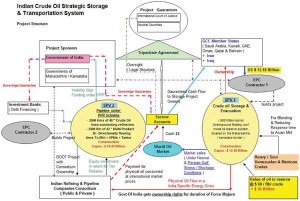

The Pipelines SPV

The pipelines Special Purpose Vehicle (SPV 2) will be a consortium of Indian energy companies and strategic investors some of whom will be investing primarily for tax purposes. This SPV will therefore be owned primarily by Indian companies while SPV 1, which will be the storage SPV, will be owned by oil exporting countries.

There will be two broad categories of pipelines within SPV2.

Also read: Indian Energy Security-I

The first network will consist of crude oil pipelines which will connect the strategic storage to all Indian refineries.

The second network of pipelines will be product pipelines, but with a difference. Unlike conventional product pipelines, these will be multiproduct, bi-directionally flowing lines. Under normal or steady state conditions, they will carry petroleum products from Indian refineries to target markets all over India. All these product pipelines will operate under the common carrier principle and investors will receive dividends which will be exempt from incidence of tax.

Also read: Indian Energy Security-II

The special feature of these pipelines will be that they will be enabled for bi-directional flow and will be configured to enable imports from the Indian east coast in the event of either a process upset in any Indian refinery or if any west coast port / import terminal for petroleum products gets damaged for any reason. By throwing a single switch it will be possible for a remote operator sitting hundreds of miles away to enable the pipeline system to accept petroleum products at a designated terminal (to be decided) on the east coast and move products in the reverse direction to markets all over India. This system is necessary, because in times of a national energy crisis, the immediate need is for transport fuels like petrol and diesel and not crude oil.

Since the storage facilities and pipelines are extremely capital intensive, and require massive upfront investment, which by itself is not economically sustainable, the central government should provide tax and policy incentives to facilitate investment in this essential national energy security infrastructure

The overall financial structure and the basis for the project documents is given below.

International Institutional / Legal Framework

For the scheme to work and to guarantee the transactions leading to the creation of the reserve, its operation as also the payments into and from the Escrow accounts, it might be necessary to provide investor comfort by way of involving organizations such as the International court of Justice in the Hague or some other organization having sufficient credibility to guarantee the agreements. Alternately it could be a committee of nations with shared interests outside of the OECD (the IEA already has huge reserves and could constitute a monopoly) who can act as guarantors acceptable to all concerned parties.

Tax Incentives needed to encourage investment in this Project

Since the storage facilities and pipelines are extremely capital intensive, and require massive upfront investment, which by itself is not economically sustainable, the central government should provide tax and policy incentives to facilitate investment in this essential national energy security infrastructure, besides providing some minimum viability gap funding under the PPP route. The government should provide strong policy support for this project as it lays the foundation for a robust economy, and also constitutes an essential step towards making India a de-facto regional superpower.

The entire project (Storage SPV + Trans-portation SPV) needs to be notified as an infrastructure project for the purposes of tax under:

The entire project (Storage SPV + Trans-portation SPV) needs to be notified as an infrastructure project for the purposes of tax under:

- Section 80 IA … 10 year Tax holiday on revenue. In addition, the SPV 1 Project area needs to be notified as an SEZ or a bonded warehouse

- of some sort where no Indian taxes will be payable.

- Section 10 (23 G) read with Section 115-O … Allowing exemption of dividend distribution tax to domestic companies.

- Exclusion from the incidence of MAT (minimum tax on book profits @ 7.5 percent) by removal of section 115 JB for companies eligible for 100 percent tax holiday under sections 80 – 1B.

- Exemption of sales tax / work contract tax / services tax for vendor provided goods and services.

- Both the project companies should also be allowed accelerated depreciation and 100 percent depreciation of asset values in the first year itself for tax purposes as a one time write off.

In addition to the above, both project SPVs need to be notified as infrastructure projects to enable them to seek exemption from customs duties by issuing appropriate customs notifications for project related imports. Purchases from the domestic tariff area (DTA) should also be freed from the incidence of excise duties. Entry tax which is applicable on project material in some states needs to be exempted as well.

Indian entities will be greatly encouraged to participate in this project if there is a special provision that enables them to take an equity stake in this particular project by implementing a tax optimisation structure which allows equity in the pipeline / storage SPV to qualify for deduction from corporate tax to the tune of 100 percent. For example, if an Indian company were to invest Rs. 100 crores in either project company, it will also get a Rs. 100 crore deduction in its corporate income tax besides equity rights in the project company.