There is a distinctive buzz about Prime Minister Modi’s new campaign for “Make in India”. The thrust is to increase share of manufacturing from the current level of 15 per cent of Gross Domestic Product (GDP) to 25 per cent and create additional employment opportunity of ten million per year. This has led a few cynics to observe that, “There is a lot of sizzle but where is the steak?” Columnists such as Swaminathan Iyer are of the view that “Make in India” is only an outcome and not a policy while Governor of RBI Raghuram Rajan is of the view that the government is putting too much of thrust on export-led growth and should give primacy to “Make for India”. Discerning writers such as Debasis Basu however, feel that what is germane to the debate is the “cost of doing business” in India.

The defence services account for nearly Rs 2.29 lakh crore of the Central Government Budget…

Defence manufacturing came out of the stranglehold of Public Sector Undertakings-Ordnance Factories (PSU-OF) monopoly with major liberalisation in 2001 with 100 per cent private sector participation and the recently announced 49 per cent in Foreign Direct Investment. Policy footprints such as the Defence Procurement Policy (DPP) 2013 have created a level playing field for the private sector. The Defence Production Policy 2011 aims at higher self reliance in critical technology and the Offsets Policy 2012 which seeks to leverage our big arms’ acquisition to bring in state-of-art technology, and long term partnership with Original Equipment Manufacturers (OEMs). The Self Reliance Index of our defence acquisition, however, remains at a wobbly 30 per cent despite spasmodic policy posturing to improve indigenisation.

Defence industry is a subset of a nation’s concern to ramp up manufacturing capability. The capability of our defence industry in terms of value addition, self reliance in critical technology and policy initiatives so far and their impact needs to examined and a possible synergy between “Make in India” policy and defence industry capability needs to be brought about.

Defence Manufacturing and Challenges in Self Reliance

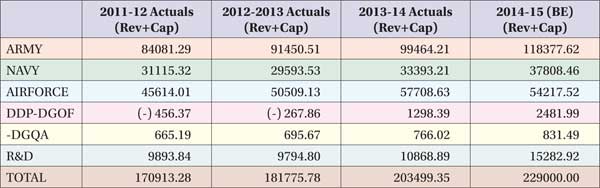

The defence services account for nearly Rs 2.29 lakh crore of the Central Government Budget which is nearly 2.5 per cent of the GDP and 13 per cent of the Central Government expenditure. The trend of allocation to revenue and capital acquisition schemes is given below.

Table 1: Service/Department-Wise Break Up Of Defence Expenditure (Rs. Cr.). Source: Annual Report 2013-2014, MOD

It would be worth to note that while the increase in the revenue allocation roughly matches with the wholesale price escalation, the capital acquisition budget has witnessed significant growth of around 20 per cent per year, far outstripping the overall trend of increase in defence expenditure. Capital Acquisition constitutes nearly 40 per cent of the defence budget of which the value of production of the Defence PSUs and the OFs account for the following:

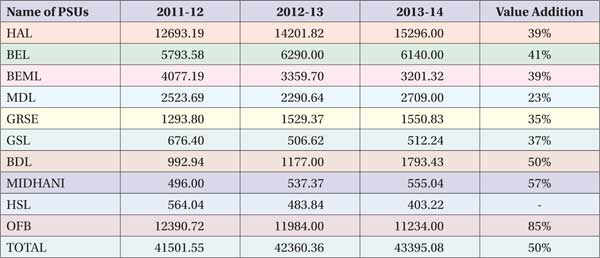

Table 2: Value Of Production And Value Addition Psus And OFB (Rs. In Crore). Source: Annual Report 2013-2014, MOD

It would be seen from the above that while the average yearly increase in Value of Production (VOP) of Defence PSUs is around five per cent per year, in case of the OFs it is only two per cent. It would be interesting to note that the value addition of different defence PSUs varies between 23 per cent and 57 per cent; it is very high, about 85 per cent, for OFB. PSUs such as HAL and MDL show a poor level of value addition as they are largely system integrators while Midhani and BDL have contributed handsomely to indigenisation. The higher indigenisation in case of OFBs is largely attributable to the low end technology.

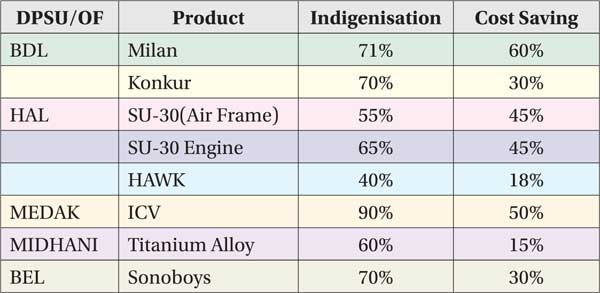

Historically, India has been availing of technology through licence agreements from Russia and a smattering of Western countries. The exceptions are some of the missile systems, small arms and their ammunition and tanks where technology has been indigenously developed by the Defence Research and Development Organisation (DRDO). The Light Combat Aircraft (LCA) Tejas with Final Operational Clearance (FOC) will hopefully be a major “Make in India” platform. It must be mentioned that indigenisation has effected a substantial reduction in cost of the systems due to India’s labour arbitrage, good facilities and fairly well-trained labour force. The following table brings out the cost savings of a few major products through the Transfer of Technology (ToT) route.

Table 3: Indigenisation & Cost Savings through ToT. Source: Table prepared by Author based on data obtained from DPSUs/OF

Self-Reliance Trends

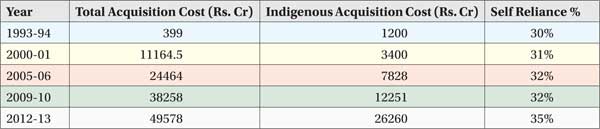

Self-reliance trends in defence acquisition present a dismal picture. A committee under Dr APJ Abdul Kalam, the then Scientific Advisor to the Raksha Mantri, had recommended that India should ramp up this quotient from 30 per cent (1995) to 70 per cent by (2005). The following table, however, brings out how the Self Reliance Index has remained sticky at around 30 per cent.

Table 4: Total Acquisition and SRI: Trends. Source: Table Prepared by Author based on data obtained from Ministry of Defence

The principal reason for this state of affairs is our poor design capability in critical technologies, inadequate investment in R&D and our inability to manufacture major sub-systems and components. The Transfer of Technology route has provided India with the know-how without providing the clue for know why. It is due to this that even for an upgrade of the systems, defence PSUs are critically dependent on the original licensors. A case in point is the SU-30 upgrade where the Russians often hold HAL to ransom.

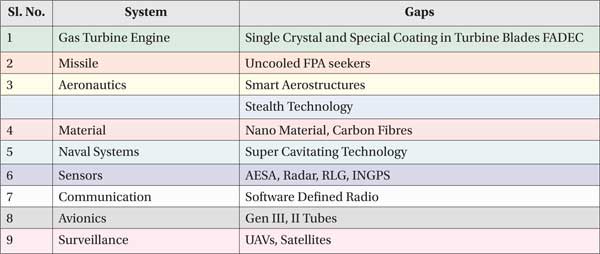

The following table brings out the gaps in critical technology of different systems.

From the table above, it would be seen that the major deficiency in terms of capability is in the areas of propulsion, weapons and sensors. Some of the critical technologies where progress made by the DRDO has been abysmally poor are Focal Plane Array (FPA), Active Electronically Scanned Array (AESA) Radar and Stealth Technology. India is presently engaged in the design and production collaboration with Russia for a Fifth Generation Fighter Aircraft (FGFA), that will have stealth features.

India is presently engaged in the design and production collaboration with Russia for a Fifth Generation Fighter Aircraft.

Procurement, Production and Offsets Policy in Retrospect and Their Impact

The Defence Procurement Policy 2013 envisages higher preference to Buy (India), Buy and Make (India), and Make options over the earlier thrust towards Buy (Global) or the import option. It ostensibly looks at creating a better level playing field between the Public and Private sector with greater impetus towards indigenisation. A major departure from the previous policy is allowing the private Indian industry to avail of ToT which was earlier the exclusive domain of DPSUs/OFs. The policy also encourages Joint Venture with OEMs. Prime Minister Modi’s “Make in India” campaign has added another category to Defence Acquisition though it would include cases coming under the panoply of ‘Buy and Make’ and ‘Make’ where technology is indigenously developed.

The Offset Policy guidelines (2012) have for the first time allowed ToT through the JV or through non-equity route. It has also allowed multiplier for critical technology areas such as FPAs, Nano Technology-based sensor, fiber laser technology and THZ technologies.

The Defence Production Policy (2011) aimed at achieving substantive self-reliance in design, development and production of critical sub-systems by forming consortia, JVs by involving academia and R&D institutions. It also promised to set up a defence technology fund to support public, private sector as well as academic and scientific institutions for pursuing high-end research. The impact of all such policies on FDI inflow, export, augmentation and long term partnership has been quite disappointing for reasons enumerated below.

Value addition in the global value chain for India was only one per cent in 2009 as against nine per cent in China and Germany…

FDI Policy

The OEMs for setting up business in India in partnership with public/private players want to have a major say in the management of manufacturing. While the announcement to scale up the FDI limit from 26 per cent to 49 per cent in the last budget has been a step in the right direction, it is unlikely to enthuse reputed global manufacturing houses to set up manufacturing bases and bring in front-end technology though some Joint Venture intents have been evinced for companies like the Tatas. On the other hand, countries such as China and South Korea have become major manufacturing hubs in aeronautics and ship building technology by being very liberal in their FDI policy and providing high modicum of ‘Ease of Doing’ business compared to India.

R&D Allocation

Besides the FDI policy, inadequate investment in R&D and lip service to technology funding by making a token allocation of Rs100 crore to Defence Technology Fund in the last budget is adequate commentary on our lack of seriousness in the area of Research and Development. The allocation to DRDO remains sticky – around six per cent of defence expenditure though successive parliamentary committees have recommended a minimum allocation of ten per cent. Private sector giants such as the Tata, L&T and Mahindra and Mahindra invest less than one per cent of their turnover in R&D unlike in countries such as France where corporate organisations invest more than ten per cent in R&D. It would also be interesting to note that the overall allocation to R&D is significantly lower (0.85 per cent) in India compared to advanced countries which spend in the range of 2.2 per cent to 3.5 per cent. The following table would bring out the trend.

Very good insight and analysis. The only turnover doesn’t tell the complete picture. This means a turnover of Rs 20,000 Crs at OFB will be equivalent to around Rs 21,800 Crs in terms of value addition.

India offers tremendous opportunities in engineering services, supply chain sourcing and associated maintenance, repair and overhaul-related activities, however to achieve self-reliance we need to create a robust ecosystem that can address the capacity and capability requirements for the industry.

Low productivity in defense sector is a serious problem for national security. India must have a capacity of at least 200 fighter planes , 500 tanks , 500 armored personal carrier . 1000 guns and mortars and their ammunition annually. Only public -private partenership in R&D and production can resolve this problem. Relation with China and Pakistan will remain hostile .

Very good article sir. We are a NAM nation, if we harness our defence capability, then we have seamless opportunity with a big market.

Nice article Dr. Sharma. I wonder if there is any incentive to encourage MSMEs to invest in defence manufacturing. India will have to largely involve MSMEs if it wants to become self reliant in defence manufacturing, otherwise PSUs will continue to be integrators and do low value addition than actual manufacturing.

Thx,

Dr. Praveen Srivastava

Comment that value addition of OFs is 85% because of low technology items is because of ignorance. OFs manufacture bulk of land systems and ammunitions. Any stretch of imagination can not categorise these as low tech. Rather all high end manufacturers are vying for manufacturing the land systems and ammunitions by screwdriver technology. It is only Ordnance Factories, which make items in a self reliant manner. OFs may be doing it under ToT but after absorbing and indigenising it. That is how their value addition is high. It is much better than getting the sub systems and assembling them.

Nice Article , Sir

As per your vast experience , which product would be the best to propagate in India’s Defence.

I am very interested in the “Make in India” concept but not able to get a foreign defence company to show interest in our Defence programmes .

I hail from a family of 5 defence fauji officers . I would appreciate it if you could guide me accordingly.

Any suggestions.

We have our office in Delhi.

Dennis

Jai Hind !!

Skype : denniscollins128

+91-8688597499

+91-7569778889

Excellent and in-depth analysis.As pointed out, unless & until private, public and Govt. have desire to develop technology through R&D efforts, make in India compeign will either not succeed or be infractus

Author has tried to make a good attempt by interweaving many aspects that will contribute to defence manufacturing in India like requirements of fund for new technology development, status of GERD in India, status of SMEs in India, FDI in defence manufacturing, Offset policy , skill requirements and development , ease of doing the business at low cost etc. However, interweaving of various factors, its interdependence and its effect on defence production has not been done properly. Similarly, some of the facts have not been presented properly, for example level of indigenization has been shown 85% for OF, but the reason attributed is that OF is in low end technology. OF make variety of products right from uniform and shoes for Siachen to tanks, ICVs, small arms, ammunition, B-vehicles, artillery weapon etc which can not be grouped in low technology area. Similarly, SME in Japan are present in big way in manufacturing, but they are not in competition with big industries , but they are working in collaboration with them.

To boost up make in India in defence, one has to ensure that market comes before production. Defence industries works in monopolistic or oligopolistic market. Without assured market for a reasonably long period, nobody will invest their money. So, first reform has to be made at demand side. There should be a long term perspective plan for acquisition where specifications needs to be frozen for a reasonable period of time keeping in mind the availability of technologies at competitive and affordable cost, strategic requirements based on capabilities of potential adversaries and incubation period of next generation weapon system development. SQR should not be based on whims and fancy of decision makers . Manufactures views should also be taken while framing GSQR. If a contract is won by one company , then it should supply 5 to 10 years till it recovers its return on investment, technology technology is phased out globally or becomes irrelevant .

Firstly our curriculum from High School level should be changed to Skill based knowledge on practical applications.Howmany students can identify a spanner, screwdriver or electric current? Very few.Without basic knowledge students cannot pursue research.

There is a major flaw in the author’s understanding of shipyards whether private or public sector. Shipyards are locations where the ship/ submarine is brought together . Shipyards do NOT make systems , or even valves ! They come from subcontractor MSME factories in the hinterland. Modular / Integrated construction is the way ahead for shipyards to speed up construction. That requires up gradation of facilities and land. Lastly we need orders on frozen staff requirements from users navies. Midway changes slows down production to a crawl. The IN is leading the Builders Navy concept for many years now and can do much more with a focused thrust in our public and private shipyards. HOW? Our strategic tasks are many as we stand challenged in the Indian Ocean as never before by China. Our need is numbers now as older units need to be replaced / retired in the next 25 years! So time to build is now for the next 25 years at a frenetic pace, whether it is ships , submarines or Naval LCA fighter aircraft.

Certainly India has ignored R&D in this sector, but although it is a little too late, yet we can now rectify our strategy, collaborate with best manufacturers, set up specialised recruitment and training centres to exploit our best brains and in the next ten years make productive products for domestic and overseas use. Raising funds from the stock markets by manufacturers in due course of time may also be permitted. Long term benefits clearly can come our way !

We dont have a good R&D base – we need to drastically improve and expand our R&D base. All IITs and Engineering Colleges in the country should be co -opted in expanding our defence tech base. We should also improve the intake of Scientists into the DRDO. They are lowly paid Government Servants with little motivation. I have met many during my service and was not at all impressed with them. Some of them even complained of being shackled and not given the freedom to work.

The DRDO has been responsible for the armed forces not getting the latest technology. It has always lobbied with the govt that they will produce the required system – One example is the INSAS weapon system. They took years to produce an out dated weapon – its basically cut paste technology. Even its manufacture at RFI is poor – its stamped cut rather than a moulded configuration. If you cant produce something of your own – steal technology as the Chinese have done but dont delay us. You cant even produce precision ammo for the artillery. Shabby job if you ask me.

With due respect sir , are you from Indian army , if yes then you should have known that INSAS was developed and manufactured by OFB , not DRDO . Do your home work properly before scribbling nonsense