IAI: Aiming High : What is remarkable about Israel is that despite its size and less-than-friendly neighbours—one of whom regularly threatens annihilation—it continues to survive. The country has not just endured, but thrived, and dominates the agenda of West Asia. What is remarkable about the government owned Israel Aerospace Industries Ltd (IAI) is that notwithstanding its humble beginnings—servicing and refurbishing a few dozen aircraft—half a century later it is the foremost industrial corporation in Israel. The company has consistently played a part in the technological and economic progress of the country and its security.

Today, with about 17,400 employees, it is Israel’s largest aerospace and defence enterprise. . It is already the nation’s leading industrial exporter and is fast emerging as a key source of unmanned drones and missiles for the global military market. Reason enough for it to have an impressive presence at Aero India 2011.Apart from producing fighter aircraft, the state-owned behemoth builds civilian aircraft—like the G100/G150 and G200/G250 mid-size business jets—for US manufacturer Gulfstream. It undertakes maintenance, reconfiguration and upgrade of foreign-built civilian and military aircraft. IAI also focuses on Unmanned Air Vehicles (UAV) and high-tech missiles and its expertise extends to weapons and other systems for ground and naval forces.Many of its products are designed for the Israel Defence Forces (IDF), while others are exported to about 70 countries. 15 per cent of every new F16, for instance, consists of Israeli systems and many of these from IAI.

Today, with about 17,400 employees, it is Israel’s largest aerospace and defence enterprise. . It is already the nation’s leading industrial exporter and is fast emerging as a key source of unmanned drones and missiles for the global military market. Reason enough for it to have an impressive presence at Aero India 2011.Apart from producing fighter aircraft, the state-owned behemoth builds civilian aircraft—like the G100/G150 and G200/G250 mid-size business jets—for US manufacturer Gulfstream. It undertakes maintenance, reconfiguration and upgrade of foreign-built civilian and military aircraft. IAI also focuses on Unmanned Air Vehicles (UAV) and high-tech missiles and its expertise extends to weapons and other systems for ground and naval forces.Many of its products are designed for the Israel Defence Forces (IDF), while others are exported to about 70 countries. 15 per cent of every new F16, for instance, consists of Israeli systems and many of these from IAI.

Making History

IAI was established in 1953 as Bedek Aviation Company with the aim of supporting the defence of the beleaguered five-year old nation. It is doubtful if the 70 dedicated employees operating from a ramshackle site on the sand dunes of Israel’s Lod Airport could have imagined the heights their company was destined to attain.

Much of IAI’s world-class expertise was born out of sheer necessity. It worked closely with the Israeli Air Force (IAF) maintaining a sharp practical focus. Israel has been at war through much of its history—as a result, IAF pilots are skilled in aerial warfare, and know exactly what they want from their aircraft. It made sense for the IAF to send its fighters, helicopters, and aviation support systems for modification, upgrade and improvement to IAI. As a result of its pioneering efforts in refurbishment and enhancement, IAI quickly became a leader in the field. Israel has always hankered after autonomous control of its lethal weapons. It insists that it be allowed to install its own specialised weapons and equipment—especially radar, electronic warfare (EW) and communications systems—even on foreign-sourced combat aircraft.IAI frequently provides the technological underpinning that makes this policy viable. Innovative to the core, it constantly tries to develop new and improved weapons and systems for the IDF.

Much of IAI’s world-class expertise was born out of sheer necessity. It worked closely with the Israeli Air Force (IAF) maintaining a sharp practical focus. Israel has been at war through much of its history—as a result, IAF pilots are skilled in aerial warfare, and know exactly what they want from their aircraft. It made sense for the IAF to send its fighters, helicopters, and aviation support systems for modification, upgrade and improvement to IAI. As a result of its pioneering efforts in refurbishment and enhancement, IAI quickly became a leader in the field. Israel has always hankered after autonomous control of its lethal weapons. It insists that it be allowed to install its own specialised weapons and equipment—especially radar, electronic warfare (EW) and communications systems—even on foreign-sourced combat aircraft.IAI frequently provides the technological underpinning that makes this policy viable. Innovative to the core, it constantly tries to develop new and improved weapons and systems for the IDF.

In February 1980, IAI launched an ambitious programme to design and manufacture the Lavi, a multi-role combat aircraft. But the multi-billion dollar project received a setback when the Israeli government considered the project to be unaffordable. Besides, political pressure from the US government, which feared that success of the Lavi could impinge on the demand for the F16. The project was shelved in 1987. A grievous blow indeed but ultimately a blessing in disguise because it forced the company to focus on UAVs.

Unmanned and Deadly

Israel’s legendary battle-hardened military machine has always generated unique and specialised needs—from tanks to EW to combat aircraft. It is increasingly plumping for UAVs. “UAVs are the future and will play a major role in asymmetric warfare against insurgent groups and non-state actors,” says Yair Shamir, IAI’s Chairman of the Board of Directors. IAI-MALAT, a division of IAI’s Military Aircraft Group, is a world leader in UAV technology. Its UAVs have notched up more than 750,000 operational flight hours of intelligence gathering, dissemination and targeting missions for 48 customers on four continents.

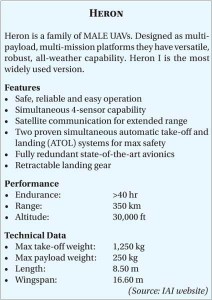

Introduced in 2006, its best-known product the Heron,, is a Medium Altitude Long Endurance (MALE) UAV and is used for both strategic and tactical missions. An enhanced version of the Heron, called Heron TP or Eitan, was developed for the IAF. Heron has proved popular with countries around the globe, India being one of them. IAI is among the world’s top two developers of missiles with loitering capability.

Introduced in 2006, its best-known product the Heron,, is a Medium Altitude Long Endurance (MALE) UAV and is used for both strategic and tactical missions. An enhanced version of the Heron, called Heron TP or Eitan, was developed for the IAF. Heron has proved popular with countries around the globe, India being one of them. IAI is among the world’s top two developers of missiles with loitering capability.

Also being readied for action is a tilt-rotor UAV named Panther. This machine combines the characteristics of a fixed-wing aircraft with helicopter-like hover capability which enables a runway-free operations from unprepared surfaces. With an automatic flight-control system, the transition from the hover to forward flight and vice versa, is smooth and does not even need an external pilot. Panther, which weighs 65 kg, has three ultra-quiet electric motors, and six-hour loiter capability up to three km altitude, with a radius of operation of over 60 km. It carries IAI’s Mini- Plug-in Optronic Payload (POP), a camera with a laser rangefinder and laser designator. The smaller 12-kg Mini Panther can remain on station for approximately two hours and is intended for more modest missions.

The system is expected to be operational in 2011. UAVs are likely to become ubiquitous over the next decade or two. The US military campaign in Afghanistan prominently features MQ-1 Predator and MQ-9 Reaper UAVs armed with Hellfire AGM-114 air-to-ground missiles—these have taken out numerous Taliban and jihadist luminaries in recent months. China is ramping up production of UAVs in an apparent effort to catch up with USA and Israel. Russia has invested heavily in their development, but its systems are inferior to those of Israel, due to their high acoustic signatures and insufficient miniaturisation of mission payloads.Significantly, Russia’s first ever purchase of a foreign weapons system was an all-UAV affair. In 2010, it acquired from IAI the Bird Eye 400 mini-UAV, I-View MK 150 tactical drone and the medium-range Searcher Mark 2. It is also eyeing the much-sought-after Heron. Other countries across the globe are acquiring UAVs on a smaller scale since most lack the Israelis’ level of experience in unmanned operations. The IAF itself is planning to switch to UAVs in rather dramatic fashion. It is expected that within 10 to 12 years a third of IAF aerial platforms will be unmanned; this could increase to 50 per cent by 2030. Most likely, IAI will be the main supplier.

The system is expected to be operational in 2011. UAVs are likely to become ubiquitous over the next decade or two. The US military campaign in Afghanistan prominently features MQ-1 Predator and MQ-9 Reaper UAVs armed with Hellfire AGM-114 air-to-ground missiles—these have taken out numerous Taliban and jihadist luminaries in recent months. China is ramping up production of UAVs in an apparent effort to catch up with USA and Israel. Russia has invested heavily in their development, but its systems are inferior to those of Israel, due to their high acoustic signatures and insufficient miniaturisation of mission payloads.Significantly, Russia’s first ever purchase of a foreign weapons system was an all-UAV affair. In 2010, it acquired from IAI the Bird Eye 400 mini-UAV, I-View MK 150 tactical drone and the medium-range Searcher Mark 2. It is also eyeing the much-sought-after Heron. Other countries across the globe are acquiring UAVs on a smaller scale since most lack the Israelis’ level of experience in unmanned operations. The IAF itself is planning to switch to UAVs in rather dramatic fashion. It is expected that within 10 to 12 years a third of IAF aerial platforms will be unmanned; this could increase to 50 per cent by 2030. Most likely, IAI will be the main supplier.

According to IAI sources, UAV-based EW and cyber warfare will be a major emerging opportunity. UAV design goals will focus on how low-cost systems can undertake multiple tasks and provide mutual support. Active Electronically Scanned Array (AESA) technology with its ability to detect small objects with high discrimination, will be essential. EW capabilities will be inbuilt and stealth will be essential. If not too expensive, UAVs can be launched in large numbers to overwhelm enemy defences.

Therefore, quantity will be the primary consideration, the more UAVs produced for a given investment, the better. The bottom of the performance spectrum is also steadily gaining importance. IAI is actively working on several new UAV designs and many will be cheap, light and practically invisible.

The company has reportedly tested a six inch, butterfly-like UAV with four flapping, transparent wings stable enough to record live video clip of a small crowd. Similar UAVs could well be snapped up by the burgeoning homeland security market.

Interception by Arrow

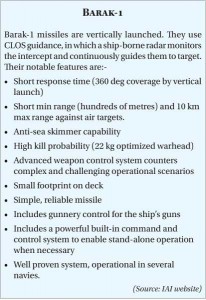

In missile technology, IAI is again at the cutting edge. The IAI Barak-1 is one of the most potent ship-launched surface-to-air missiles designed for superior performance against the full range of naval threats. Several frontline warships of the Indian Navy are armed with the Barak-1 acquired in 2000.

Israel is perhaps the only country in the world actively working towards a national missile shield expected to be operational by 2015. The shield comprises three layers. The bottom layer consists of Iron Dome, which uses small radar-guided missiles to destroy short-range rockets—like the Katyusha and Grad used by Hezbollah in Lebanon and Hamas in the Gaza Strip.

To counter medium-range missiles, there’s David’s Sling or Magic Wand which is the middle layer. And the top tier is Arrow, jointly produced by IAI and Boeing. Arrow-2 interceptor missiles are already operationally deployed in Israel. In July 2010, Israel and the US signed an agreement to produce the Arrow-3, capable of shooting down long-range missiles outside the atmosphere.Arrow-3, to be deployed in conjunction with Arrow-2 and employing kinetic kill instead of Arrow-2’s proximity-warhead detonation, it will be the most advanced ballistic missile interceptor in the world. It will have super manoeuvrability enabling it to change its trajectory to engage another target—even one that was detected after its own launch. Its maiden launch is expected mid-2011.

To counter medium-range missiles, there’s David’s Sling or Magic Wand which is the middle layer. And the top tier is Arrow, jointly produced by IAI and Boeing. Arrow-2 interceptor missiles are already operationally deployed in Israel. In July 2010, Israel and the US signed an agreement to produce the Arrow-3, capable of shooting down long-range missiles outside the atmosphere.Arrow-3, to be deployed in conjunction with Arrow-2 and employing kinetic kill instead of Arrow-2’s proximity-warhead detonation, it will be the most advanced ballistic missile interceptor in the world. It will have super manoeuvrability enabling it to change its trajectory to engage another target—even one that was detected after its own launch. Its maiden launch is expected mid-2011.

A Win-Win Relationship

And what of the Indian market? India is reportedly looking at a possible $50 billion worth of defence purchases over the next five years and some $100 billion by 2022. Over the past decade, Israel has rapidly emerged as India’s second largest defence supplier, next only to Russia. The relationship has blossomed despite the dichotomies in India’s foreign policy in the region. Israel responds to India’s arms requests promptly and has secured several lucrative modernisation contracts. Russian equipment—tanks, ships, helicopters and fighter aircraft—all have been upgraded with Israeli electronics and missiles. And IAI has been in the forefront of the action.

Several joint R&D projects between IAI and DRDO are reportedly underway including long-range SAMs for naval warships, medium-range SAMs for the Indian Air Force, UAVs, network-centric warfare equipment, satellite systems and advanced precision-guided munitions (PGMs).

Technological cooperation has focused on surveillance radars, drones and missile systems. Major contracts between India and Israel that feature IAI include three Phalcon AWACS radar systems, 18 low-level quick-reaction Spyder missile systems, four EL/M-2083 Aerostat radars and the Barak ship-based air defence system. Several joint R&D projects between IAI and DRDO are reportedly underway including long-range SAMs for naval warships, medium-range SAMs for the Indian Air Force, UAVs, network-centric warfare equipment, satellite systems and advanced precision-guided munitions (PGMs).

Both sides benefit from the collaboration. In January 2008, ISRO successfully launched TECSAR, an advanced synthetic aperture radar (SAR) satellite developed by IAI. TECSAR ranks among the world’s most sophisticated space surveillance systems. It carries an SAR payload, designed to provide images during day and night, and under all-weather conditions, including through cloud cover. Then there’s Nova Integrated Systems Ltd, a joint venture between IAI and Tata Advanced Systems, near Hyderabad. The facility will be used to manufacture a wide range of defence and aerospace products, including missiles, UAVs, EW and homeland-security systems. Work is likely to begin in 2011. In fact, such has been the range and depth of India’s relationship with IAI that it has not been seriously affected even by allegations of kickbacks in the Barak-1 missile deal.

Privatise for Progress

Israel currently ranks third, after the US and Russia, as a global arms exporter. This is because it refrains from mixing politics with business, focusing on technological sophistication and competitive pricing. And IAI plays a large part in Israel’s stellar export performance. Around 80 per cent of IAI’s sales revenue comes from exports. Though it lacks a strong domestic customer base and faces intense competition from foreign companies, some are 10 times larger, IAI consistently punches above its weight. Its total sales in 2009 amounted to $2.9 billion, a creditable performance by any yardstick. Besides, it currently has a healthy $9 billion backlog, which will help ensure the company’s growth over the coming years. “Our products are appreciated by our customers, and we strive to develop new products that will open new international markets for us,” says IAI CEO Yitzhak Nissan. Understandably, therefore, the IAI stall at expos, including Aero India, attracts many visitors. There is no doubt that Aero India 2011 would witness participation by IAI in full strength!

Though America is Israels closest ally, it rarely hesitates to intervene to scuttle arms shipments to third countries.

Being a government-owned company, IAI has to contend with bureaucratic supervision and intrusion that competitors could not imagine. Company officials complain that IAI has lost out on major deals or lucrative joint ventures for lack of the required government authorisation and tardy decision making. Privatisation is the obvious answer, witness how Embraer of Brazil soared after it was freed of government control. In Israel, the arms industry is intimately involved in the whole gamut of national security, so private ownership could well create some grey areas. Nevertheless, a gradual process of semi-privatisation began around 2006 when a restructuring exercise shed many group and division level managers. Early 2010 IAI formally applied to move towards privatisation. However, privatisation is likely to be incremental rather than overnight.

IAI is also subject to foreign political pressure. Though America is Israel’s closest ally, it rarely hesitates to intervene to scuttle arms shipments to third countries. IAI old-timers rue the day when the Lavi project was cancelled under US demands and domestic indecision. Had the Lavi succeeded, IAI may well have emerged as a leading developer of combat aircraft. Is it still capable of designing a first-rate fighter aircraft? Some of the expertise that existed at the time of the Lavi has undoubtedly disappeared over the years. But, as Israel has proved time and again, it is not lacking in advanced technological capability, management skills and steely determination. If IAI’s track record in developing sophisticated UAVs and missiles is any indicator, it does indeed have the potential to successfully produce any major weapons system, even combat aircraft.

Others in the Race in Aerospace

No doubt the state-owned Israel Aerospace Industries (IAI) towers above its rivals being a prime source of aerospace products, this should not mask the notable contribution of the country’s other major aerospace entities: Elbit Systems, Rafael Advanced Defense Systems and Israel Military Industries (IMI). These too have to contend with a very limited domestic market and depend on aggressive exports to survive, even though their products are boycotted by several countries, especially major West Asian buyers with deep pockets. Each firm has made a name for itself , achieving noteworthy success in competition with the best technology offered by the West , Russia and now China.

Elbit’s Systematic Success

Take Haifa based Elbit Systems Ltd—Israel’s only major privately owned aerospace company—which employs over 11,000 people worldwide. Elbit is a famous name in defence circles thanks to its family of Hermes and Skylark UAVs, value upgrades for aircraft, helmet-mounted displays, and satellite imagery. It began in 1966 as a small computer and electronics firm; today it is a multi-billion dollar enterprise that ranks among the world’s 40 largest defence firms. It regularly features in Fortune’s list of the world’s 100 fastest-growing companies, currently standing at 56. With growth by 700 per cent over the past decade, its revenue was $2.83 billion in 2009, up 7.4 per cent from 2008. Its backlog of orders exceeded $5 billion.

What is the secret of its striking success? The company credits its revenue growth to higher sales of airborne systems, electro-optics and C4I (command, control, communications, computers and intelligence) systems. Apart from organic growth, it has profited from a series of well-judged acquisitions within Israel and elsewhere, in consonance with global defence trends. It strives to be number one or at least in the first three of whichever field it enters into, focusing strictly on technologies where it maintains a competitive edge like helmet-mounted displays and advanced avionics systems. The country of origin of the equipment has never been a constraint. It is equally at home with the Russian MiG29 and the world’s most advanced fighter, the US F35.

Elbit believes that the changing nature of military operations in recent years, including low intensity conflicts and terrorist activities, has resulted in a reorientation of defence priorities. There is greater demand for C4I, as well as intelligence, surveillance and reconnaissance (ISR) systems. Elbit also feels that in a few years, perhaps 40 per cent of Israeli military air missions will be mounted by UAVs. Eliminating the pilot means less operator training, fewer countermeasures and no aircrew losses, possibly reducing UAV costs to just 5 to 10 per cent of those for an equivalent F16 mission. Besides it permits the mounting of far riskier missions than with manned fighter aircraft. For UAVs, high endurance and low loiter speed are important; hence jet engines are meaningless.

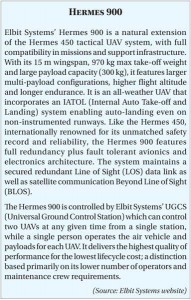

Elbit’s new Hermes 900 is an improved version of the Hermes 450 tactical UAV. It is a medium sized multi-payload vehicle designed for medium altitude long endurance (MALE) tactical missions.

Elbit’s new Hermes 900 is an improved version of the Hermes 450 tactical UAV. It is a medium sized multi-payload vehicle designed for medium altitude long endurance (MALE) tactical missions.

The Israeli Defence Force (IDF) recently selected Elbit Systems’ Skylark 2 as the infantry’s brigade-level UAV and completed a series of operational tests on it.

Advantage Rafael

Established in 1948, Rafael Advanced Defense Systems Ltd is a state-owned firm that designs and manufactures a wide range of high-tech defence systems for air, land, sea and space applications. The company made attempts to enter the UAV market but abandoned these efforts last year. Most of its current projects are classified. According to Rafael, when setting up an armament production or sales facility, it seeks to create local jobs, transfer technology needed to upgrade and maintain the equipment and, finally, leverage local industry’s participation to secure sales.

The strategy is working as in 2009, sales jumped 16 per cent from a year earlier, while its order backlog climbed nearly 30 per cent to $3.2 billion. Rafael offers a broad spectrum of advanced products and capabilities, including Iron Dome and David’s Sling, protection systems for land combat vehicles (such as the Trophy active protection system against sophisticated anti-tank missiles), electro-optical systems for target acquisition, laser designation and reconnaissance purposes, and C4I systems for net-centric warfare.

However, the programme most responsible for Rafael’s high growth is probably the Spike family of missiles. Spike is a fourth generation man-portable fire-and-forget anti-tank guided missile with tandem-charged high explosive anti-tank (HEAT) warheads, currently in service with a number of nations. It comes in various versions including Long Range, Medium Range and Extended Range.

However, the programme most responsible for Rafael’s high growth is probably the Spike family of missiles. Spike is a fourth generation man-portable fire-and-forget anti-tank guided missile with tandem-charged high explosive anti-tank (HEAT) warheads, currently in service with a number of nations. It comes in various versions including Long Range, Medium Range and Extended Range.

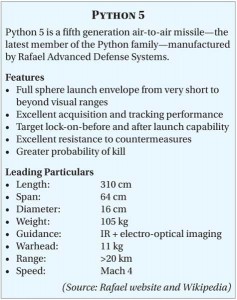

In aerospace circles, however, Rafael is practically synonymous with its Python family of missiles that has passed through five generations, including the first two versions which were named Shafrir. Python 5 provides the pilot engaging an enemy aircraft with a revolutionary full-sphere launch capability. The missile is also available in an air defence configuration. With the Python 5 now in production for several years, speculation about the next evolution of Rafael’s premier missile is growing.

If Rafael needed more fame, a US diplomatic cable recently released by WikiLeaks listed Rafael’s Haifa weapons development facility as a site of vital security interest to the US, due to its role in providing materials for sophisticated American cluster bombs. At Aero India 2011, the company is likely to display a limited range of products, including air defence and communication systems, reconnaissance and targeting pods as also tactical missiles like Spike.

IMI Inches Forward

Israel Military Industries Ltd (IMI) is the smallest of the “big four” of the Israeli aerospace sector. It manufactures firearms, ammunition and military technology mainly for the Israeli security forces especially the IDF. IMI’s Uzi is arguably the world’s most popular submachine gun on account of its compact nature and reliability. IMI also produces aircraft flares, decoys, electronic countermeasures control systems, rockets, guided missiles and heavy aerial weaponry. The company employs 3,200 personnel in five divisions. In 2008 it generated a turnover of $650 million. IMI’s current orders backlog is $4 billion, 70 per cent of which is for export. Fully owned by the government, the firm is considered by some to be the neglected child of the defence establishment. It has been in trouble for several years. The management has prepared a two-stage privatisation plan: first the sale of 49 per cent of the company to the public and later the sale of the government’s remaining stake. But negotiations on privatisation have remained deadlocked for months, even as IMI limps along.

Consolidate or Cringe

What makes Israel’s aerospace industry tick? It could be the country’s technological culture, its impressive number of science graduates. It could be the relatively lower price tags of Israeli products when compared with similar equipment produced by larger Western companies. It could be that most products offered for export are battle-tested and already shown to work by the IDF. This applies especially to weapons for asymmetric warfare. Israel’s experience since the mid-1980s in countering insurgents and terrorist groups, rather than large conventional forces, has spurred its arms industry to invest heavily in appropriate weapons and technology. Such technology is biased towards networks, situational awareness and precision attacks, rather than brute firepower. Equipment of this kind is now greatly desired by other armed forces faced with shadowy opponents, as well as by homeland security agencies.

But the technology most likely to define the aerospace industry of Israel for years to come is unmanned systems. Indigenous UAVs make Israel less dependent on US military assistance which often comes with strings attached. Israel is among the world’s most experienced countries in the use of military UAVs. It does not publicly confirm or deny the widespread suspicion that many of its UAVs are armed. Neither does it reveal too much about its future UAV plans, a likely pointer to considerable activity taking place behind the scenes. With its Air Force now betting heavily on unmanned aviation, Israel’s major aerospace companies are hoping for a large slice of the cake.

But the technology most likely to define the aerospace industry of Israel for years to come is unmanned systems. Indigenous UAVs make Israel less dependent on US military assistance which often comes with strings attached. Israel is among the world’s most experienced countries in the use of military UAVs. It does not publicly confirm or deny the widespread suspicion that many of its UAVs are armed. Neither does it reveal too much about its future UAV plans, a likely pointer to considerable activity taking place behind the scenes. With its Air Force now betting heavily on unmanned aviation, Israel’s major aerospace companies are hoping for a large slice of the cake.

But it seems to be the Israeli government’s policy to pit its companies one against the other. Lack of cooperation between them has already spoilt some lucrative aerospace orders. Israeli defence exports to Colombia reportedly suffered a major blow last year after bitter rivalry between IAI and Elbit Systems over the sale of UAVs to the Colombian Army. For years, IAI executives have been quietly lobbying for the company to absorb its state-owned competitors IMI and Rafael. Rather than privatising IMI, it might indeed make sense to merge it with IAI or Rafael, but will the government bite the bullet? In the meantime, private sector Elbit may not find it easy to sustain its high-growth trajectory because there’s practically nothing left for it to take over in Israel.

The relatively small Israeli firms have spiritedly taken on the aerospace giants of the West, but are finding the going increasingly tough. There are signs that the Israeli government is finally awakening to their plight. In December it allowed Elbit Systems and IAI to collaborate on a Ministry of Defence tender for the procurement and maintenance of a new jet trainer that is due to replace the Air Force’s obsolete Skyhawks. Most experts agree that consolidation is the need of the hour; however consolidation within the Israeli aerospace industry is a leisurely process. The question is will the current pace be enough to keep these companies competitive against the global aerospace giants?

It is anything but difficult to fall prey to bumbling programmers, yet in the wake of understanding this, I trust you never must be a survivor of programmers who can’t finish the activity given to them. I was at one time a casualty yet not any longer and this is on the grounds that I have discovered the best programmer ever and I wish to tell you that (cryptocyberhacker @ gmail com), Whatsapp:+15188160274 is as well as can be expected ever consider and he generally convey and he his solid.