India is the third largest arms importer and 10th in terms of global military expenditure.1 Capital acquisition of naval ship and platforms account for 25 percent of India’s capital acquisition budget which is around $13 bn. This is expected to grow by at least 20 percent every year. Imports constitute around 50 percent of navy’s capital allocation.

The Indian Commercial shipbuilding depends mainly on 28 shipyards comprising eight Public Sector (6 yards under Central and 2 under State Governments) and 20 Private Sector shipyards.

MOD promulgated an Offset policy in 2005 as part of DPP-2005 3 which aims at leveraging India’s big ticket acquisition by bringing in FDI, fostering JV arrangements, sub contracting products and services, boosting exports, setting up MRO facility to bolster indigenous military industry capability. The scope of offsets which was direct was extended to civil aerospace sector and homeland security products in DPP 20114.

However, the civil shipbuilding sector, has been kept out of the ambit of offset scope. This article brings out the yawning gaps in demand and supply in commercial and warship building sector, international scenario in shipbuilding, present policy framework and suggests the urgent need to include the commercial shipbuilding sector in the ambit of offsets, foster private public partnership, JV arrangements and promote investment in R&D in niche technology to bolster shipbuilding capability.

Commercial Shipbuilding

India is a major maritime country which is predominantly peninsular in nature having a coastline of 7515. Km and 1197 islands and located strategically in major maritime routes.

It is estimated that Indias requirement of natural gas will be around 391 MM SCMD by 20255 and India will have a requirement to import 84 million tonne by 2015

The Indian Commercial shipbuilding depends mainly on 28 shipyards comprising eight Public Sector (6 yards under Central and 2 under State Governments) and 20 Private Sector shipyards. Only Cochin Shipyard Limited (1,10,00 DWT) and Hindustan Shipyard Limited (80,000 DWT) have the required infrastructure and graving dock to build large vessels.

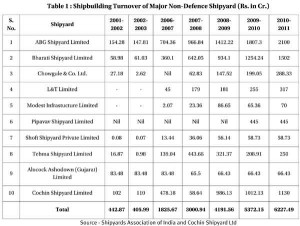

The current capacity of all the yards is 5, 00,000 DWT approximately. The Indian Shipbuilding Industry, which had only about 0.1 percent share of the world shipbuilding in 2002, expanded over tenfold to claim one percent share by 2007/2008 riding on the global boom and supported by a subsidy scheme. Shipbuilding turnover for Private and Public Sector Shipyards excluding Defence Shipyards has grown about 14 fold in the last nine years from about Rs.440 crores in 2001-2002 to an estimated Rs.6200 crores in 2010-2011.

A table showing improvements in turnover, employment generation, investments, order book and deliveries of Indian Shipyards from 2002 to 2010 is shown in Table 1 below.

India’s Requirement of Natural Gas – Capacity Gap

It is estimated that India’s requirement of natural gas will be around 391 MM SCMD by 20255 and India will have a requirement to import 84 million tonne by 2015 6. In terms of LNG vessels India will require 34 vessels by 2025 as against two LNG vessels of 1.38 lakh cubic metre capacity available with SCI.

The overall shipbuilding capacity of DPSUs is at the best four ships a year. During the next 10 years, as against annual requirement of 107 SSUs (Standard Ship Units), around 40 SSUs are available at the DPSUs.

Warship Building

The Indian Navy is committed to the concepts of Self Reliance and indigenization. There are four shipyards under the Ministry of Defence – Mazagon Docks Ltd., GRSE, Goa Shipyard Ltd. and Hindustan Shipyard Ltd. A total of 99 ships have been constructed by these yards and 32 ships have been ordered.

Mazagon Docks Ltd

Mazagon Docks Ltd. is a premier warship building yard where construction of major warships was initiated in 1966 with the Nilgiris class of frigates. Since then they have built 16 major warships including two submarines and three destroyers. It is the only shipyard equipped to build warships upto the size of a destroyers. It has also undertaken major refits and modernization of warships and submarines.

GRSE

It is the second major shipyard with a 100 year old history. It initially built relatively small lightly armed seaward defence boats, landing crafts utility, etc. and subsequently undertook construction of fleet tankers, landing ships, corvettes and frigates.

GSL

It is the third of the defence PSU shipyards and has been building FPVs, OPVs, Missile vessels, survey ships and Sail training ships.

Compared to international benchmark, the productivity of India’s defence shipyards is much below international standards. Also in terms of build time it far exceeds the international norms.

It clearly emerges from the foregoing that existing structure governing the Indian shipbuilding sector commercial and warship building is inadequate to meet the burgeoning demands ahead.

CSL

CSL, a PSU, is engaged in construction of the first indigenous aircraft carrier for Navy. It has a capacity to build ships upto 1,10,000 DWT and can build a wide variety of ships for merchant navy, ports, Island territories and commercial ships to national and international owners. It has absorbed technology to build high end offshore vessels. It has so far built 11 bulk carriers, 47 small and medium built vessels, 4 tankers besides a no. of tugs, patrol boats, launch barges, etc.

CSL has core competence for ship repair and has capacity to repair merchant ships upto 1,25,000 DWT and can repair aircraft carriers, oil rigs, merchant ships, etc. accounting for 60 percent market share in India

HSL

HSL, the fourth shipyard to come under DDP in 2009 and is engaged in repair and refit of submarines and has built OPVS in the past. It has orders for several bulk carriers (3,000 DWT) and building barges for Andaman and Nicobar administration.

Private Shipyards

Four Private shipyards engaged in construction of various types of patrolling vessels and boats are ABG Shipyards, Bharati, Pipavav, Adhani and L&T.

ABG is a modern shipyard and has delivered multiple small and medium sized vessels. A new shipyard at Dahej has come up recently with build capacity of vessels upto 300 m including VLCCs. Bharati will be able to build ships upto 170 m long. Pipavav has huge dockyards and massive cranes. L&T is in the process of setting up two international size shipyards.

International Benchmarks

The productivity of India DPSU shipyards is much below the levels achieved by international standards. Whereas first tier yards like MDL and CSL have a capacity to build 1.33 and 0.48 ships respectively, the comparable international standards are 5.7.

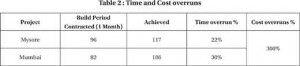

Similarly in terms of build time trends, it’s almost four times more than international standards. For instance, a ship with displacement tonnage of 3500 tonnes in US is built in 30 months with 2.5 lakh manhours as against 72 months and 10.8 lakh manhours (Godavari class).

Also there are substantial time and cost overruns between contractual milestones and actual as under:

Warship Building Demand & Capacity Gap

The overall shipbuilding capacity of DPSUs is at the best four ships a year. During the next 10 years, as against annual requirement of 107 SSUs (Standard Ship Units), around 40 SSUs are available at the DPSUs.

International Experience

At the end of year 2010, world market stood at 261 million GT in terms of order book position, 77 million GT in terms of new orders and 96 million GT in terms of completion of order. Growth of world market has been very erratic since 2009 in terms of order book and new orders while growth has been stable as far as completions are concerned. The fluctuations in the world market is captured in the following graph:

The world market in shipbuilding is dominated by three Asian countries namely China, South Korea and Japan which together account for approximately 90 percent of world market in terms of existing order book at the end of year 2010. The emergence of these countries in the second half of the last century is a lesson for other countries such as India. Among the three nations, China has seen some spectacular growth in the industry since 1990s while South Korea usurped Japan as the world leader in 1999.

The Road Ahead

The National Manufacturing Council (NMCC) in its report to PMO (2009) made the following recommendations for developing Indian shipbuilding Industry.

- Prepare on an urgent basis a comprehensive plan to enhance domestic ship building capabilities and building large new shipyards.

- Adopt a Mission Mode approach for the purpose. In this context, the examples of both Korea and China be studied; and

- A continuing mechanism be evolved to synergise the efforts of the naval authorities under Ministry of Defence and the Ministry of Shipping for meeting long term requirements of the country.

It clearly emerges from the foregoing that existing structure governing the Indian shipbuilding sector commercial and warship building is inadequate to meet the burgeoning demands ahead.

Capacity expansion in the commercial sector will have a positive spin off for the warship construction activity as it will allow shipyard to focus more on complex warship construction activity. In that sense the policy facilitation of level playing field to private sector players in Shipbuilding Procedure 20117 is really welcom.

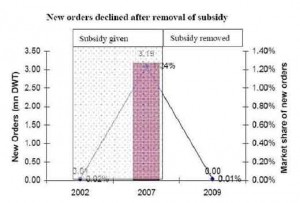

During 10th Five Year Plan, (2002 ““ 2007) a subsidy scheme was introduced where 30 percent subsidy on bid price was available to shipyard on domestic and export order. This galvianized the shipbuilding by raising global share from 0.2 percent in 2002 to 1.3 percent in 2007.

Infrastructure Initiatives

This will include construction of additional international standard greenfield shipyards through private public partnership as also through foreign JV arrangements.

Concurrently modernization/upgradation of existing shipyards needs to be undertaken to improve productivity and turnover time in line with global benchmarks.

Build period is greatly improved when a series of ships of identical design are constructed. Series effect studies have shown that 10th ship require 35 percent less work load than the first one.

Design and R&D Initiatives

We have severe limitation in design capability with only IIT, Kharagpur and CUSAT, Kochi and IIT Chennai having some expertise.

However, vital gap remains in design/development areas like vulnerability survivability, stealth technology, effect of shocks/blasts on ship construction and hydrodynamics of high spared marine vehicles and submarines.

The need for increasing FDI to 50 percent in the warship building sector and 100 percent in civil shipbuilding, recognizing shipbuilding as an infrastructure sector of the economy have been highlighted.

Established as an overarching institute to source requisite talent, both quantitatively and qualitatively.

Funding R&D to educational and research institutions in shipbuilding need to be encouraged. Defence Production Policy (2011)8 is a welcome initiative in this regard.

Fiscal Initiatives

- Subsidy Scheme

During 10th Five Year Plan, (2002 – 2007) a subsidy scheme was introduced where 30 percent subsidy on bid price was available to shipyard on domestic and export order. This galvianized the shipbuilding by raising global share from 0.2 percent in 2002 to 1.3 percent in 2007.

This subsidy was withdrawn by govt. in 2007 for all new orders which has resulted in India’s share dropping to 0.01 percent in 2009 as depicted below:

The subsidy scheme needs to be reintroduced urgently and redirected towards capital expenditure. It should extend to capital equipment such as cranes, plasma cutting machine to improve our shipyard’s productivity.

- Infrastructure Status and FDI Policy

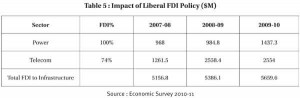

It is quite ironic that shipbuilding is not in the purview of infrastructure in India’s development lexicon. It is high time its strategic importance in global competitiveness is recognized. As a key policy FDI to the extent of 100 percent be allowed in civil shipbuilding sector. Such liberal FDI had catalytic impact in the power and telecom sector as given below:

Post 2001 MOD 26 percent FDI has been allowed in defence production to foreign OEMs. This does not seem to encourage long term partnership and provide incentive in terms of Return on Investment.

Therefore at least 50 percent FDI be allowed in warship shipbuilding and potential JV’ with major foreign shipyards be seriously explored.

JV in R&D, infrastructure augmentation, co-production, ship design and systems would facilitate bringing in cutting edge technology to India.

Some of the marine system and equipment where foreign partnership and collaboration can be considered10 are

- Centrifugal pumps for naval ships and submarines (10TPH-250 TPH)

- Davits of capacity 1-14 tons

- Capstan of different capacities for anchor, mooring, anchor windless,

- Helo traversing system of different capacity.

Offset Policy

India is a late entrant to the club of offset policy though it did enter into a large no. of license agreements for aircraft, frigates since the mid-sixties. This has enabled India to build significant manufacturing capability in the above deliverables, missiles, defence electronics, strategic material etc11.

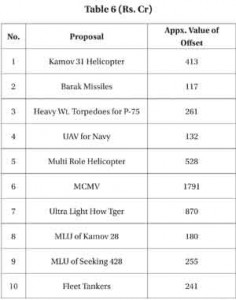

It would be seen that these likely contracts would offer offset benefit of around $1B. These opportunities are only going to soar up.

The formal offset policy introduced in 2005 included in its scope direct purchase of products and services, ROH arr(s), FDI, JV, Co-production initiatives to bolster manufacturing and design capability. It was limited to direct offset i.e. defence specific which has been amplified to include civil aerospace and home land security products in DPP-2011.

Of the 12 offset contracts signed so far for $2.1 B, the naval segment accounts for 34 percent. The first offset contract was infact for Navy’s acquisition of three fleet tankers from M/s Fincanteri, Italy at a cost of Rs. 800 Crores. The offset liability in respect of the first fleet tanker has been discharged 50 percent, while the tanker has been delivered in Feb 2011.

The other major contract is LRMRASW aircraft from Boeing where the offset expectation is around Rs. 3205 Crores.

The offset realization is so far is towards sub-contractorisation of low end products and services, ROH facility, simulators, training etc. and has not aroused OEMs interest for forging JVs, investing in FDIs in any substantial measure.

The formal offset policy introduced in 2005 included in its scope direct purchase of products and services, ROH arr(s), FDI, JV, Co-production initiatives to bolster manufacturing and design capability.

The major reasons that get flagged for such tepid response are low FDI cap, and non inclusion of technology transfer for offset credits.

In the context of shipbuilding sector, the need for bolstering design and development capability, infrastructure have been brought out at paras 5.1 and 5.2.

The need for increasing FDI to 50 percent in the warship building sector and 100 percent in civil shipbuilding, recognizing shipbuilding as an infrastructure sector of the economy have been highlighted. Potential areas where we could profit from FDI have also been flagged.

There is a need to kick start private public partnership in the shipbuilding sector as major private shipyards like Pipavav, ABG and Bharati and L&T often take an adversial posture vis-à-vis defence shipyards. The private shipyards, despite their good facilities, are seriously hamstrung in terms of design and development capability and in integrating major subsystems, where defence shipyards like MDL, DGND, DG WESEE have a definite advantage. However, for achieving global standards in niche technology, construction of submarines, frigates, shipyards like MDL have considerable distance to catch up.

The way forward seems to be public private partnership, JV arr(s) with reputed foreign OEMs with 50:50 FDI participation and bolstering our indigenous R&D capability. The acquisitions in naval system in the pipeline are as under:-

It would be seen that these likely contracts would offer offset benefit of around $1B. These opportunities are only going to soar up. There is a definite need for synergy between the aerospace sector and shipbuilding sector, as a large no. of commonalities exist in systems like propulsion, weapons and sensors. DPSUs like BEL would be effective interface in areas like sensors and communication in tandem with foreign OEMs.

Some of the areas in which offset in commercial shipbuilding sector can be allowed are:

- Shipbuilding and ship repair

- Navigational aids, machinery control and cargo handling systems.

- Propulsion machinery, hydraulic systems, pneumatic compressors and refrigeration/air conditioning for marine applications.

- Platforms and equipment for use in offshore oilfields.

- Life saving and fire fighting equipment for marine use.

- Diving and underwater equipment including remotely and autonomously operated under water vehicles.

- Pollution Control and Hydrographic Sensors and equipment.

Conclusion

India’s offset policy must include commercial shipbuilding sector as part of its scope and treat the shipbuilding sector in its entirety. Liberalising of FDI norms, bringing in critical technology, through technology transfer investing in R&D for developing niche technology have to be assiduously followed if the twin challenges of improving our self reliance index and boosting indigenous military industry capability are to be met.

A national offset policy must be put in place to policy road map for bringing in key technology and FDI into shipbuilding, aerospace and infrastructure sectors.

The linkages between civil and military products in both aviation and shipbuilding sector must be fully harnessed. PMO must provide requite oversight and momentum to realize full potential of offset policy.

Notes

- SIPRI Year Book 2010

- Defence Service Estimates, Min. of Defence.

- http:www.mod.nic.in

- Ibid

- Hydro Carbon Vision – 2025 – Report of Ministerial Group

- Amit Mitra – Hindu Business Online – 17/10/2005

- htpp://www.mod.nic.in

- www.mod.nic.in

- Reply from CMD, GRSE dt. 13.07.2011

- A.Bhaskaran – (2004) : Role of Offsets in Indian Defence Procurement Policy – Arms Trade and Development.