Countries that consume large amounts of energy have been coping with oil prices hovering around $110 per barrel since the beginning of 2011, as most of the developed and developing nations have been trying to emerge from financial and debt crises. A sustained period of lower oil prices has provided relief. Major oil producers on the other hand, have grown accustomed to high oil prices, using them to prop up their national budgets. Sustained low oil prices are now making these oil producers to rethink their spending. Just how positive would be the effects, will depend on how long the price of oil continues to maintain the present levels.

Oil prices have dropped to less than half from what they were hovering around a few years ago. In 2016, a rising output in the Middle East outweighed a decline in production in the US shale oil, which when combined with a decline in the US dollar, resulted in low prices of oil. Crude production in the Organisation of the Petroleum Exporting Countries (OPEC) in April 2016, had risen to the highest level in recent times. Iraq’s exports from its Southern fields had increased, as also the seaborne exports from Russia, the largest exporter outside the OPEC.

The oil prices yo-yo has continued throughout the year gone by, with the price of the Brent crude, the international benchmark, wavering between $37 and $55 per barrel. OPEC with other major non-OPEC exporters such as Russia, in a desperate bid to control the slide, held a series of meetings towards the end of 2016, to decrease production and thus make the prices to rise. These measures were initiated since the economies of all the oil-exporters were being adversely affected. Did the measures proposed and adopted, to an extent, succeed, is yet to be fully realised, but to their collective relief, the downfall of the oil prices has been arrested.

Oil Reserves

While most of the OPEC are located in the Middle East, it is the South American nation, Venezuela, also a member of OPEC that tops the list of proven reserves, followed closely by Saudi Arabia which is the largest producer and exporter amongst OPEC and is considered as the ‘oil tank’ of the world. There are many other nations in the Americas, Africa and SE Asia with proven reserves. However, OPEC dominate the world, holding more than 80 per cent of the entire proven oil reserves, of which 66 per cent are in the Middle East.

Although the first oil well in India was drilled in 1867 in Assam, the first commercial well to go into production was in 1889…

Oil in the Arabian Peninsula was discovered as early as in 1908, but consideration of the area as a likely source of hydrocarbons did not really take off until oil was discovered in neighbouring Bahrain in 1932. The first significant Saudi Arabian discovery was on March 04, 1938. As of January 2007, Saudi Aramco’s proven reserves were estimated at 259.9 billion barrels, comprising about 24 per cent of the world total. Officially, the Saudi Arabian Oil Company, most popularly known just as Aramco (formerly Arabian – American Oil Company), is the Saudi Arabian national petroleum and natural gas company with a value estimated between $8.25 and $10 trillion, making it the most valuable company in the world by Market Capitalisation. Aramco’s reserves would last for 90 years at the current rate of production. It may be of interest that 85 per cent of Saudi oil fields, are so far, not in production!

The British oil and gas multinational, British Petroleum (BP), in a report in 2013, had stated that at the then current world trends of extraction, the world will run out of oil in about 53 years, while gas reserves would last slightly longer (http://oilprice.com/Energy/Energy-General/BPs-Latest-Estimate-Says-Worlds-Oil-Will-Last-53.3-Years.html).

This includes half of the five billion barrels in the Saudi-Kuwaiti neutral zone, which Kuwait shares with Saudi Arabia and 900 million barrels detected in Russia and 800 million barrels in Venezuela. Most of Kuwait’s oil reserves are located in the Burgan field, the second largest conventional oil field in the world, which has been producing oil since 1938. Dubai has approximately four billion barrels of oil in reserve and holds the second place in terms of oil reserves in the UAE. Dubai’s oil production peaked in 1991 at 410,000 barrels per day (b/d) and has been steadily declining ever since. The UAE’s reserves-to-production time is about 93 years! However, BP, in 2015, (at whose behest?) did a U-turn and changed its predictions that the global reserves would almost double by 2050, even at the booming rate of production and consumption! (http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11971280/The-Earth-is-not-running-out-of-oil-and-gas-BP-says.html). The United States now holds the world’s largest recoverable oil reserve base, more than Saudi Arabia or Russia, due to the new technology for extraction of shale oil.

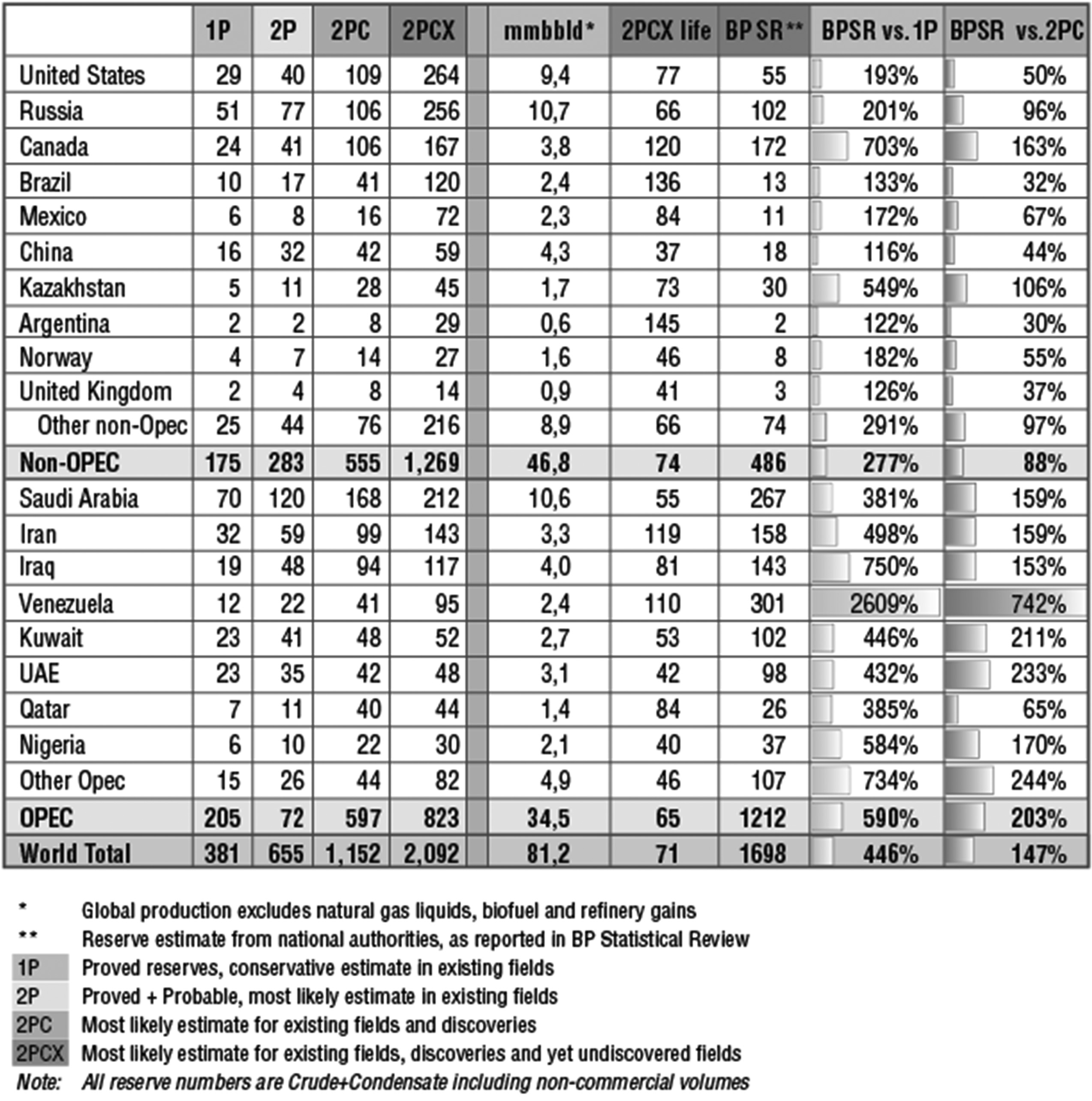

Ranking nations by the most likely estimate for existing fields, discoveries and as-of-yet undiscovered fields (proved, probable, possible and undiscovered), the US is at the top of the list with 264 billion barrels of recoverable oil reserves, followed by Russia with 256 billion, Saudi Arabia with 212 billion, Canada with 167 billion, Iran with 143 billion, and Brazil with 120 billion (Table 1- Source: The American Oil and Gas Reporter July 2016 – http://www.aogr.com/web-exclusives/exclusive-story/u.s.-holds-most-recoverable-oil-reserves).

The US Department of Energy has signalled its intentions to increase oil production to ten million b/d, the highest average annual level on the books. The revision, if achieved, is an indicator that US drillers are taking full advantage of OPEC’s deal with crude exporters to limit production in a bid to shrink a global oversupply.

Indian Oil Reserves

Although the first oil well in India was drilled in 1867 in Assam, the first commercial well to go into production was in 1889. All through the decades after gaining independence, until the 1960s, India’s oil production was confined to Assam, with an output of about 5,000 b/d, a very insignificant figure. Then oil was discovered in Western India, first in the onshore Cambay Basin in 1958 and later in the offshore Bombay Basin in 1974.

The proven reserves of India, both offshore and onshore, satisfy only about 25 per cent of the requirements of the nation…

In 1980-1981, about half of the production of crude oil came from on-shore fields, while the off-shore resources supplied the rest. After that juncture, the off-shore production increased at a much faster rate than the on-shore production. For more than two decades, from 1990-1991 to 2003-2004, about two-thirds of production of crude oil was being provided by the off-shore fields.

The production touched an all-time high in 1989-1990, but slumped in 1991-1994. The sharp drop of production by over seven million tonne in a short span of four years has been ascribed to overworking of Mumbai High oil wells, a dangerous trend and reversed thereafter. A number of short and medium term measures, such as early production from satellite fields, use of state-of-the-art technology, i.e. horizontal drilling and drain hole drilling were initiated in 1993. As a result of these measures the production increased from 1994-1995, until the second phase of falling production was noticed after 1996-1997. The production stood stagnant at about 32 million tonne in 1999-2001. In 2001-2002 and thereafter, a marginal increase in production was recorded where-in the on-shore sources produced about half the quantity that was produced by off-shore oilfields. Over the last decade, with the upturn in India’s economy, coupled with the increased domestic and global demand for oil, and advances in drilling technology in deepwater basins, the face of the petroleum industry in the country has changed.

Indian oil basins are showing great promise for new discoveries. The proven reserves of India, both offshore and onshore, satisfy only about 25 per cent of the requirements of the nation. At the same time, the country’s thirst for energy is becoming insatiable. India is the world’s fifth-largest energy consumer; coal continues to dominate, while oil accounts for 28 per cent and natural gas supplies and eight per cent of India’s energy consumption. India is the world’s sixth-largest oil consumer and imports three-quarters of its oil from overseas, mostly from the Middle East, though the first shipment of two million barrels from USA in more than 42 years, landed in September 2017, at the port of Paradip in Odisha, thus diversifying the sources of its imports.

Considering the shortfall in the requirement of oil, India is creating strategic reserves of oil for an emergency consumption of ten days, which converts to about five Million Metric Tonne (MMT). India’s strategic plan to build an emergency stockpile with millions of barrels of crude oil is in the rollout phase, on the lines of the reserves that USA and its Western allies had set up after the first global oil crisis of 1973-1974. Under the first stage of the Strategic Petroleum Reserve project, underground rock caverns for total storage of 5.33 MMT of crude oil at three locations – Visakhapatnam (1.33 MMT), Mangalore (1.5 MMT) and Udupi (2.5 MMT) – have been commissioned. All these are located on the East and West coast and are readily accessible to the nearby refineries. These strategic storages are in addition to the existing storages of crude oil and petroleum products with the oil companies and would serve as an emergency response to external supply disruptions.

Saudi Arabia and Iran were at the centre of disagreement that scuttled a previous OPEC effort to freeze production in April 2016…

The facility at Visakhapatnam in deep underground rock caverns, connected by tunnels extending over seven kilometres under the hills, has already been filled up while nearly a quarter of the Mangalore storage facility has also been filled. The storage facility at Udupi is likely to be commissioned shortly. Finance Minister, Arun Jaitley, had announced, in his 2017-2018 budget speech, the setting up of two more such caverns at Chandikhole in Jajpur district of Odisha and Bikaner in Rajasthan, as part of the second phase. On completion, the strategic reserve capacity would then increase to 15.33 million tonnes.

Geopolitics of Oil

The precipitous drop in oil prices has shuddered not just the economic order; tremors have been felt in geopolitical circles too. The price drop has set off an abrupt shift of fortunes. It has bolstered the interests of USA and pushed several oil-exporting nations, particularly those hostile to the West, to resort to extreme austerity measures.

Russia, as it is reeling under sanctions imposed by the US and its allies due to its annexation of Crimea and playing dirty in Eastern Ukraine, is now facing the low global oil prices making it see a drop of about $45 billion revenues than earlier projections, which have led to the adopting of austerity measures. The military is exempt from these measures. The Russian military has been active in the battle against the Syrian rebels and ISIS. The US too has been fighting the ISIS in the same region, but is engaged against the Syrian forces, which have the support of Russia. The two major powers are, thus, pitted against each other in Syria, while also fighting a common enemy!

Iran, the major opponent of Saudi Arabia, is recovering from years of sanctions, which were lifted after its nuclear treaty with the P5+1 nations, for a protocol for non-proliferation, with meaningful audits and inspections of its nuclear programme. It is now back in the market, but years of isolation have had a telling effect on its oil production. Initially, it refused to lower production, but relented to the 2016 agreement to do so in stages, so as the little upswing in the economy does not get an immediate jolt. Then there is the cooperation between the West and Iran over the terrorist group ISIS. Despite its support for Hezbollah in Lebanon and President Assad in Syria, Iran’s elite Revolutionary Guards are fighting the ISIS alongside the US, Britain and Canada. Commenting on the irony of the evolving political situation, JL Granatstein has mentioned in his write-up on the subject in National Post, “Politics makes strange bedfellows indeed, but not much can be stranger than this.”

Barring UAE, Kuwait and Saudi Arabia, none of the other members of OPEC have the economic flexibility to reduce production. Libya, Algeria, Iraq, Iran, Nigeria and Venezuela, all need maximum oil output and high prices to finance their budgets and social spending programmes. With the advent of US shale and the sharp increase in production, Saudia Arabia initially displayed little indication of reducing its output, rather prioritising higher market share over higher prices. There was a reason behind Saudia Arabia’s move; it had found itself in a similar position in the 1980s when it had cut production, only to discover that its hold over manipulating international oil prices was restricted. During the last four decades of exorbitantly high prices, Saudi Arabia, UAE, and Kuwait have thence amassed huge funds, enabling them to simply sit back and weather this period of low oil prices.

As the world’s largest crude oil producers, Saudi Arabia has been hit by the major fall in prices..

Saudi Arabia and Iran were at the centre of disagreement that scuttled a previous OPEC effort to freeze production in April 2016 and both are central to any future deal. While Saudi Arabia refused to agree to any limitations on production unless all producers agree, Iran refused to be limited in any way, as it was in the process of regaining its market after sanctions against it were lifted. Saudi Arabia, however, began to feel the pinch of continuing low prices. Over the past two years, Saudi Arabia has cut energy subsidies, slashed public spending and started to look for new ways to raise revenue outside of the oil sector. Crumbling state finances amid low oil prices and dubious plans for financial reforms, triggered Fitch, the international credit rating agency, to downgrade the kingdom’s rating. In response, the Saudi Finance Minister has insisted the economy and the government’s balance sheet were strong. As the world’s largest crude oil producers, Saudi Arabia has been hit by the major fall in prices, which has gone from more than $100 a barrel in 2014 to around $30 last year and remains hovering around $50 today. OPEC and non-OPEC oil producers met in Vienna on Oct 20, 2017, with all options on the table for what to do next for a global deal on cutting crude output. Whether they will succeed in cutting production to raise prices and stabilise their economies, is anybody’s guess.

India’s Options

While in the beginning of the year, the benchmark Brent crude was in the market at around $30, it rose sharply to around the present day figures of $55 by June 2017. The meeting of the oil producers, OPEC and non-OPEC, in Vienna on October 20, could spell further trouble for India, should the oil exporters agree to further reduce the output. India’s energy requirements are met through oil imports. 75 per cent of its needs are imported, as compared to just 37 per cent in the 1990s. India, therefore, has every reason to feel jittery.

A further price rise could wipe out most of the trade and fiscal gains of the last two years. Numbers seem to justify these fears. In 2014-2015, India purchased its oil basket at around $110, which fell sharply to $35 last year. The total import bill fell from a figure of $450 billion approximately, to a little over $350 billion, a precious gain that could be wiped out if the prices continue at the present levels or rise.

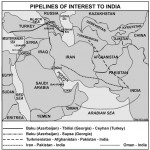

Globally, the solution to India’s woes lies in Iran that as mentioned earlier, had refused to lower its production levels and has been pumping at a furious rate to reach its target of four million b/d. In May this year, it was expected to increase its exports by about 60 per cent. Not surprisingly, India is Iran’s biggest market and has an edge over other global purchasers. India is not curbed by banking and other restrictions, as the others are. This advantage should not be lost, though there has been some friction in oil purchases from Iran. India should offer deals to invest in Iranian oilfields, which have been starved of funds and technology since 1979, when sanctions were imposed. Similarly, the strategic oil treaty with UAE is a step in the right direction, though imports only from the Middle East, is not advisable. Deft exploitation of the market to diversify the sources for imports, as has been done for imports from Russia and now, USA, needs to be pursued vigorously.

Within the country, apart from increasing exploration and production, the policies of marketing of petroleum products should be streamlined, as against being arbitrarily taxed. Some steps have been initiated, but more needs to be done to end or modify the transfer of subsidies on various products. Similarly, to boost competition, petroleum products should be available in the open market, rather than being sold only by public sector companies. This would help the consumer to take advantage of the retail margins. Alternate energy is the future. Just as the world is investing heavily in this field, India too, should invest in research in sources of alternate energy to reduce its dependence on oil and hydrocarbons.

Concluding Thoughts

Notwithstanding the spirited search for alternate sources of energy, oil continues to be the most significant geopolitical commodity and any structural change in oil markets echoes throughout the world, creating clear-cut winners and losers. Cheaper oil acts like a shot of adrenaline to global growth; a $40 drop in costs shifts about $1.3 trillion from producers to consumers! Big importing nations, such as the EU, India, Japan, Turkey, and China have enjoyed windfalls due to the current drop in prices. Any increase now could erase all the advantage and reinstate austerity measures.

Countries that consume large amounts of energy have been coping with oil prices hovering around $110 per barrel since the beginning of 2011, as most of the developed and developing nations have been trying to emerge from financial and debt crises. A sustained period of lower oil prices has provided relief. Major oil producers on the other hand, have grown accustomed to high oil prices, using them to prop up their national budgets. Sustained low oil prices are now making these oil producers to rethink their spending. Just how positive would be the effects, will depend on how long the price of oil continues to maintain the present levels.

Even though prices appear to have stabilised at the present levels, the recent plunge and subsequent rise in the price of oil serves as a reminder of how geopolitically significant oil prices can be. Oil supplies form the backbone of modern industrial economies and energy resources are critical export commodities for those who possess it in abundance. As long as fossil fuels remain the dominant source of energy, something that is likely to last quite a few decades, oil supply and oil prices will remain critical. Oil, is it a dying resource? Not as yet, by any stretch of imagination!