that Belgium had to pay an estimated in ‘over costs’ in conjunction with offsets.39 Stephen Martin reports that offsets do cost more than off – the shelf purchase.40 Sub contractorisation constitutes the major area of offset realization in India. This is not surprising as India is a cost efficient destination for outsourcing. A case in point is export of empennage for SU30 to the Russians, where, as against $18 MHR (Man hour rate) in HAL Russia’s MHR was @$45-$50.

Some critics aver that such outsourcing arrangements would have come without an offset stipulation. The real question is whether offsets, really represent new business, business that would not have taken place without the offset deal.41 UK experience suggests that only 25% to 50% of total offset is genuinely new business.42

Technology Development Capability

In terms of its impact on Technology capability, offset seems to have facilitated introduction of new products, registration of patents with Indian players getting associated with a wide array of foreign players.

Significantly these SMEs are investing handsomely in R&D (20% – 40%) making them technically fleet footed and more sure of absorbing leading edge technology. They are leaner, more agile, have low setup cost, high level of skills and cost effective is production of smaller systems compared to many larger private sector companies.

Big private the Indian companies, therefore, need to invest more in R&D to spur foreign OEMs to collaborate in high technology products.

The private sector companies like Tatas, L&T, and Pipavav, despite having excellent facilities, have an inherent limitations in terms of design development capability and system integration. Japan’s success in fast technology absorption was largely due to its highly skilled personnel and low cost of labour.43This holds an important lesson for major private players also in India.

HAL & BEL need to ramp up their R&D investment to around 10% from the present allocation of around 6%44 for smooth absorption of technology in major programmes like Fifth Generation Fighter Air Craft (FGFA), Multirole Transport Air Craft (MRTA) & Tactical Communication System (TCS).

In France, R&D activities absorb more than 15% of the turnover of Aerospace companies. French Research excels in propulsion and combustion, composite materials, aerodynamics, acoustics and embedded electronics making France a leading player in Aerospace & Defence Sector.45