Ka-226T multi-role Helicopter

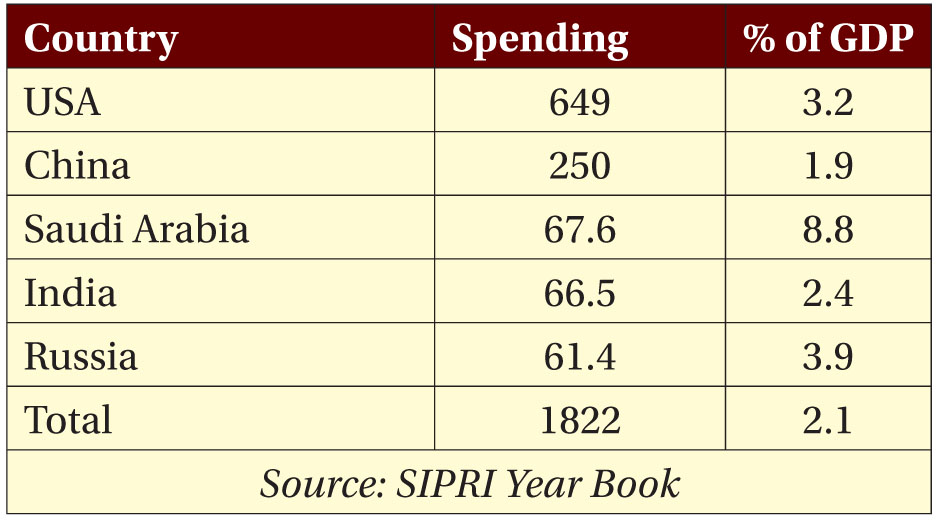

The aerospace industry accounts for nearly 40 percent of global military expenditure which stood at $1,822 billion last year (Sipri 2018). The US is a major player in terms of military expenditure (30 percent), export of conventional arms (34 percent) and allocation to defence R&D (60 percent). Nearly two-thirds of major defence OEMs are based out of the US. India has been the largest importer of arms till last year and has now been pipped to the post by Saudi Arabia (12 percent). However, India still has a humongous share of global defence imports, making it a favoured hunting ground for OEMs of countries such as Russia, USA, France, UK, and Israel.

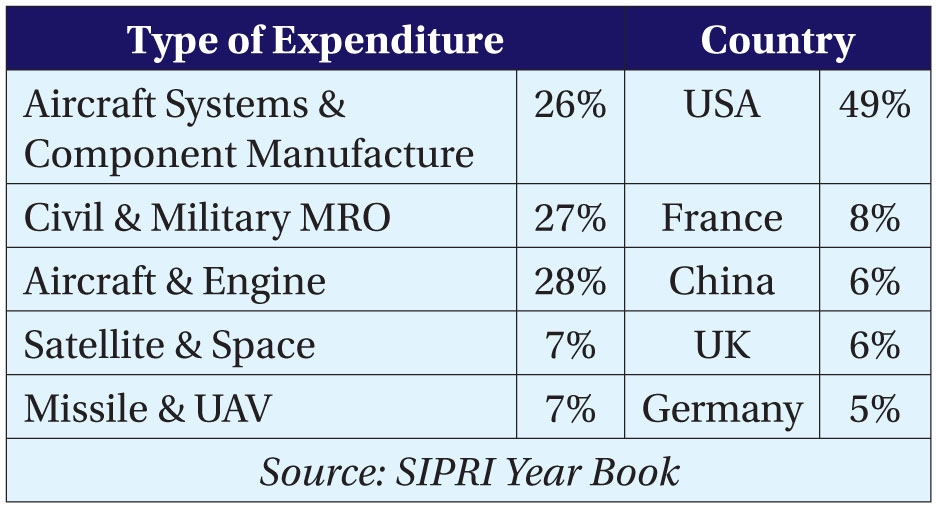

The aerospace industry is a major player involved in the development, production and maintenance of aircraft, missiles and UAVs. It also includes airborne defence electronics, simulation, ground supply engineering and Maintenance, Repair and Overhaul (MRO). The aircraft systems and component manufacturers account for 26 percent, civil and military MRO – 27 percent, aircraft and engines (28 percent), while satellites, missiles and UAV account for around seven percent each of aerospace manufacturing. The US is a predominant player in aerospace manufacturing accounting for nearly 50 percent of around $838 billion, as brought out in Table 1 below.

Table 1: Trends in Aerospace Manufacturing

The trends in global military expenditure are brought out in Table 2 below.

Table 2: Trends in Military Expenditure

This paper seeks to analyse the evolution of India’s aerospace industry and its financial impact, major government policies, their impact and the way forward.

Evolution of India’s Aerospace Industry

The Indian aerospace industry is predominantly the remit of the government where Hindustan Aeronautics Limited (HAL) has been the prime player since the Second World War. Beginning as a fledgling private set-up in December 1940, with a paid up capital of Rs 40 lakh by Walchand Hiralal, the repair and overhaul set up in Bangalore was involved in the repair and overhaul of US aircraft, and provided spares support to British aircraft to thwart the Japanese air attacks. It was taken over by the government after independence. The British did not leave behind an enduring aircraft manufacturing legacy in India nor did they invest in design and development of either civil or military aircraft. The British objective in developing a network of railways was to connect the hinterland to the ports to carry raw material for British industry and connect the country through P&T & Telegraph. Karl Marx had aptly observed, “The British were the unconscious hands of history to promote economic development in India.”

Make-in-India has been a major initiative of the Government of India to improve its manufacturing footprint from its share of 16 percent in GDP to about 25 percent…

The early years of this organisation witnessed design efforts to produce a trainer aircraft (HT-2). The Indo-China War and the major debacle thereof, demonstrated the need for India to build good military industry capability and triggered India’s first foray into licensed manufacture agreements with Russia. The Transfer of Technology (TOT) for MiG-21 aircraft was done in 1964. It was a major watershed policy decision where Nehru’s India opted for future aircraft manufacturing to be done through Transfer of Technology and Building to Design, rather than Design to Build. Indigenous Research and Development, and manufacturing aircraft based on indigenous design were given a short shift. The reality of a poor academic base in the aerospace industry largely contributed to such thinking.

In 1970, India collaborated with SNIAS France for manufacturing the Cheetah and Chetak helicopters. A major boost to India’s aerospace armoury came with the induction of the Mirage aircraft from France in 1982, in response to Pakistan acquiring the US F-16 fighter jets. The most significant imprint in our aerospace inventory has been the acquisition of SU-30 MKI aircraft, and the licensed manufacture agreement with Russia for producing the SU-30 MKI – a very potent fourth generation aircraft. The IAF’s present inventory of 269 Sukhoi aircraft is a major template of India’s air presence, which can easily overwhelm the aircraft capabilities of adversaries such as Pakistan and evenly match the capabilities of aircraft on the PLAAF’s inventory.

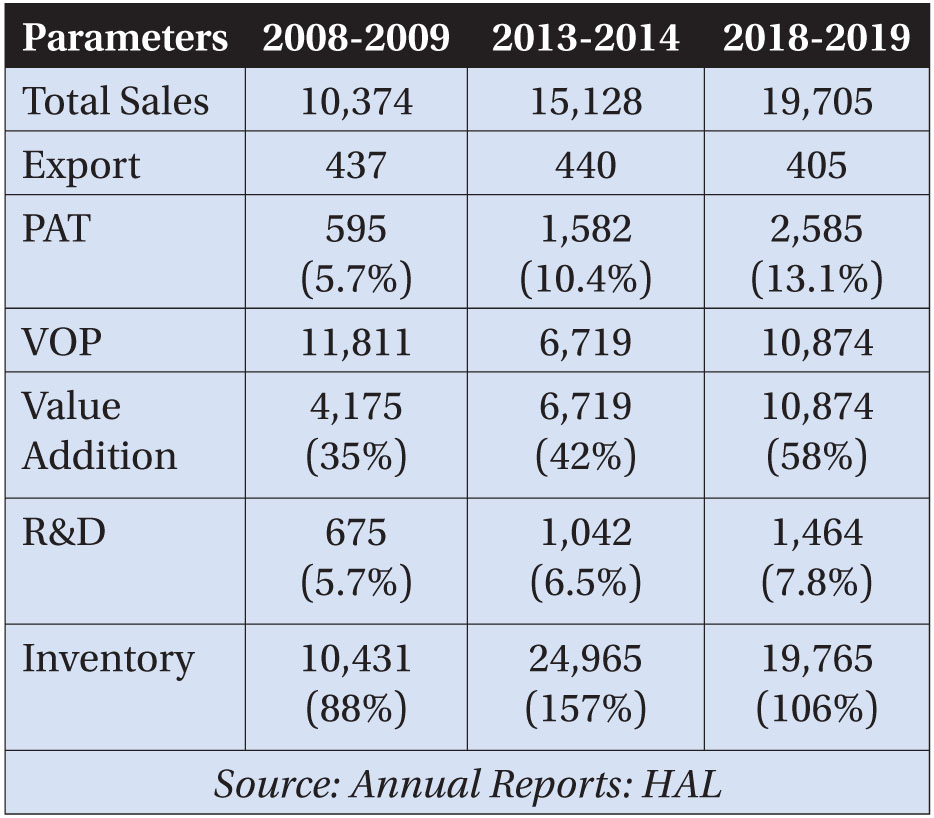

HAL’s major foray into indigenous manufacture based on indigenous design came with the production of the Light Combat Aircraft (LCA) developed by the ADA (DRDO). It has been a long delayed project, where the LCA was to replace the ageing MiG-21. Despite the hiccups, the IAF has ordered 123 LCAs from HAL. The other major achievement has been in the manufacture of the Advanced Light Helicopters, which also have a chequered history. Beginning with our collaboration with M/s MBB Germany, the ALH aircraft is going to be the mainstay for the three services, both in civil and weaponised versions. A notable success story has been in 2010, when India, outshining major global companies, bagged an export order for ALH from Ecuador. HAL also has built up reasonable design and development capability by developing a basic trainer aircraft, and designing a Light Utility Helicopter for the three services. The financial statement of HAL during the last decade is summarised in Table-2 below.

Table 3: Financial Highlights: HAL (2009-2019) (Rs Crore)

HAL’s vision is to ‘become a significant global player in the aerospace industry’ with a mission to achieve self reliance in design and development, upgrade and maintenance of aerospace equipment with world-class performance standards, value addition and growth in exports. As the above table would show, in terms of value addition, HAL has improved its performance significantly from 35 percent (2009) to about 58 percent in the current year. However, in terms of allocation to R&D, it is quite meagre compared to major global aerospace companies, who spend more than ten percent. Also, the level of inventory held is unacceptably high at 106 percent (2018). HAL has also not been able to make any further impact after its success in selling a few ALHs to Peru and Ecuador. Its export record also is not edifying and is, in fact, decelerating. The long delay in designing and developing the LUH has become a veritable justification for the services to clamour for import. The same story applies to the design of a basic trainer aircraft.

The private sector players have a legitimate grievance that they are deprived of the technology from foreign companies and often bereft of government support…

HAL is organised in three clusters, viz. the Bangalore complex where aircraft and engines of the Jaguar and Mirage, overhaul, aerospace products, LCA and helicopters are manufactured, the MIG complex, where Su-30 aircrafts and engines are produced and overhauled, and the Accessory Complex where electronic components, hydraulics and radars are manufactured. The Bangalore complex is mainly concerned with aircraft of Western origin whereas the Nashik complex handles aircraft of Russian origin. There are 19 production units and ten R&D centres which are engaged in manufacturing 15 types of aircraft, their engines and their ROH.

The private sector does not have any independent production complex. However, after liberalisation in the defence sector in 2001, allowing FDI of 26 percent, and subsequently raising it up to 49 percent, private companies such as TASL, Mahindra and Mahindra and L&T have entered into collaborative arrangement with foreign OEMs for the production of aero structures for the C-130J and components for S-92 helicopters. The Government of Telangana has also set up an aerospace park to encourage the private sector to get into aerospace production for global requirement. In other words, most of the private sector initiatives are collaborating with companies such as Sikorsky and Lockheed Martin for manufacturing components and parts for the end product. Their association with HAL is more as sub-contractors rather than as partners.

Major Government Policies and their Impact

The defence sector was late into economic liberalisation by a decade. It came in 2001, permitting full private sector participation and foreign OEMs to put in equity up to 26 percent. It was increased to 49 percent in 2015. Presently, the government allows 100 percent FDI, if that can give access to modern technology. Despite these policies, the FDI inflow into the defence sector is significantly low ($0.8 million) as compared to the other sectors, where the total inflow was around $62 billion during 2018-2019.

The major policies, thereafter, have been driven by the Kelkar Committee and Make-in-India initiative. The Kelker Committee advocated a level playing field for the private sector and encouraged PPP in the defence sector. It also kick-started the ‘offset policy’, introduced in the DPP in 2009, which sought to capitalise on India’s big ticket acquisition by asking OEMs to part with key technology, bring in FDI and outsource production requirements.

Make-in-India has been a major initiative of the Government of India to improve its manufacturing footprint from its share of 16 percent in GDP to about 25 percent. Of the 25 sectors identified, aviation is a major sector. The Dhirendra Singh Committee (2016) suggested a strategic partnership between major public and private sector players. However, this has not made any discernible impact. However, one of the very concrete initiatives in this regard has been the Joint Venture arrangement with the Russians for building KA226T Kamov helicopters in India. HAL has also struck a JV with Irkut (Russia) for manufacturing 332 components of SU-30 MKI in India. The idea is to build indigenous capability in manufacture of radio and radar, electrical and electronic systems, mechanical and instrument systems in India.

The major strength of India in the aerospace sector has been the large pool of engineers, ITI diploma holders and their cost effectiveness as highly skilled labour input. Airbus and Boeing have set up R&D units in Bangalore to capitalise on the availability of IT engineers in the city. India is presently the ninth largest civil aviation market and expected to be the third largest by 2024. There are also considerable opportunities for setting up of MROs where there is high potential for revenue growth.

The IAF’s present inventory of 269 Sukhoi aircraft is a major template of India’s air presence…

However, the weaknesses are the absence of established OEMs, protectionism extended to the HAL as a captive supplier, lack of Tier-II and Tier-III companies that can support aircraft manufacturers and SMEs struggling to go up the value chain. A major hiccup has been the cancellation of the TOT agreement between M/s. Dassault Aviation and HAL for the manufacturing of the MMRCA aircraft in India. The change from ‘Buy & Make’ to ‘Buy’ from Dassault Aviation has been a major setback for Make-in-India initiatives.

The other major setback has been the shelving of the FGFA programme with the Russians, where we would have designed, developed, and produced a fifth-generation fighter aircraft with stealth technology. Besides entities such as HAL, DRDO, NAL, MIDHANI, ADA and Indian Institute of Science, Bangalore often work in silos. The Rama Rao committee had very strongly suggested that design, development and production should be under the supervision of the one agency. This will bring in better coordination and accountability. The committee had pointed out how the failure of the Kaveri Engine was due to the lack of synergy between GTRE (the design lab) and HAL (the production agency). In Russia, the design and the production houses work under one umbrella.

There is also a lack of synergy between the private sector players and HAL which perceives them as adversaries rather than collaborators. The private sector players also have a legitimate grievance that they are deprived of the technology from foreign companies and often bereft of government support. The fallout of this has been enormous delay, high costs and the lack of accountability by an aerospace behemoth such as HAL. In the shipbuilding sector, when competition was open to the private sector for manufacturing OPV and IPV, it was seen that the private sector players delivered them faster and at lesser cost. The quality control system was much better.

The Way Forward

Economic liberalisation in the telecom and pharmaceutical sectors has seen significant erosion in the role of the public sector. However, a similar success story is yet to be inked in the defence aerospace sector. HAL continues to be the monolith with many private sector players genuinely feeling sidelined from a level playing field. Most of the discerning observers believe that the manufacture of helicopters, transport aircraft and trainers could be outsourced to the private sector which has the requisite infrastructure and technical sinew to deliver machines of the desired quality and well within the given timeframe.

While strategic systems can remain within the production purview of HAL, the private sector must be allowed entry into the production of helicopters, transport aircraft and the trainers. The private sector cannot be treated as a pariah in the system and must be encouraged to be effective partners with HAL and OEMs. When Lockheed Martin wanted to set up a production base in India for its F-16, it was very keen on a partnership with a private sector player such as the TATAs rather than with HAL.

The experience in case of offsets also reveals that the foreign OEMs are keener to partner with the private sector rather than the defence PSUs. The private sector is far more fleet footed, professionally agile and accountable than the public sector in India. To be counted as a global player, India needs a big push towards privatisation in the aerospace sector, build credible military industry capability and be a part of the global supply chain, as China has successfully achieved. The humungous political mandate of Prime Minister Narendra Modi must aim to provide the defence aerospace sector with decisive economic liberalisation.