There is a definitive buzz amongst the private sector defence players in India that the Modi Government is now keen to rev up private sector participation in a major way for production of weapon systems and platforms through a strategic partnership model. This is a takeoff from the recommendation made by the Dhirendra Singh Committee (May 2015) where they had mooted such a model, with a view to providing defence private sector players a bigger role in design, development of production of major platforms and weapon systems. The identified private sector players would receive a preferential treatment in ‘Buy & Make’, decision. The committee has also suggested that India should achieve a Self Reliance Index of 70% by 2027 as against a meager 30% now. India is the leading importer of arms as per SIPRI Year Book (2016).

The Global Picture

The military industry complex is characterized globally by an oligopolistic tendency, with a few arms suppliers producing bulk of the arms produced and exported. Of the $401B arms produced, the USA company like Lockheed Martin accounted for $37.4B, Boeing $28.3B, BAE Systems $25.7B, Northrop Grumman $19.6B and General Dynamics $18.6B during 2016.

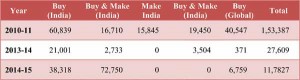

India has the dubious reputation of being the highest importer of arms and USA the largest exporter. The global position on exports and imports is an under:

India’s Military Industry Complex

Despite having a large defence manufacturing base and 52 Defence Research and Development laboratories, India’s self reliance index, i.e. % of imports in value to total defence acquisition, remains at a stagnant level of 0.3 since 1992. A Self Reliance Index Committee under Dr. APJ Abdul Kalam, the then SA to RM, had identified definitive areas where significant investments would need to be made for India to improve its SRI to 0.7 by 2005. The areas identified were (a) Radars & Stealth Detection, (b) Active Arrays, (c) Heavy Particle Beams, (d) Intelligent Terminal Guidance, and (e) Supersonic & Hypersonic Propulsion. India’s critical voids are in the areas of propulsion, weapons and sensors, where the import dependence is around 80-90%.

In case of material like carbon fibres which are required for manufacturing helicopters, India’s dependence on an imported source is 100%. Lamentably our self-reliance index remains fixated around 30%; and we have the unenviable tag of being assemblers of imported parts, rather than being value adders; with wafer thin capability in designing critical subsystems. The Dhirendra Singh Committee has identified six segments for strategic partnership of the big private sector players like the Tatas, L&T, Mahindra & Mahindra, Kirloskar, Godrej & Boyce viz. Aircrafts, Warship, Armoured Fighting Vehicles, Complex Weapons, Command, Control & Communication & Critical Material.

Trends of Production by DPSUs & OFs

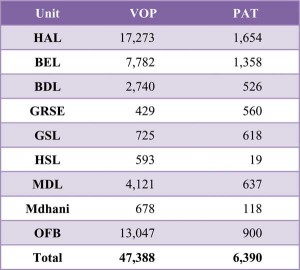

India’s 9 DPSUs & 39 ordnance factories accounted for nearly $8.3B in terms of value of production. The details of VOP & Profit After Tax are as under:

The DRDO with 42 lab(s) account for nearly 6% of defence expenditure which stands at Rs. 2,59,261 crore during 2017-18. The capability of DRDO in terms of designing critical subsystems like passive seekers, Ring Laser Gyros, Active Electronic, Scanned Array Radar remain wobbly. In areas like Focal Plane Arrays and gas turbine engines for LCA their record has been unedifying.

Liberalization in Defence Manufacturing

The defence manufacturing sector saw its first wave of liberalization in 2001, when 100% participation by the private sector and 26% FDI was allowed. The Kelkar Committee (2005) was a major watershed, as it championed the cause of private sector participation, public private partnership and joint participation in R&D projects. This Committee also mooted the idea of an offset policy which should aim at leveraging our big ticket acquisitions to gain critical technology, FDI & outsourcing orders from the OEMs. Subsequently the Prabir Sengupta Committee (2006) coined the concept of Rakhya Utpadan Ratnas (RUR), as per which 12 companies were identified to have the same status as Navratna PSUs like the HAL & BEL. However, this laudable initiative could not be progressed further as there was a perception that many large IT companies have been overlooked and a few have been favoured.

The Present Proposal: Issue and Concerns

The present proposal of strategic partnership model draws its inspiration for the ‘RUR’ model of 2006. The Dhirendra Singh’s model, however, has not received the kind of enthusiasm from the Indians industry as it should have. This is because it has proposed to limit the SP to one segment only. This will limit the potential of major conglomerates like Tatas & L&T who can operate in several segments like aircrafts, warship, command control and communication.

FDI Policy

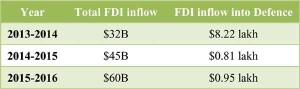

One of the major policy change by the present government is to unshackle the FDI limit to 100% in defence without requiring CCS approval. Initially it was increased to 49% in 2014-15. The Commerce Minister Mrs. Nirmala Sitharaman has clarified that MOD and MHA would need to be on board in regard to such FDI inflow. It is expected that 100% FDI would improve the flow of foreign investment, long term partnership with OEMs and generate greater employment opportunity as part of Make-in-India initiative.

A close look at the total FDI inflow and inflow into the defence sector clearly underlines the urgent imperative to unshackle our FDI policy in defence sector.

It would thus be seen that despite increases the FDI limit to 49% in 2014-15, the inflow in the defence sector been tepid and the present move to increase it to 100% is timely.

BUY (Indian)

One of the highpoints of change in our defence procurement policy has been reduction in outright import component i.e. Buy (Global) and a significant increase in Buy (India) and Buy and Make (Indian) components where the Indian firms collaborate with foreign OEMs and make a value addition of at least 40% to the final product.

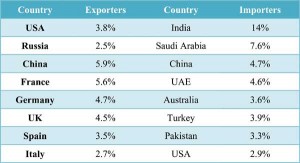

The following table would highlight the trends:

Trends in Acquisition under different categories (Rs. in Crores) - Source: Dhirendra Singh Committee Report (2015)

The most disappointing aspect of our acquisition process, however, has been the niggardly progress in the ‘Make’ category since 2010-11. Except for MBT & LCA, the track record of our indigenous R&D, culminating into production has been few and far between. The failure of Kaveri engine to power the LCA has put DRDO’s design capability in terms of developing as turbine engine has been disappointing and we will continue to depend on GE-414, an American engine to power our indigenously developed light combat aircraft.

Need for Joint Design and Development

While the Dhirendra Singh Committee has highlighted the importance of a strategic partnership model for productions it has paid scant attention to the need for joint design and development of state of art systems in tandem with reputed design houses. It may be recalled that our experiment with Israel to design and develop a Medium range surface to Air Missile has been salutary. The ongoing Design and Development Project for developing a fifth generation fighter aircraft with the Russians is also a step in the right direction. The Joint Venture programme of Brahmos, a cruise missile, with the Russians is a shining template how India can substantially profit from such collaboration as a strategic partner. We need similar joint venture tie ups in critical technologies like ‘seekers’ which is required by all the three services for their night vision devices, missile system, etc. Both France (MBDA) and Israel have evinced keenness to partner with India. However, this is stick in bureaucratic red-tapism.

The Prime Minister is keen that the strategic partnership projects should be pursued for new submarines, naval utility helicopter, single engine fighter aircrafts and armoured vehicles. The scope should be enlarged to include technology like “seeker”, “AESA” radars and “Carbon Fibers” where our dependence on import is 100%. The Kelkar Committee had rightly underlined that apart from partnership for production by allowing FDI, there is an urgent need to rev-up joint design and development projects with major design houses. Design, Production and post-production maintenance is a complete chain of activity. Most of the developed countries like USA look at this chain in a synergistic manner. In France, the DGA (Director General of Acquisition) has a holistic control over R&D, production and maintenance.

Need for Institutional Reform

In India unfortunately, the production agency, design agency work in a watertight compartments without accountability. The Ramarao Committee (2008) had suggested that the design agency must function under the production agency, so that there is proper accountability and time and cost overruns are minimized. In Russia, the design houses have overreaching control over the production houses in the aircraft sector. India has to take a stand on this and with the political clout that the present Government enjoys an institutional reform as suggested by Prof. Rama Rao must be put in place. Make-in-India should not be a subterfuge for ‘Assembly in India’, with no IPR rights.

Military Malthusiasm

It was Robert Malthus, who had highlighted how population growth would outpace food production, leading to crisis. Prof. Thomas Scheetz coined the term Military Malthusiasm to highlight how exponential growth in cost of weapons outpaces linearly growing fiscal income of countries. In the Indian context, this is true as the following table would reveal.

Defence expenditure constitutes nearly 3% of our GDP and is the ‘holy cow’ in our budgeting. Concomitants funding have never been a problem area in defence acquisition. The drive for indigenization is often hamstrung because of the absence of fund crunch. This has to give way to a culture of economy, efficiency and public accountability, which can be ensured if private sector players get into the fray in a divisive manner.

Concluding Thoughts

The defence sector is often shrouded in infernal secrecy because of its strategic nature. However, the production segment is unduly patronized by the government for a long time; with inefficiency, unreasonable cost and weak accountability as the fall out. The private sector got an opportunity to have a level playing field with the liberalization move in 2001. The Kelkar Committee has also helped in bringing in greater private sector role. The offset policy has also provided a level playing field to the private players. Allowing 100% FDI into the defence sector has been a paradigm shift in defence policy. The “Strategic Partnership Model”, now being considered at the highest level, would hopefully take away the hegemony of the public sector and ink a new architecture of long term partnership between major design houses, OEMs globally and India’s resurgent private and entrenched public sector players. The DPSUs often treat their private sector counterparts as adversaries and parcel out jobs to them as contractors. The private sector players are also deprived of state of art technology transfers from other countries because of lack of government hand holding. The strategic partnership model would do away with these inherent disadvantages that the private sector players suffer vis-à-vis public sector players.

In the 1990s, UK under Mrs. Margaret Thatcher embarked upon massive privatization of its ordnance factories and defence public sectors. Similar reforms are called for in many segments like helicopters, ship building and armored vehicles in the long run. The present model would be a half way house towards greater efficiency, through vibrant public private partnership and hopefully improve our self reliance quotient in state of art technologies in a significant manner.

![China Task Force [CFT] Act: The US Goes Bonkers Over China China Task Force [CFT] Act: The US Goes Bonkers Over China](https://www.indiandefencereview.com/wp-content/uploads/2016/10/Flag-of-China-150x150.jpg)

This article brings in mind the proverb “Jack of all trades, Master of nothing”. It sweeps over a wide range of technology, from opto-electronics to RF and what not e.g. manufacturing fighter engines. India is a new comer in military hardware production and obviously it will take decades to master any particular field, not to forget diversification. Overseas even some of the hardware components for the US players such as Lockheed and Northrop may not be produced in the US – they are in many instances outsourced to European conglomerates and vice versa. So it is futile to contemplate “success” in every venture for DRDO or HAL or anybody for the sake of argument. I do not know what the bureaucrats in Delhi expect from their local scientific technological manpower to achieve in this context. The PM’s catch phrase “Make in India” is a dud for those who are in the know. As an aside, the respected director writes “The capability of DRDO in terms of designing critical subsystems like … Active Electronic, Scanned Array Radar remain wobbly”. Oh well, this could be very well true for their foreign counterparts. AESA is a hot topic in Sensor Array research and even the experts in the area differ significantly in its implementation in the open literature. This technology is primarily aimed for multiple target tracking and is meant to be an advance on Phased Array systems. It belongs to a highly secretive area of military knowledge base. It is doubtful whether the French have really succeeded in implementing it in their Rafael. It could well be the present hierarchy under the new PM has gone with a blind faith in the overseas marketeers and fallen in their trap.