Reputations are made and destroyed in the oil industry for those hazarding educated estimates of where the oil price is headed. Remember the prediction that oil price is headed to $200 per barrel?

Each $10 decrease in oil price reduces India’s Current Account Deficit (CAD) by $10bn.

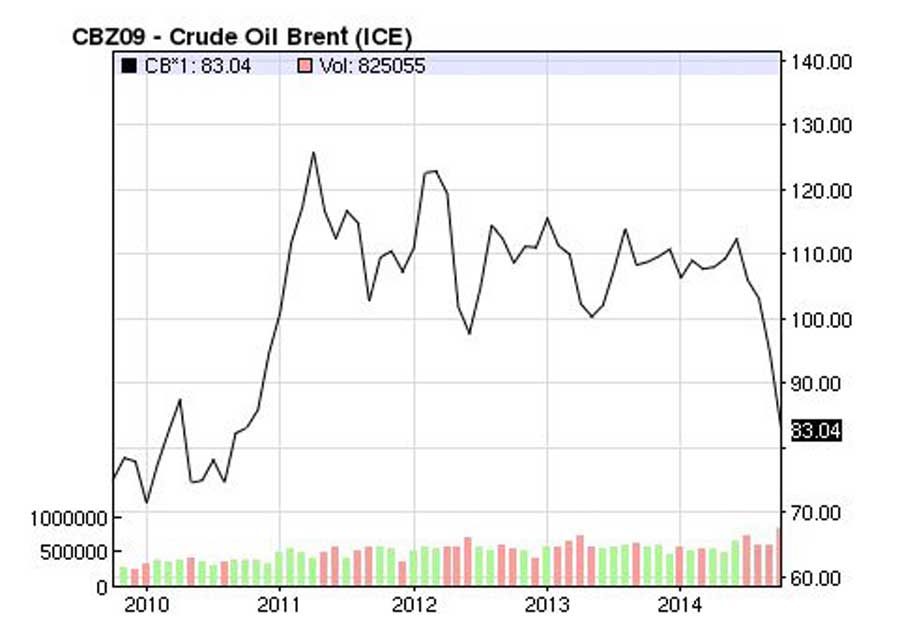

Front month oil price yesterday closed at US$ 83. I will nevertheless keep aside the conventional wisdom and suggest oil prices would probably see further weakness and possibly drift lower to US$70 before rebounding in the US$ 80-90 range. There are multiple bear and bull factors at play, not all of which are economic in nature.

Some market commentators suggest the current weakness in oil prices is due to the traditional refinery autumn maintenance and once the refineries come back online the prices would rebound. I respectfully differ with this line of reasoning. The seasonality in the product demand is well known and most of it to the producers and refiners. Producers are generally prepared for the maintenance twice a year and this year should have been no different. Further, data suggests the market was untouched by this price weakness in the last 4 years (see chart), which further re-enforces the first point.

The reality is that there is just too much oil floating around the world. OPEC in its October oil market report reported its members having produced 415,000 barrels of oil per day more than the previous month. Guided by profit, the animal instincts of the US independents have been in a relentless pursuit to push oil production higher and are sitting on historical highs. However few seem to be curtailing production. Libya, has come to an agreement of sorts with the militia to let its oil keep flowing to the export markets. ISIS hasn’t been able to make a dent on the Iraqi production. Even Saudi has seen higher sequential production in September!

On the demand side, the IEA yesterday cut its 2014 demand forecast by 200,000 bopd, which is almost 22% lower than its previous forecasted growth of 900,000 bopd.

…in the murky world of oil there seems to be a cold-war style US-Russia angle. This time around it is Saudi not cutting the production and US increasing production to contain Russia…

Despite the oversupply, few OPEC members seem to be in a hurry to cut production. Venezuela has called for an emergency meeting, Iran has called for production cuts by members. But Saudi seems to be less inclined to oblige. The next meeting is scheduled for end November which would look for rationing the quota for 1Q 2015.

Good omen for India

With the oil prices having declined $30/bbl since mid-June high of US$115/bbl, Modi government seems to be getting lucky. Each $10 decrease in oil price reduces the Current Account Deficit (CAD) by $10bn. For comparison, pre-oil price decline CAD was expected to be around 2% of GDP (US$36bn) and if current prices persist for the full year, then CAD will decrease to less than 1% of GDP.

Softer oil price also helps contain inflation which inturn keeps the vote-bank happy, a possible reflection of which we will see in the results of the upcoming Haryana and Maharashtra election on the 18th October. Going by the exit polls, the Modi government seems to have found favor with the electorate.

Oil producers’ benevolence

Is there benevolence at play to support the global economic growth? Remember a US$10/bbl lesser oil price translates into a (lesser) wealth transfer of US$330 bn a year from consuming to producing countries. This line of thought I doubt – remember there was no soft heart in the much more difficult years of 2010-13, so I remain a skeptic if that indeed were the case today.

Conspiracy to Avenge Ukraine adventure

There is market chatter around a larger conspiracy at work. As with almost everything unexplained in the murky world of oil and trust me, there’s enough of that, there seems to be a Middle Eastern actor- Saudi in this case, along with a cold-war style US-Russia angle. This time around it is Saudi not cutting the production and US increasing production to contain Russia, which derives almost half of its revenue through oil and oil-linked gas sales.

…the net impact on oil prices will be negative for the coming few quarters, which bodes well for the global growth and specifically for India…

According to Sberbank CIB, if oil prices average the current level of US$90, then Russia would run a 1.2% budget deficit in 2015 and needs about US$104 to balance its budget. US and EU have already imposed sanctions on Russia as a reprisal of Russia’s Crimea annexation and Eastern Ukraine overtures, and this move would largely fishtail with the current day sentiment.

Saudi unhappy with US wells flowing

However the plot thickens with another conspiracy theory doing the rounds – this time around Saudi avenging the disturbance of its stable oil prices regime. The Saudi has seen the oil price stable through international geo-political crisis, first by increasing production to accommodate Iran, Syria and Sudan’s decreasing production and then by accommodating Iraq’s rising production. Saudi has acted as the only global swing producer, which was in control of both its oil production and economy to maintain the price stability.

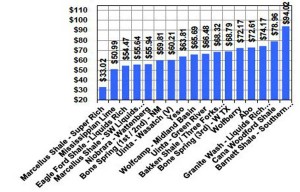

However with the increase in US oil production- up almost 70% in the last 6 years and at it’s highest since 1986, the Saudi’s ability to maintain stability has been considerably impacted. In a bid to restore balance Saudi could be playing its cost advantage against the higher cost shale oil producers. In this scenario, Saudi will perhaps have to let oil prices slide to US$75-80 and let it stay there for a while for some US drillers to move out of the businesses and hence pricing power to get restored back with Saudi. As can be seen from the following chart, the break-even for various oil shale plays in the US is between US$50-75.

Saudi has already made the first move by reducing its benchmark official selling price to levels lower than the 2008 levels. The adjustment to selling price can be a precursor to major adjustments to production, which will have to eventually follow in case the demand scenario remains weak, in contrast to many market observers belief that Saudi will be able to maintain its market share.

In both the scenarios, the net impact on oil prices will be negative for the coming few quarters, which bodes well for the global growth and specifically for India, which imports about three-fourth’s of its oil requirement.

However the government now needs to take cognizance of the global oil market developments and develop a view on where they believe the prices will go.

The diesel prices in India are already Rs. 3-4 more than what they should be and the government seems to be reluctant to seize the opportunity to liberalize diesel prices.

As for PM Modi and Oil Minister Dharmendra Pradhan, all’s well till you have it but remember Brandon Mull’s gilded advise- Luck has a way of evaporating when you lean on it.