The Highlights of Offset Contracts:

- Steady increase from $ 48.6M in 2007 to $519.5M in 2008, $974M in 2009 to around $ 700 M during 2010.

- The Aerospace sector accounts for 65% and balance by the other services.

- Level playing field concerns has been turned on its head as the Indian private industry accounts for 70% in value of these contracts.

- The DPSUs viz. HAL and BEL and Tatas and L&T from the private sector are major players.

- The SMEs and IT companies have also a fairly handsome share.

- There is no positive impact on exports.

- In terms of FDI inflow for infrastructure, production and R&D, the impact is minimal.

- Only l case of credit banking has been approved so far.

Major Beneficiaries

The major beneficiaries of the offset arrangements in the public and private sector are given below:

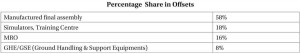

Major Areas of Offset Realisation

The major areas of Offset realisation are (a) Sub contractorisation (58%) involving supply of fuselage, cabins, radome, tail cone, data link, & other products (b) Engineering projects, project management, (c) Overhaul and repair facilities (16%) (d) Various types of training facilities, simulators & (e) Ground Handling/Support Equipments.

7 Impact of Offsets

Aerospace Sector

The Aerospace sector is historically the prime beneficiary of Offsets as most countries source their fighter aircrafts like F5, F15, F16 and F18 with varying degrees of offset obligations.

USA accounts for nearly 60% of global Arms production which was around $ 471 B during 2008.30 Of the 100major global Arms producing companies, aerospace products account for nearly 80%.31

HAL enjoys monopsonic position in aerospace sector and has been beneficiary of Technology transfer for MIG 21(1960s- 70s),MIG 27, MIG 29 and SU30(1996). It has enabled HAL to achieve high level of technology capability in manufacturing combat aircraft and engines.32

The TOT arrangements, however, has not created defence industrial capability for supplying advanced weapons system that would be competitive with western equipments. Nor has the technology gap closed.33

The types of work realised through offset arrangement in HAL are as under:

MRO Capability

In the Defence sector capability to undertake MRO, (Manufactures Repair Overhaul) upgrade and assemble is the most basic level capability. Establishment of depot Maintenance capability (MRO) was one of the key areas recommended by Dr. Kelkar through offset arrangements.34

The offset contracts for Mig 29 upgrade and VVIP helicopters, are in this genre. In case of the ‘Globe master’ contract, HAL is likely to benefit in terms of ROH (Repair Overhaul) facilities through offset.35

Credit Banking

A provision of banking credit with sunset and sunrise clause was introduced in DPP 2009. Of the 8 proposals received only one has been approved so far in respect of M/s. Eurocopter.

There has been unusual prevarication in MOD to finalise such banking arrangements though the amounts involved are insignificant & that too from reputed OEMs. This has understandably embittered foreign OEMs36 as they look for expeditious approval process.

Impact on Indian Partners

A questionnaire was sent to Indian partners involved in ongoing offset contracts to elicit their response to such arrangement with OEMs. From the feedback received, it was seen that offset arrangement has helped them in skill up gradation, boosting export & helping market penetration.

These contracts seem to have a favourable impact on export, skill up gradation with a potential for future business. Sustainment is another challenge.

Defence, being a very niche sector with specific skills requirement, it is important to develop training grounds for manpower.

Impact on Exports

It would thus be seen that except for BEL there has been no impact of Offset for promoting exports. A rank correlation between arms exports and size of defence industrial base during 1980-2006 for EDA (European Defence Agency) countries reveal a significant rank correlation (+0.76) showing that size of DIB (Defence Industrial Base) was positively associated with arms exports.37

Cost Effectiveness

Critics of offset arrangements often contend that offsets come at an additional cost implication ranging between 4 – 15%.38 Wally Strys argues that Belgium had to pay an estimated in ‘over costs’ in conjunction with offsets.39 Stephen Martin reports that offsets do cost more than off – the shelf purchase.40 Sub contractorisation constitutes the major area of offset realization in India. This is not surprising as India is a cost efficient destination for outsourcing. A case in point is export of empennage for SU30 to the Russians, where, as against $18 MHR (Man hour rate) in HAL Russia’s MHR was @$45-$50.

Some critics aver that such outsourcing arrangements would have come without an offset stipulation. The real question is whether offsets, really represent new business, business that would not have taken place without the offset deal.41 UK experience suggests that only 25% to 50% of total offset is genuinely new business.42

Technology Development Capability

In terms of its impact on Technology capability, offset seems to have facilitated introduction of new products, registration of patents with Indian players getting associated with a wide array of foreign players.

Significantly these SMEs are investing handsomely in R&D (20% – 40%) making them technically fleet footed and more sure of absorbing leading edge technology. They are leaner, more agile, have low setup cost, high level of skills and cost effective is production of smaller systems compared to many larger private sector companies.

Big private the Indian companies, therefore, need to invest more in R&D to spur foreign OEMs to collaborate in high technology products.

The private sector companies like Tatas, L&T, and Pipavav, despite having excellent facilities, have an inherent limitations in terms of design development capability and system integration. Japan’s success in fast technology absorption was largely due to its highly skilled personnel and low cost of labour.43This holds an important lesson for major private players also in India.

HAL & BEL need to ramp up their R&D investment to around 10% from the present allocation of around 6%44 for smooth absorption of technology in major programmes like Fifth Generation Fighter Air Craft (FGFA), Multirole Transport Air Craft (MRTA) & Tactical Communication System (TCS).

In France, R&D activities absorb more than 15% of the turnover of Aerospace companies. French Research excels in propulsion and combustion, composite materials, aerodynamics, acoustics and embedded electronics making France a leading player in Aerospace & Defence Sector.45

8. Lessons & Major Policy Issues

As the foregoing would show Offsets have helped in sub contractorisation of low end products and services, setting up simulator and training facilities, project management, depot maintenance facility, GHE/GSE.

However, in terms of Foreign Direct Investment in production and R&D, JV arrangement and exports the response so far has been rather tepid from the foreign OEMs.

Some of the major policy issues that need to be addressed urgently in order to realize potential of offsets are increasing FDI cap in Defence & including technology transfer as a policy option.

FDI Cap in Defence

The DIPP (Department of Industrial Policy & Promotion) circulated an approach paper rooting for more than 74% FDI Cap in Defence production to offer significant incentives to foreign companies for transferring leading technology.46 While CII, FICCI are generally guarded while recommending increase to 49%, foreign OEMs recommend 50% FDI for manufacturing & 100% for services sector. Dr. Kelkar & Deepak Parekh recommend FDI higher than 49% if they bring in critical technology.47 Air Commodore Jasjit Singh supports the case for increasing FDI to 49%.48

Countries like China witnessed substantial increase in FDI inflow i.e from $5.8B (1990) to $67.3B in 2007 because of liberal FDI norms. The inflow was predominantly to the manufacturing sector (51%) boosting China’s export singnificantly.49

Dr. Arvind Virmani argued before the FDI group (2000-2004) in Planning Commission that 100% FDI in high technology defence equipment is preferable to being perpetually dependent on imports for the same items. 50

SA to RM is of the view that FDI increase may improve manufacturing capability but not design capability.51

JV arrangement with Russia for Brahmos cruise missiles is considered as a useful model. Brahmos model with 50 : 50 FDI participation using core competence of India & Russia is perceived as a successful model for future needs of the nation.52 The Brahmos JV was formed with Russia in 1998 with 50:50 equity participation ($300 m). Today it has successfully delivered its product, has an order book of $4B which is to swell to $12B soon. It has been made possible due to the commitment of both JV partners & commitment of services.53

India has come to be recognised as an economic and technological powerhouse in the making. Manufacturing now accounts for above 27% of India’s GDP, contributes 53% of total exports, 79% of FDI & employs 11% of the

Workforce.54 Sectors like Telecom with a FDI limit of 74% has been receiving significant FDI inflow (around $ 25B)55 in the recent past despite the global financial crisis.

Therefore, there is a strong case for increasing FDI to atleast 50%, so that the JV arrangements make economic sense to the OEMs in terms of Return on Investment.56 Dr. Vivek Lall, VP, Boeing India is also of the view that increasing FDI cap to 49% will be consistent with other sectors & foster long-term investment.57

Technology Transfer

Inclusion of technology transfer for identified key technologies seems to be gaining vide support in offset policy.

Many DPSUs like HAL,BEL, BDL, MDL, Midhani have been recipients of Technology predominantly from Russia and a few Western sources.

While substantial indigenisation has been achieved in non critical technologies but in critical technologies, OEMs rarely provide manufacturing know how leading to continued dependence on OEMs for upgrades.58

Prof. Brauer, is also of the view that just because India is a big buyer of defence equipment does not guarantee that counterpart countries will transfer relevant technology.59 Even if transferred, it can become obsolete by the time it is installed and absorbed.

Dr. Kalam, feels that TOT in the past to DPSUs/OFs only provided some manufacturing capabilities but not key technologies.60Adm Suresh Mehta, Ex-CNS is of the view that TOT should be a stepping stone to leapfrog and develop indigenous manufacturing technology than when transferred. Successful technology needs defined underlay & buyers must have capacity or knowledge base to absorb superior knowledge smoothly. Know why must be insisted & no restrictive conditions accepted.61 Mr. Mohanty, Ex-CMD, HAL is, of the view that HAL succeeded in getting high end technologies because of dealing with foreign suppliers with firmness.62

For instance, Key technologies like Single Crystal blade for turbines was passed on by Russia and successfully absorbed making Engine Factory,

Koraput an important destination for getting engine components machined by reputed engine houses like Pratt & Whitney.63

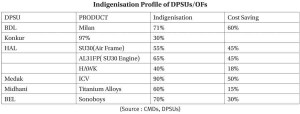

A profile of indigenisation achieved in of various products through technology concomitant transfer and cost reduction worth import cost of DPSUs/OFs is placed below:

It would thus be seen import dependence has been substantially whittled down with cost economies because of substantive technology absorption in manufacturing by our DPSUs & OFs.

Some economists suggest that obtaining technology through offsets is a more efficient way than direct purchase,64 while DGIDSA feels that buying TOT is a better option65 as it will be on a competitive basis. There is also a view that when TOT is part of a large contract, the risk is shifted to the vendor who will have greater incentive to transfer technology successfully.66 Dr. Vivek Lall, VP. Boeing opines that the ‘Buy & Make’ policy is adequate for platform related technologies. However, technology based offset projects share IPR (Intellectual Property Rights) and are designed to assist, industry, R&D institutions and universities.67

Dual Use Technology

Impact on the civil aviation sector consequent on inclusion of this sector in DPP-2011 is too early to judge. However, indications are, it has generated enthusiasm particularly for security related products,68 aero structures and cabins.

Japan has been the prime beneficiary of dual use technology in areas like electronics, cryptology, sensors etc.

Dr. Rama Rao’s Committee strongly advocates such technology for Air Traffic Control, Imaging for Agriculture, Water and Mineral Resources, Met.

And Oceanographic Study and Disaster Warning.69 In the area of flight display, avionics & inflights entertainment and propulsion systems, dual use technology will have excellent commercial spin off.70

Malaysia’s MOD has given primacy to promoting priority dual use items71 as it helps sustainment of business.

The civil shipbuilding could be considered for offsets. In the Report of PM’s group on Growth of Indian Manufacturing Sector- Shri Krishnamurthy has advocated mission made approach for building domestic shipbuilding capability and new shipyards.72

To meet the growing demand of ships both for maritime trade and to meet the requirement of Navy and Coast Guard, it is crucial that the shipbuilding sector be provided due impetus. This requires a multi-pronged strategy to revitalise the Indian shipbuilding industry. This would encompass modernisation of shipyards, induction of contemporary technologies and construction processes, enhancements in ship-design knowledge, fiscal incentives and public-private partnership.

The implications of a vibrant and competitive shipbuilding industry, on maritime security, energy security, trade security and indeed the overall economic development of the nation are enormous. Shipbuilding should be viewed in this overall strategic context. We have made considerable progress and today we are amongst the few select nations which build their own warships and submarines. However, with our expanding maritime responsibilities and interests, the shipbuilding sector could be considered as part of the products eligible for meeting Offsets obligations.

| Also Read: |

Warship shipbuilding is a crucial sector and its revitalisation could benefit from the offsets route especially in light of the number and value of acquisitions planned in respect of warships and submarines.73 Joint Secretary (Shipyard) MOD is fully supportive of such dual use.

Major Russia military aviation companies are also eyeing seriously for diversification to civil aircraft sector through Joint programme as Military Aviation constitutes 92% of their business.74 Joint R&D & production programmes like Regional Transport Air Craft for the civil segment makes eminent commercial sense.75 However, some critics view that it is much more cost effective to go after civilian technology directly rather than reshaping military oriented technologies to fit civilian uses. (Dumas 1982). 76

Road Ahead

The primary objective of Indian defence offset is to be self reliant by acquiring key technologies, absorbing manufacturing capability of major systems, upscaling skills levels, participating in Joint development of (R&D) and building long term win win investment partnership with foreign OEMs.

As per assessment, acquisition proposals in the pipeline are of $23 bn with likely offset realization of around $9 bn. IAF will account for 70%, Army 20% & Navy 10%. For meaningful realization offsets the following is recommended

- Focus on transfer of Key technologies like Seeker, FPA, AESA, Stealth & Single Crystal & allow suitable multiplier.

- Increase FDI cap to 50% for investment proposals which bring in such niche technology or major manufacturing capability of systems/subsystems.

- Govt. has to play the pivot through Bilateral Defence Cooperation discussion at the level of RM with strategic partners like Russia, France, Israel & USA.

- Bolster manufacturing capability to make India a potential hub in OEM’s global supply chain. China is a good example to replicate.

- Need for synergy between Design, Development & Production Agency.

- Foster Public Private partnership.

- Substantial increase in R&D spend by public & private sector players.

- Have a properly empowered & technically equipped Defence offset Facilities Agency.

Notes

- DPP-2005 http://mod.nic.in

- http://mod.nic.in

- Ibid

- ibid

- DPP-2011 http://mod.nic.in (P/57)

- ibid (P/55)

- http://mod.nic.in

- DPP-2011 - P/56

- DPP-2005 http://mod.nic.in

- http://mod.nic.in

- Email from Prof. Ron Matthews dt.20.4.2011

- Annual Reports MOD

- Ibid

- Ibid

- Annual Report, Midhani (2009).

- Annual Report, MOD

- Ibid

- Reply to Parliamentary Standing Committee on Defence (2009-10)

- DPP-2009 http://mod.nic.in

- DPP-2011 http://mod.nic.in

- Report of the Review Committee To Evolve A Ten year plan for self - reliance in Defence system.

- Ibid

- Air Commodore Jasjit Singh: Indian Aircrafts Industry: Knowledge World (2011)

- Ibid

- Tony Saich, ‘Reference of China Science & Technology Org. System in Fred & Goldman-eds

- Defence Expenditure Review Committee Report (2009)

- MD(M): HAL

- 15 Year Indigenisation Plan (Navy) (2003)

- Reply from COM, NHQ dt. 8.06.2011

- SIPRI Year Book (2010)

- Ibid

- A. Bhaskaran

- Ibid (P-224)

- Dr. Kelkar Committee Report (April 2005)

- Indian Express dt. 31.05.2011

- Email reply dt. 8.05.2011 from Lockheed Martin

- Study on Effect of offsets on the dev of EDA & Market - A. A. Eriksson12th July 2007.

- Kogila Balakrishna – Evaluating effectiveness of Offsets as Mechanism of promoting Malaysian Defence Industrial Development (April 2007)

- Strys - W(2004) “Offsets in Belgium” Arms Trade & Eco. Development, London :Routledge.

- Martin S & K Hartley (1996) “The UK Experience with Offsets” Economics of offsets.

- Lloyd J.Dumar- “Do Offsets Mitigate of Magnify Military Burder? Arms Trade & Economic Development

- Prof. K. Hartley – The Future of EDA- Economic Perspective- Defence Peace Economics (2009)

- Chinworth & Mathew - Defence Industries Through Offset - Japan, Arms Trade & Economic Development, London : (Routledge)

- Parliamentory Standing Committee on Defence (2009-2010)

- http:/www.invest.in.france.org/Medias/publication/223/Aerospace 20 industries pdf

- http:/dipp.nic.in/Discussion papers 17th May 2010.doc.

- Interview with Dr. Kelkar & Deepak Parekh 3rd Sept. 2010 & 31/8/2010

- Air Commodore Jasjit Singh – Indian Defence Industry (2011)

- Nelie Yan - China’s Search for Indigenous Industrial Development, Ph.D Thesis (June 2009)

- Email reply dt. 20.6.2011

- Meeting with SA to RM dt 6.09..2010

- Email from Dr. APJ Abdul Kalam dt. 5.05.2011

- CII Conference, New Delhi, on 12th June, 2011 - Address by Dr Kalam

- Shri J.D.Patil, VP, L&T: Conference on Offsets (12/07)

- Economic Survey - 2010-2011

- Meeting with Country Head Thales & VP, BAE System 3rd June 2011.

- Meeting with VP, Boeing(India)dt.4.1.2010

- Stephen Martin - N-35

- Email - Prof.J Brauer - Economic Aspects of Arms Trade 25.4.2011

- Meeting with Dr. APJ Abdul Kalam dt. 3rd June 2011

- Inaugural Address in International Seminar on Defence Finance, New Delhi (11/06)

- Ex Chairman, HAL dt. 13.05.2011

- Ex CMD HAL

- Stephen Martin- Overview of Theory & Evidence - Economics of Offsets London

Routledge) (P/38)

Routledge) (P/38) - DGIDSA (15/06/2011)

- Stephen Martin N 118

- Reply dt. 30.03.2009

- Sr. Advisor HCL (Overseas)

- Rama Rao Committee Report (2008)

- Meeting with CEO - SAMTEL dt. 3rd June 2011

- Kogila Balakrishna - N -29

- Report of the PMs Group: Measure for Ensuring Sustained Growth of Indian Man. Sector (9/2008)

- Feedback from NHQ dt. 16.05.2011

- SIPRI Year Book - 2011

- Interaction with Chairman, UAC, Russia

- Lloyd - J. Duma N56A