Talking about energy security has become a fashion. Every now and then there is a conference on the subject or someone writes a scholarly article. The flavour of the season could be “equity oil” (buying stakes in oilfields overseas) or it could be “renewables ” such as Solar / Wind energy. Sometimes the discussion is about high oil prices (WTI crude just touched $ 100 / Bbl) being a threat to our energy security. As far as conferences go, there usually is a big function, a nice lunch and then everyone goes home.

Also read: Indian Energy Security-II

The scholarly studies on their part present the reader with voluminous sets of data and they make detailed comparisons of various options. As the reader approaches the last page, however, he/she is usually left wondering whether there was anything worth implementing in what was just read.

Achieving energy security is a serious issue. It is projected that by 2020 India’s dependence on imports will rise to 92 percent from the 70 percent levels we are at today. The Indian economy is therefore getting increasingly vulnerable to supply disruptions and this has serious implications on our sovereignty from a military and economic standpoint.The only notable, large scale, policy initiative of the government that has led to tangible energy security is the NELP (New Exploration & Licensing Policy). This initiative, which was flagged off in 1997-98, has already yielded good results and has led to the discovery and development of large scale gas reserves on the east coast of India.

Achieving energy security is a serious issue. It is projected that by 2020 India’s dependence on imports will rise to 92 percent from the 70 percent levels we are at today. The Indian economy is therefore getting increasingly vulnerable to supply disruptions and this has serious implications on our sovereignty from a military and economic standpoint.The only notable, large scale, policy initiative of the government that has led to tangible energy security is the NELP (New Exploration & Licensing Policy). This initiative, which was flagged off in 1997-98, has already yielded good results and has led to the discovery and development of large scale gas reserves on the east coast of India.

The Reliance Industries promoted KG D6 project for instance will lead to nearly doubling of indigenous natural gas supplies in the country from 88 MMSCMD currently to almost 166 MMSCMD by mid 2008. More oil and natural gas discoveries by others are expected under the NELP and this will lead to enhanced energy security and a reduction in the energy intensity of the GDP. It is to be noted that NELP has succeeded because it was based on the principles of free markets which attracted investment.

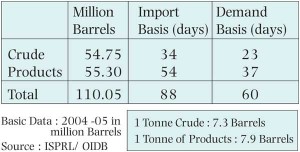

India has just 23 days of crude oil inventories and 37 days of product stocks at any point in time. This is an extremely alarming situation to be in.

The recent successes in discovering indigenous natural gas reserves however do not provide any security in the supply of critical transportation fuels and feedstock inputs to Indian refineries. There is therefore a very urgent need for a government promoted PPP (Public Private Partnership) project which encourages the private sector to work with government companies to deliver a large project that can guarantee energy security. This will bring new ideas to bear on the issue and lead to the construction of the necessary secure infrastructure in the area of transportation fuels.

For the purposes of this paper, energy security has the conventional meaning which countries like the US, Japan, some within Europe and more recently China, have adopted, which aims to create a large buffer stock of not only crude oil (to feed refineries) but also petroleum products.

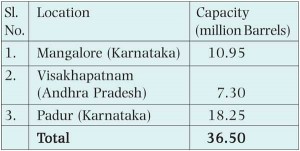

There has been a small move in the direction of strategic reserves, by the Government of India, which, acting through the Oil Industry Development Board (OIDB) has set up “ The Indian Strategic Petroleum Reserves Limited (ISPRL)”. ISPRL’s initial mandate is to set up a strategic crude oil reserve of 5 million metric tonnes, equivalent to 19 days of imports (basis demand in 2006–07). The company has since proposed three different locations for the setting up of the reserves.

As this paper goes to press, The Ministry of Petroleum & Natural Gas, is all set to award the first contract to construct two underground oil storage caverns at Vizag. The site selected for the reserve has already received environmental clearance and land acquisition is almost complete. The site will store high and low sulphur crudes in a 70:30 ratio. This reserve however is smaller than those planned at Mangalore and Padur (which is 40 Km from Mangalore).The recent successes in discovering indigenous natural gas reserves however do not provide any security in the supply of critical transportation fuels and feedstock inputs to Indian refineries.

As this paper goes to press, The Ministry of Petroleum & Natural Gas, is all set to award the first contract to construct two underground oil storage caverns at Vizag. The site selected for the reserve has already received environmental clearance and land acquisition is almost complete. The site will store high and low sulphur crudes in a 70:30 ratio. This reserve however is smaller than those planned at Mangalore and Padur (which is 40 Km from Mangalore).The recent successes in discovering indigenous natural gas reserves however do not provide any security in the supply of critical transportation fuels and feedstock inputs to Indian refineries.The government of India has so far approved a total investment of US $ 2.85 billion for the creation of the 36.5 million barrel reserve which is expected to be built over the next nine years. Annual operating costs for the programme are estimated to be US $ 20 million. The government has been planning the emergency reserve since the mid-1990s, but disputes over funding and ownership have hampered progress. So, in effect as the strategic oil storage available currently is zero, the only real buffer capacity that India has is the oil inventory that is maintained with the individual Indian refineries to support their normal operations.

Existing commercial storage available with oil companies in India

As can be seen from the table above, India has just 23 days of crude oil inventories and 37 days of product stocks at any point in time. This is an extremely alarming situation to be in.This paper will therefore examine the options that ensure the availability of crude oil and finished petroleum products to meet the needs of the country and its surface transport requirements in the event of the occurrence of any of the following:

As can be seen from the table above, India has just 23 days of crude oil inventories and 37 days of product stocks at any point in time. This is an extremely alarming situation to be in.This paper will therefore examine the options that ensure the availability of crude oil and finished petroleum products to meet the needs of the country and its surface transport requirements in the event of the occurrence of any of the following:

- An international event like the closure of the Suez Canal (July 1956) or a 9/11 kind of event that disrupts markets

- An export facility outage in a major supplier country or a closure of the Straits of Hormuz for any reason, or

- A large import terminal / port outage within India

To cater to the needs of India as dictated by the above possibilities, there is a need for conceptualising and designing a project which ensures that a disruption on account of any of the above factors does not harm the growth prospects for the economy, which is currently registering an 8 percent plus GDP growth rate. To be feasible, the solution must be based on current global energy industry realities, exporter country strategic needs and the unique needs of India given its current financial position and growth plans over the next 20-30 years.

The Answers? Do we have any?

Yes we do. A possible answer, as spelt out in this paper matches the opportunities in the global energy industry and the world’s economic surpluses among oil exporting countries with a need which is specific to India. In doing so it devises an innovative financial structure and a funding mechanism that while addressing market realities and the current geopolitical context, generates a solution that meets the needs of all market participants in an unique way. Central to this solution is financing the storage facilities, pipelines and the massive crude oil inventories (valued at US $ 36 billion @ a crude oil price of $ 60 / Bbl) in a manner that distributes ownership and risk in a fair and transparent manner.

Current Global Energy Market Realities

Commodity prices suddenly started shooting up towards the middle of 2003, driven mainly by demand from China as that country moved to dramatically expand its economy. The patterns were seen first in metals like tin and zinc and in oil. It’s a trend that has continued as demand from other countries including India and several in the middle east, started picking up. This demand acceleration, has been accompanied by enhanced geopolitical risk in oil producing countries in the Persian Gulf and in countries such as Nigeria where production has dropped sharply due to ethnic conflict. High oil prices have also been driven by a weakening in the US dollar (which is the invoicing currency for a majority of production) and the actions of speculators in the financial markets who have been actively involved in playing the entire forward curve.

The massive increase in the price of oil (basis WTI) from $ 31/ Bbl as an average for 2003 to $ 100 / Bbl at the beginning of 2008 has resulted in huge surpluses in producing nations. The GCC countries alone have earned a windfall US $ 600 billion in 2006. Going by the fact that the Saudi government is able to balance its budget at an oil price of approximately US $ 35 / Bbl, it is therefore quite believable that the GCC states have finished the year with a net investible surplus of US $ 170 billion in 2006 alone.

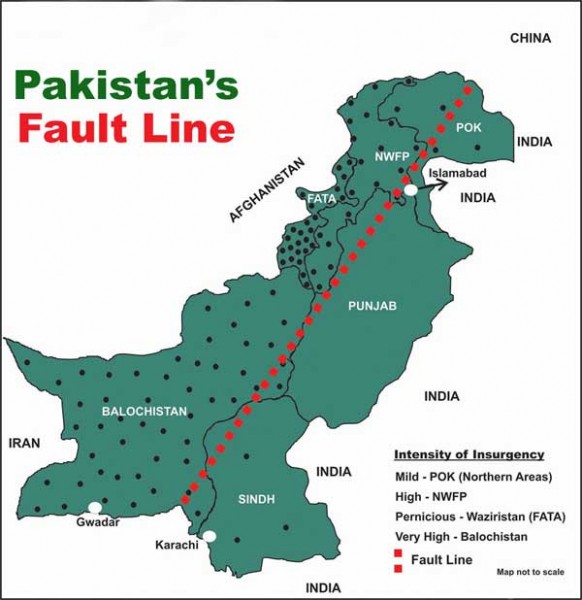

Ever since Churchill, as First Lord of the Admiralty, took the crucial decision to switch all the ships of the Royal Navy to oil fired furnaces from coal which they were using, the middle east has been an area of conflict. Today, there are clear signs that the conflict will escalate as Iran seeks to develop its nuclear capability.

Since oil prices have been rising since 2002, the investible surplus has been accumulating at an increasing rate and is now looking for suitable destinations both within the middle east and in other geographies.

Exporters’ Paradox

Ever since Churchill, as First Lord of the Admiralty, took the crucial decision to switch all the ships of the Royal Navy to oil fired furnaces from coal which they were using, the middle east has been an area of conflict. Today, there are clear signs that the conflict will escalate as Iran seeks to develop its nuclear capability. This has given rise to legitimate fears that the Persian Gulf might be closed to shipping, every now and then, due to a possible blockage of the Straits of Hormuz due to a war in the region. This is a big worry for all countries and not just those in the Persian Gulf.

While the current high oil prices are good for the exporting countries concerned in the short term, they do however create long term problems of market share as other energy alternatives become viable at an oil price over US $ 60 / Bbl. It is therefore not in the long term interests of oil producing countries to have the market trade at current levels. It is thus to be expected that these countries will take executive measures that remove the risk premium (related to geopolitical incidents) and the resulting volatility out of the oil market so as to ensure price stability and long term market share for their production. There might even be a need for OPEC to collectively evolve a strategy which while giving members an adequate surplus, caps oil price at a level of $ 60 / Bbl.

To secure its energy infrastructure, Saudi Arabia has been spending close to US $ 2 billion a year to guard its oil terminals in the Persian Gulf as also its giant central oil processing plant at Abqaiq. The Kindgom has also spent huge amounts in building backup pipelines to an export terminal located at the Red Sea port of Yanbu. All this money however still has not provided the Saudi’s with a viable alternative to their main trade route via the Straits of Hormuz. Other Persian Gulf countries do not have any such alternative. So, going forward, high oil prices and a possible prolonged blockage of their main trade route are the main risks that Persian Gulf states will be very keen to mitigate.

Dear sir very enlightening article can you provide some details on India’s Energy Security Concerns and impact on Armed Forces please.

Regards